Is BioMarin a Bargain After Recent 16.1% Jump and Strong DCF Outlook?

- If you are wondering whether BioMarin Pharmaceutical is a bargain or a value trap at around $60 a share, you are not alone, and this piece will walk through what the numbers actually say.

- After a long slide that has left the stock down about 9.7% over the past year and around 40.9% over three years, the recent 16.1% jump in the last week and 8.4% rise over the past month suggest sentiment might finally be turning.

- Much of this renewed interest has been driven by pipeline and regulatory updates around BioMarin's rare disease portfolio, which have reminded investors of the company’s long runway of potential therapies. At the same time, ongoing debate over pricing power and competitive threats in gene therapies has kept risk perceptions elevated, adding nuance to the latest price moves.

- On our valuation framework, BioMarin currently scores a 3/6 valuation score, meaning it appears undervalued on half of the key checks we run. Next, we will break down how different valuation approaches view the stock, and then finish with a more holistic way to judge whether the current price truly reflects its long term potential.

Find out why BioMarin Pharmaceutical's -9.7% return over the last year is lagging behind its peers.

Approach 1: BioMarin Pharmaceutical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those dollars back to their value in the present.

For BioMarin Pharmaceutical, the latest twelve month free cash flow is about $797.9 Million. Using a 2 Stage Free Cash Flow to Equity model, analysts and extrapolated estimates see free cash flow rising toward roughly $1.60 Billion by 2035, with specific projections such as $1.30 Billion in 2029. Simply Wall St uses analyst forecasts for the early years, then tapers growth to more modest long term levels.

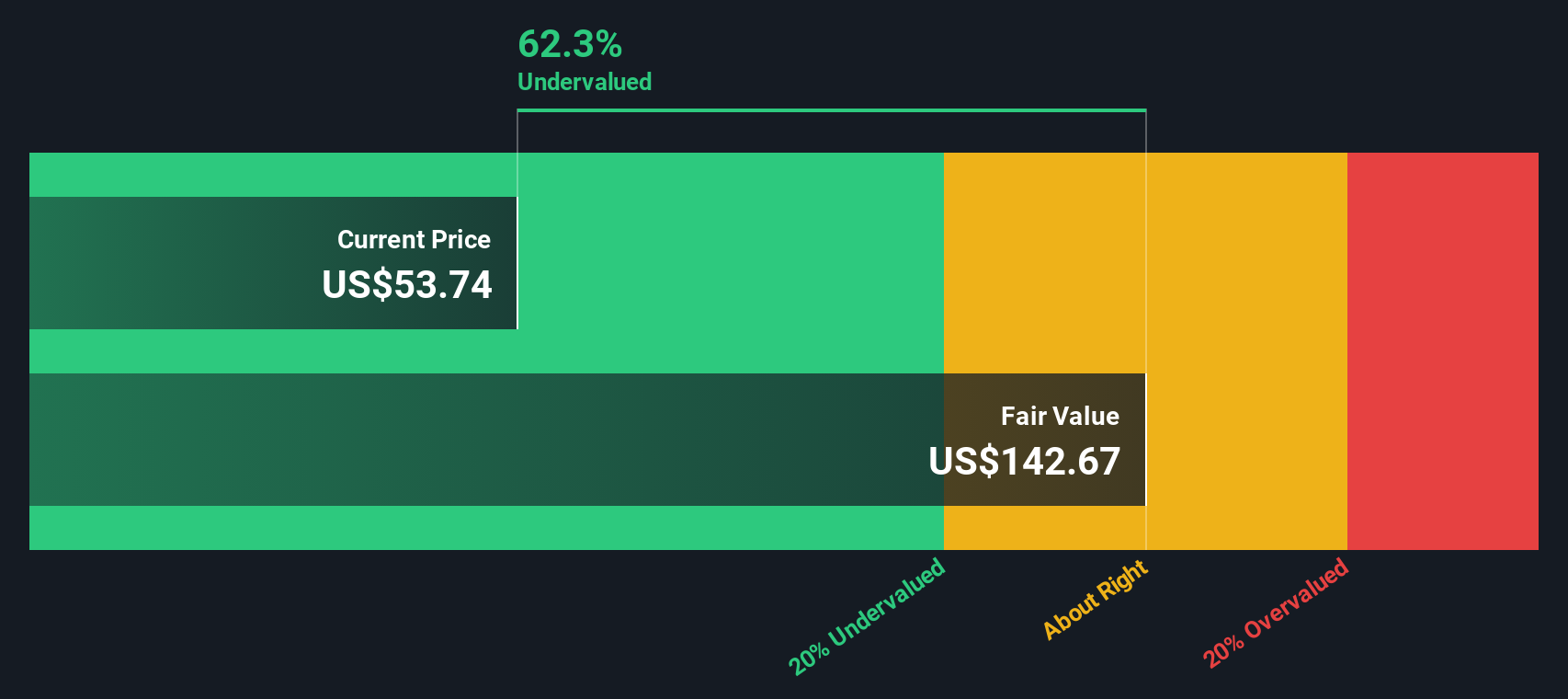

When these projected cash flows are discounted back, the model arrives at an intrinsic value of roughly $160.75 per share. Compared with the current share price around $60, the DCF suggests the stock is about 62.6% undervalued. On this measure, the long term cash generation profile appears stronger than what the market is currently pricing in.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BioMarin Pharmaceutical is undervalued by 62.6%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: BioMarin Pharmaceutical Price vs Earnings

