Has Travelers Stock Run Too Far After Its 2025 Rally?

- Wondering if Travelers Companies is still attractively priced after its big run, or if the easy money has already been made? This breakdown will help you assess whether the current price still stacks up against its fundamentals.

- The stock has climbed to around $293.84, delivering 0.9% over the last week, 1.0% over the past month, and 22.0% year to date, with gains of 23.0% over 1 year, 65.3% over 3 years, and 133.6% over 5 years.

- Recent coverage has highlighted Travelers positioning in the US insurance space as investors pay closer attention to underwriting discipline, catastrophe exposure, and how higher interest rates are affecting investment income. The company is often cited in discussions about quality insurers that may benefit from stronger pricing cycles and tighter risk management, which helps explain why the stock has remained in focus.

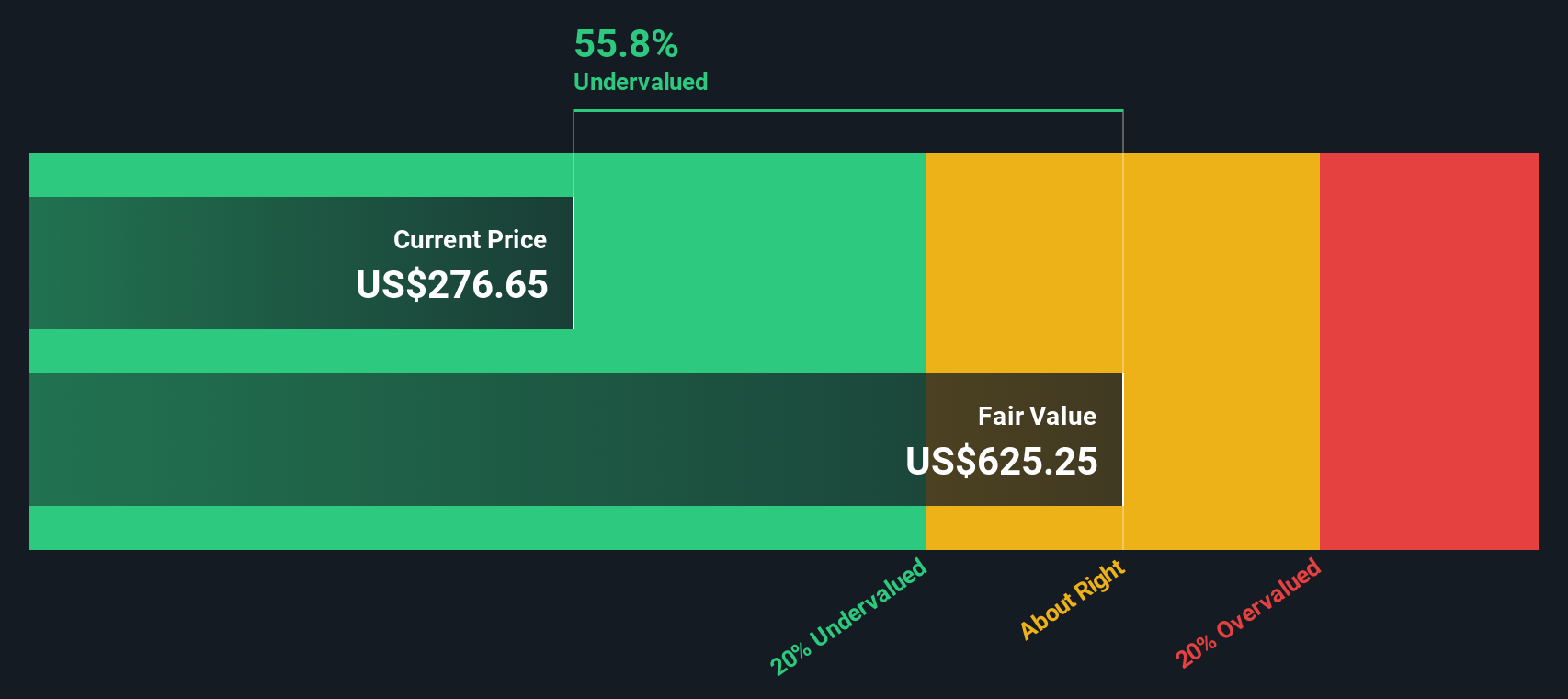

- On our framework, Travelers scores a 5/6 valuation check, suggesting it screens as undervalued on most of the key metrics tracked. Next we walk through those different valuation approaches, before finishing with a more nuanced way to think about what this score may mean for long term investors.

Approach 1: Travelers Companies Excess Returns Analysis

The Excess Returns model looks at how effectively a company turns shareholder capital into profits above its cost of equity, then projects how long those extra returns can persist. Instead of focusing on near term earnings, it asks whether Travelers Companies can keep compounding value for shareholders over time.

For Travelers, the model starts with a Book Value of $141.74 per share and a Stable EPS of $28.26 per share, based on weighted future Return on Equity estimates from 14 analysts. That implies an Average Return on Equity of 17.03%, comfortably above the estimated Cost of Equity of $11.54 per share. The gap between what investors require and what the business is expected to earn creates an Excess Return of $16.72 per share.

