Is Church and Dwight Now a Bargain After Its 18% Share Price Slide?

- If you have been wondering whether Church & Dwight is quietly becoming a bargain or just a consumer staples comfort stock, you are in the right place to dig into what the market might be missing.

- Despite its reputation as a steady household products name, the share price has slipped to around $85.46, with a 3.3% gain over the last 30 days but a much steeper drop of 17.7% year to date and 18.7% over the past year, hinting at shifting sentiment around its growth prospects and risk profile.

- Recently, the stock has been in focus as investors reassess branded staples in light of inflation easing and competition intensifying, putting pressure on companies that rely on everyday essentials. At the same time, Church & Dwight's continued investment in core brands such as Arm & Hammer and OxiClean, along with ongoing portfolio optimization moves, has kept it on the radar of long term investors looking for resilient cash generators.

- On our framework of six valuation checks, Church & Dwight currently scores a 2 out of 6, suggesting pockets of value but also areas where the market may be rightly cautious. Next, we will break down what different valuation methods tell us about that score, before finishing with a more holistic way to think about the stock's true worth.

Church & Dwight scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Church & Dwight Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

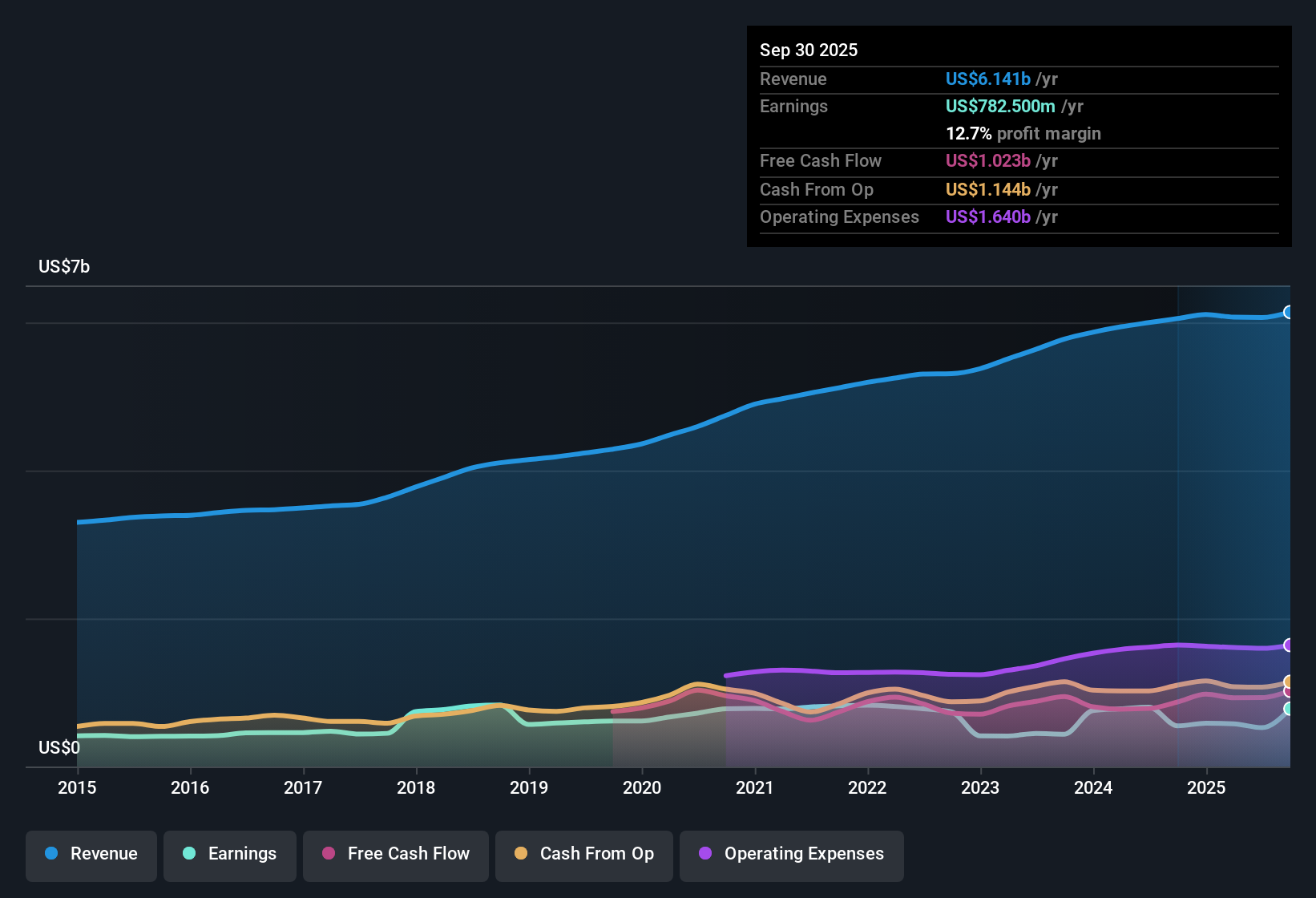

For Church & Dwight, the model uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve months free cash flow of about $955.9 Million. Analyst estimates in the model have free cash flow rising to roughly $1.20 Billion by 2029, with further increases beyond that extrapolated by Simply Wall St rather than directly forecast by analysts.

