Tootsie Roll (TR) Valuation Check After a Strong Multi-Year Share Price Run

Setting the scene for Tootsie Roll Industries stock

Tootsie Roll Industries (TR) has quietly outperformed many consumer staples this year, and that steady climb makes its recent pullback an interesting spot for investors rethinking defensive names in a choppy market.

See our latest analysis for Tootsie Roll Industries.

With the share price now around $37.42, Tootsie Roll’s year to date share price return of 18.19 percent and five year total shareholder return of 54.06 percent suggest steady, not runaway, momentum as investors reassess its defensive growth story.

If this kind of resilient consumer name has your attention, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

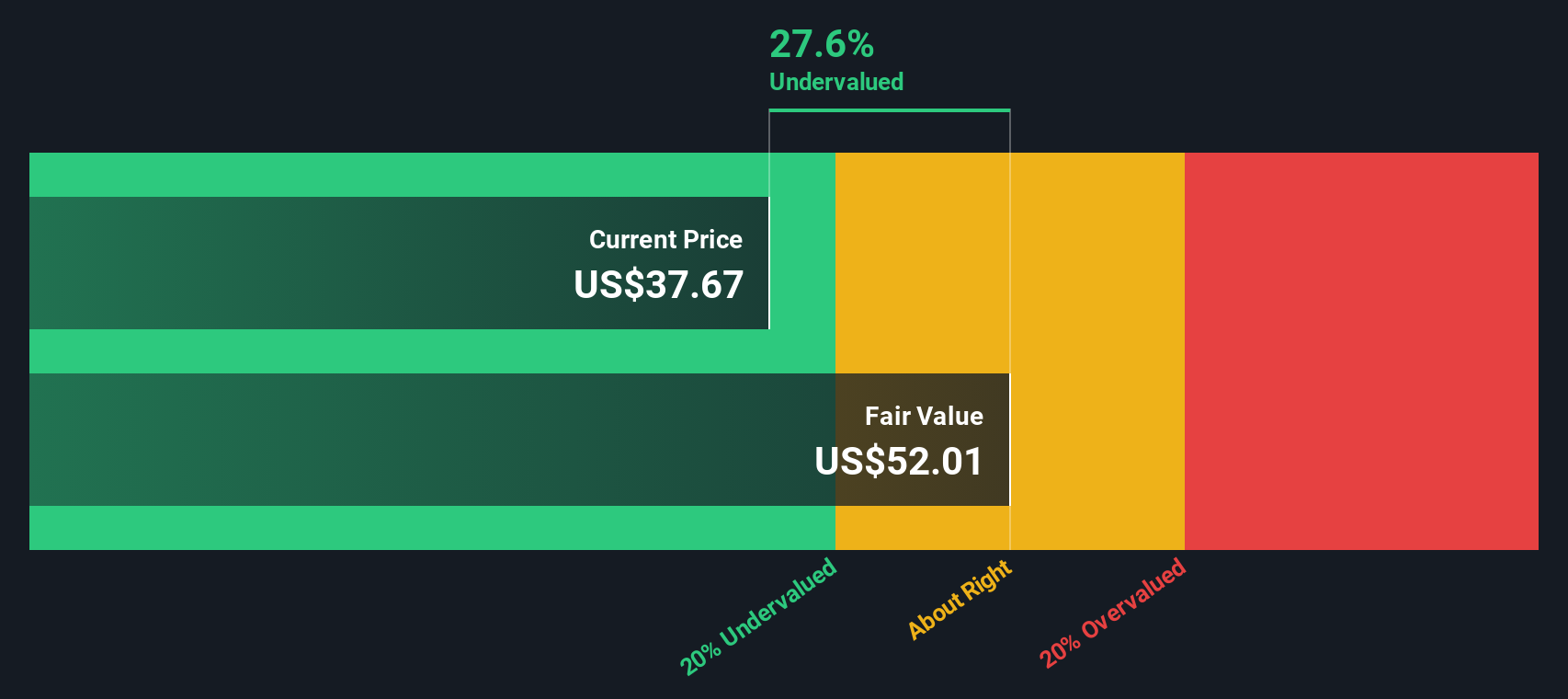

With shares hovering near recent highs and only a slight discount to intrinsic value, investors now face a key question: Is Tootsie Roll still trading below its true worth, or is the market already baking in its future growth?

Price-to-Earnings of 29.1x: Is it justified?

On a trailing Price-to-Earnings ratio of 29.1 times, Tootsie Roll Industries looks cheaper than its direct peers, despite its share price sitting close to our intrinsic value estimate.

The Price-to-Earnings multiple compares the current share price with the company’s earnings per share. This makes it a useful yardstick for a mature, consistently profitable confectionery business like Tootsie Roll.

Against a peer group trading at an average of 71.7 times earnings, Tootsie Roll’s 29.1 times suggests investors are not assigning it the premium often seen in branded consumer names, even though earnings have grown at a double digit rate over the past five years.

However, compared with the broader US Food industry’s average Price-to-Earnings of 20.3 times, Tootsie Roll trades on a noticeably richer multiple. This signals investors are willing to pay up for its stability and brand strength versus typical food manufacturers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 29.1x (ABOUT RIGHT)

However, that premium could come under pressure if input costs rise faster than pricing power, or if consumer spending weakens and dampens confectionery volumes.

Find out about the key risks to this Tootsie Roll Industries narrative.

Another way to look at value

Our SWS DCF model paints a slightly different picture, with Tootsie Roll trading just above its fair value estimate of 37.26 dollars at 37.42 dollars. That tiny premium suggests limited margin of safety, so are investors now paying up for comfort rather than clear upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tootsie Roll Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tootsie Roll Industries Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Tootsie Roll Industries.

Looking for more investment ideas?

If you are serious about sharpening your edge beyond Tootsie Roll, act now and scan powerful stock ideas with the Simply Wall Street Screener before others move first.

- Capture potential mispricing by targeting companies trading below intrinsic value through these 901 undervalued stocks based on cash flows, where strong cash flows meet attractive entry points.

- Capitalize on rapid sector shifts by focusing on innovators in medicine and data, using these 29 healthcare AI stocks to spot names transforming healthcare with intelligent technology.

- Ride major structural trends by zeroing in on digital assets and infrastructure via these 80 cryptocurrency and blockchain stocks, uncovering businesses positioned to benefit from blockchain and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報