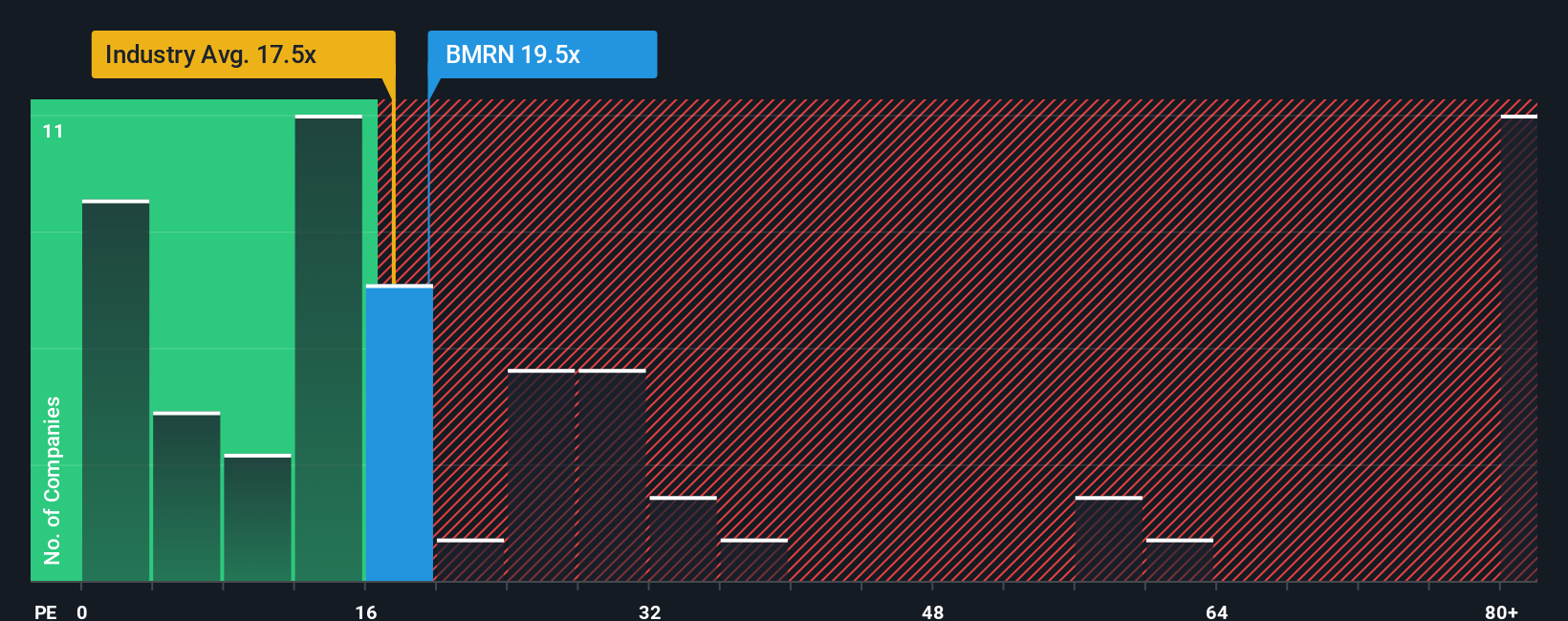

For a profitable biotech like BioMarin, the price to earnings (PE) ratio is a practical way to judge valuation because it links the share price directly to the company’s current earnings power. In general, higher growth and lower perceived risk justify a higher PE, while slower growth or more uncertainty warrant a lower multiple.

BioMarin currently trades on a PE of about 22.21x, which is very close to the broader Biotechs industry average of around 22.21x and slightly above the peer group average of roughly 20.70x. Simply Wall St also calculates a proprietary “Fair Ratio” of 24.74x for BioMarin, which estimates what the PE should be once you factor in its specific earnings growth outlook, profit margins, industry positioning, market cap and risk profile.

This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for the company’s own strengths and vulnerabilities rather than assuming all biotechs deserve the same multiple. With the current 22.21x PE sitting below the 24.74x Fair Ratio, the share price appears somewhat low relative to its fundamentals on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BioMarin Pharmaceutical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories you create about a company that connect your view of its future revenues, earnings and margins to a financial forecast, a fair value, and finally a clear buy or sell signal, all within an easy to use tool on Simply Wall St’s Community page that millions of investors already use. For example, one BioMarin investor might build a bullish Narrative assuming revenue grows closer to the upper end of expectations, margins expand toward the high 20s, and the stock deserves a fair value near the top analyst target of about $122. Another more cautious investor could create a conservative Narrative using slower growth, more pricing pressure and a fair value closer to the low target around $60. As new data such as guidance changes, clinical updates or regulatory news come in, these Narratives and their fair values update dynamically so you can keep comparing your evolving fair value to the current price and decide if BioMarin belongs on your buy list, watchlist, or sell list.

Do you think there's more to the story for BioMarin Pharmaceutical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報