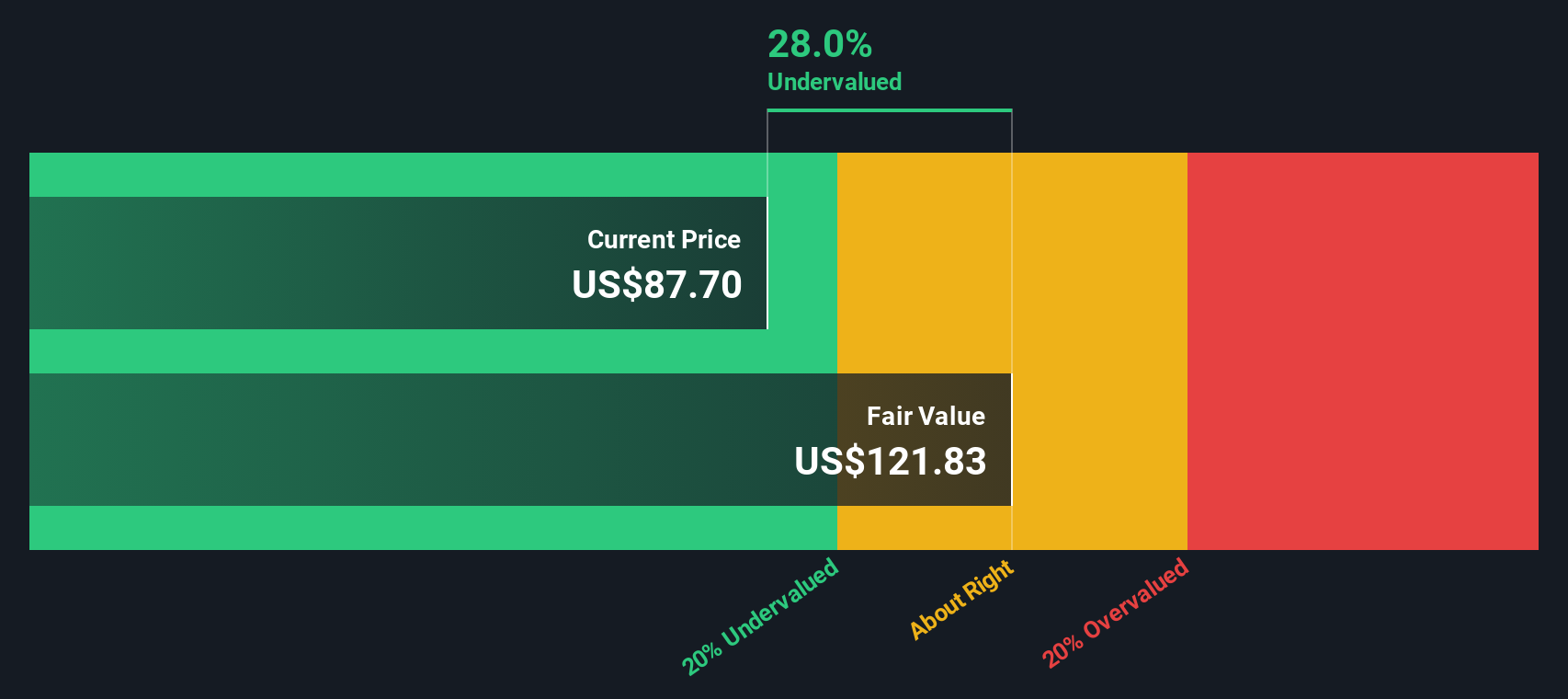

These future cash flows are discounted back to today to arrive at an intrinsic value of about $122.48 per share. Compared with the recent share price around $85, this DCF output implies the stock is trading at roughly a 30.2% discount to its estimated fair value. This indicates that, on these assumptions, the market may not be fully pricing in its long term cash generation.

