Ameren (AEE): Assessing Valuation After a Strong Year and Recent Pullback

Ameren (AEE) has quietly outperformed many defensive utilities this year, even after a recent pullback. With shares up roughly 13% over the past year, investors are weighing how much upside remains.

See our latest analysis for Ameren.

The recent pullback, including a roughly 4.7% 1 month share price return, has come after a strong run, with the year to date share price return over 12% and a 1 year total shareholder return above 13%. This suggests momentum is cooling rather than collapsing.

If Ameren has you rethinking your defensive plays, it might be a good moment to widen the lens and discover fast growing stocks with high insider ownership for ideas with a bit more upside punch.

With Ameren trading about 12 percent below analyst targets but at a premium to some peers, the key question now is straightforward: is this a fresh entry point, or is the market already baking in future growth?

Most Popular Narrative Narrative: 11.3% Undervalued

With Ameren last closing at $99.84 versus a narrative fair value near $112, the story frames today’s price as a meaningful discount that still assumes steady execution.

Ongoing and future investments in grid modernization, resilience (e.g., smart substations, composite poles, automation), and clean energy resources (wind, solar, batteries) are expected to expand Ameren's regulated rate base at a forecasted 9.2% CAGR, enabling higher allowed returns and improved net margins.

Curious how steady, regulated growth ends up justifying a premium style earnings multiple, without leaning on tech level expansion? The narrative stitches together ambitious revenue, margin, and valuation bridges that turn modest assumptions into a double digit upside case, but the critical levers only reveal themselves when you see the full set of forecasts.

Result: Fair Value of $112.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steady growth hinges on data center demand and regulatory backing. Weaker load growth or tougher rate decisions could quickly compress that upside.

Find out about the key risks to this Ameren narrative.

Another Lens on Valuation

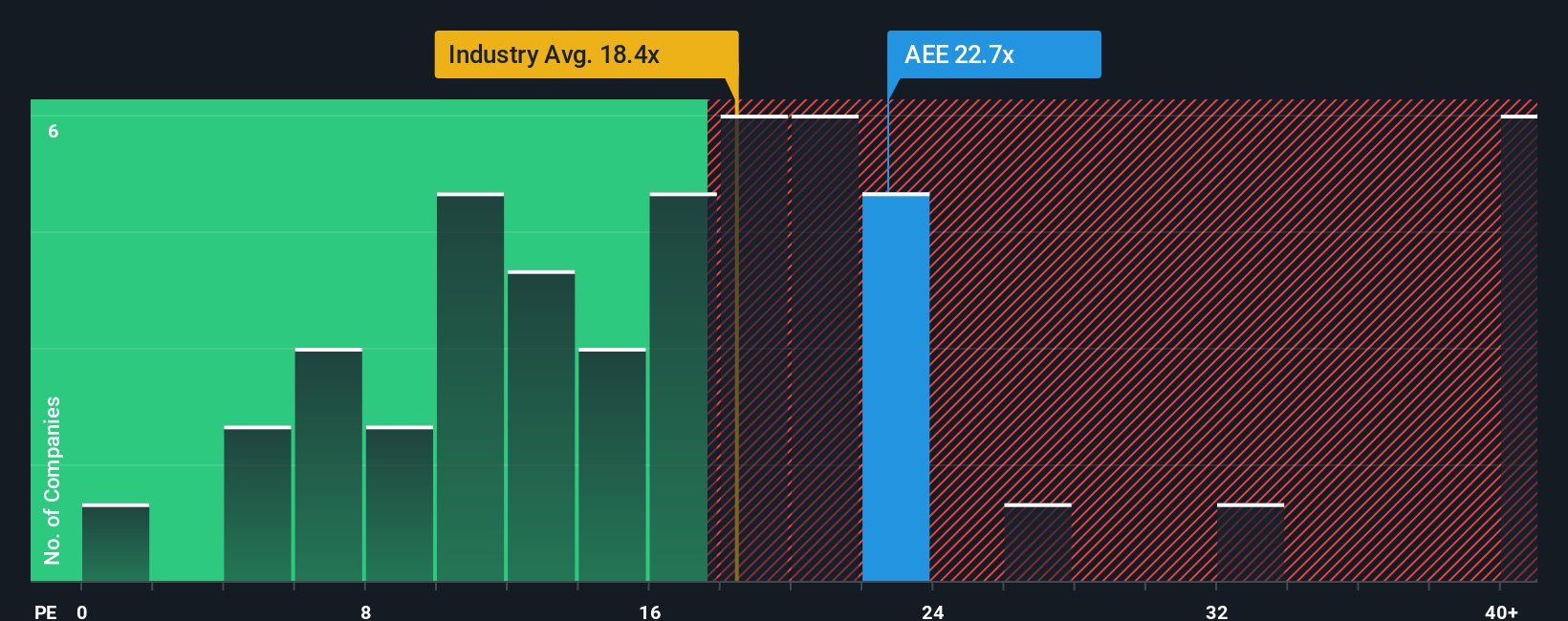

On plain earnings terms, Ameren looks less cheap. Its P E ratio of 19.1 times sits above the global integrated utilities average of 17.9 times, but below peers at 21.1 times and a fair ratio of 22.5 times. This suggests modest upside but limited margin for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If you would rather challenge these assumptions and work through the numbers yourself, you can build a fresh, personalized view in just a few minutes. Do it your way.

A great starting point for your Ameren research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you settle on Ameren, give yourself an edge by scanning fresh opportunities on Simply Wall Street, where targeted stock lists turn research into decisive action.

- Capture emerging themes in digital finance by reviewing these 80 cryptocurrency and blockchain stocks that are shaping the backbone of next generation payment and blockchain infrastructure.

- Target resilient income by focusing on these 10 dividend stocks with yields > 3% that combine attractive yields with businesses built to sustain regular shareholder payouts.

- Position yourself ahead of the crowd by tracking these 24 AI penny stocks poised to benefit from accelerating demand for artificial intelligence solutions across global industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報