These returns are projected on a Stable Book Value of $165.92 per share, informed by estimates from 13 analysts. Together, this framework produces an intrinsic value of about $618 per share, which suggests the stock is roughly 52.5% undervalued versus the current market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Travelers Companies is undervalued by 52.5%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

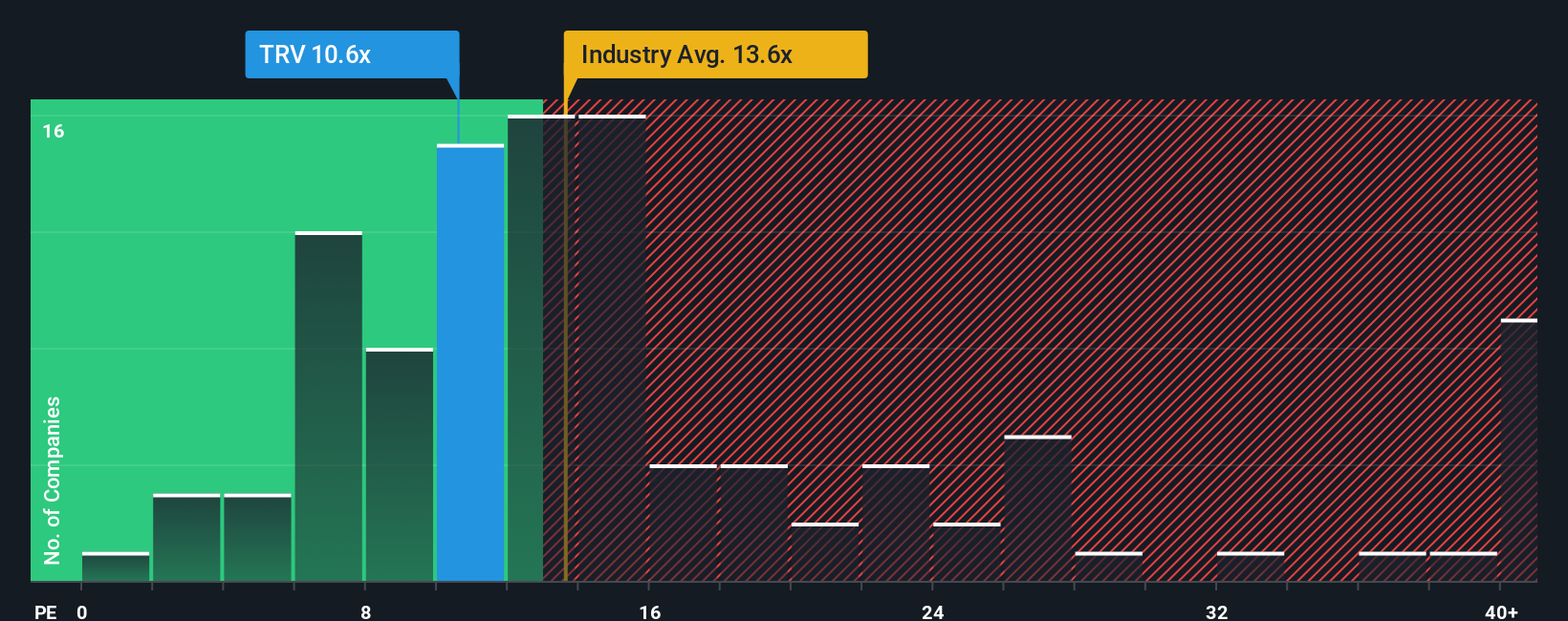

Approach 2: Travelers Companies Price vs Earnings

For a mature, profitable insurer like Travelers Companies, the price to earnings ratio is a practical way to judge valuation because it links what investors pay directly to the company’s current earning power. In general, faster growth and lower risk justify a higher PE multiple, while slower growth or higher risk tend to pull a fair PE lower.

Travelers currently trades on a PE of about 11.24x. That sits slightly below its peer average of 11.39x and more meaningfully below the broader Insurance industry average of around 13.38x, hinting that the market is not paying a premium multiple for its earnings. To refine this view, Simply Wall St uses a Fair Ratio, which estimates what PE the stock might trade on given its earnings growth outlook, profitability, risk profile, industry and market cap. This Fair Ratio for Travelers is 12.24x, suggesting investors might reasonably pay a higher multiple than today’s level.

Because the Fair Ratio sits above the current PE, Travelers appears modestly undervalued on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Travelers Companies Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, where you translate your view of Travelers Companies into a simple story that links assumptions about future revenue, earnings and margins to a financial forecast, then to a Fair Value you can compare with today’s share price.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by letting you adjust a few key drivers. The forecast and Fair Value are automatically updated as new data, earnings or news comes in, so you can see at a glance how your story compares with the current market price.

For example, one investor might build a bullish Travelers Narrative around resilient underwriting, buybacks and a higher future PE to reach a Fair Value closer to the upper analyst target near 320 dollars. Another, more cautious investor may stress climate and competitive risks to arrive nearer the low target around 233 dollars. Narratives makes both perspectives explicit, comparable and easy to track over time.

Do you think there's more to the story for Travelers Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報