Result: UNDERVALUED (on this DCF basis)

Our Discounted Cash Flow (DCF) analysis suggests Church & Dwight is undervalued by 30.2%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: Church & Dwight Price vs Earnings

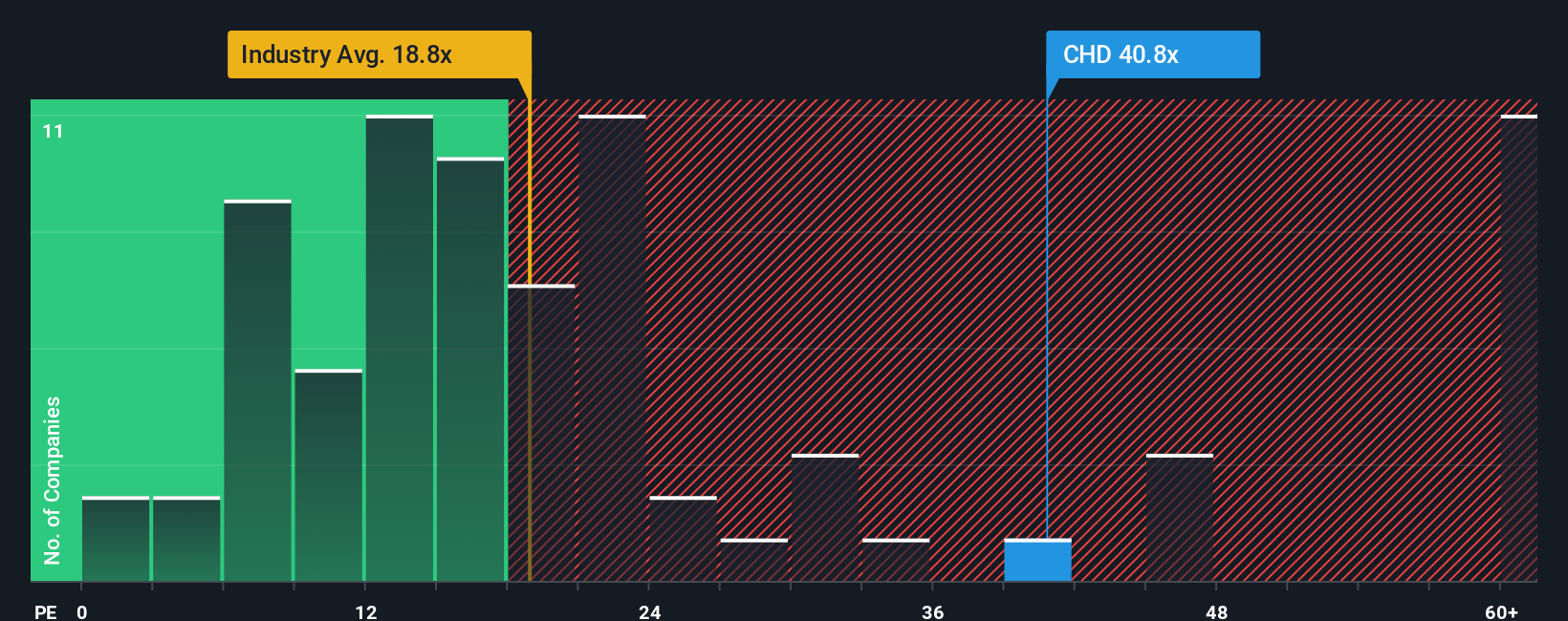

For profitable, established businesses like Church & Dwight, the Price to Earnings, or P E, ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, companies with stronger, more reliable growth and lower perceived risk can justify trading on higher P E multiples, while slower growth or higher risk usually calls for a lower, more conservative multiple.

Church & Dwight currently trades at about 26.2x earnings, noticeably above the Household Products industry average of roughly 17.3x and the peer average of around 17.6x. On the surface, that premium suggests the market is expecting better growth or resilience than typical sector peers. Simply Wall St’s proprietary Fair Ratio, which estimates what P E would be appropriate given factors such as earnings growth, profitability, industry, market cap and risk, comes out at about 18.0x for Church & Dwight. This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for the company’s specific fundamentals, rather than assuming all household names deserve the same multiple.

Comparing the Fair Ratio of about 18.0x with the current 26.2x suggests the stock is trading above what these fundamentals would justify, pointing to an overvaluation on a P E basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Church & Dwight Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Church & Dwight’s business with a concrete forecast and fair value estimate rather than relying only on static multiples like P E.

A Narrative on Simply Wall St is your story about a company captured in numbers, where you spell out what you think will happen to revenue, earnings and margins, and the platform then turns that into a forward looking financial model and a fair value estimate.

This makes Narratives a powerful but accessible tool on the Community page, used by millions of investors, because it links three things in one place: the company’s story, the forecast that flows from that story, and a data backed view of what the stock might actually be worth.

When new information hits the tape, whether it is fresh earnings, an acquisition, or analyst target changes, Narratives update dynamically, helping you quickly see whether your fair value is now above or below the current price and whether that might mean buying, holding, or trimming your position.

For Church & Dwight, for example, a bullish Narrative might lean toward a fair value closer to 120 dollars, assuming resilient margins, strong e commerce growth and successful international expansion. A more cautious Narrative might anchor around 73 dollars, building in slower category growth, tougher competition and execution risk around portfolio changes.

Do you think there's more to the story for Church & Dwight? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報