Assessing CRH (NYSE:CRH) Valuation After Its S&P 500 Inclusion and Capital Return Momentum

CRH (NYSE:CRH) is stepping onto a bigger stage as it joins the S&P 500, a shift that can meaningfully change who owns the stock and how its trading volume behaves.

See our latest analysis for CRH.

That index upgrade comes on the back of a strong run, with the share price at $127.54 after a robust year to date share price return of 37.57 percent and a striking three year total shareholder return of 241.18 percent. This suggests momentum is still building as investors reward recent acquisitions and buybacks.

If CRH’s momentum has you thinking more broadly about structural growth stories, this could be a good moment to explore fast growing stocks with high insider ownership.

But with CRH now in the S&P 500, trading near analyst targets and boasting a strong three year return, is this infrastructure champion still undervalued, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 8.1% Undervalued

With a fair value near 139 dollars versus a 127.54 dollars last close, the most followed narrative sees room for more upside rooted in fundamentals.

The ongoing rollout of U.S. federal infrastructure funding (less than 40% of the IIJA highway funds have been spent) and an encouraging outlook for the next highway bill create a substantial, multi-year runway for demand in CRH's core public infrastructure segments, offering the prospect for sustained revenue growth and backlog visibility.

Want to see how this funding wave translates into future earnings power, margins, and multiples, and why the fair value still sits above today’s price? Read on.

Result: Fair Value of $138.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on continued U.S. infrastructure funding and smooth integration of acquisitions, and any stumble could pressure margins and reset expectations.

Find out about the key risks to this CRH narrative.

Another Lens on Valuation

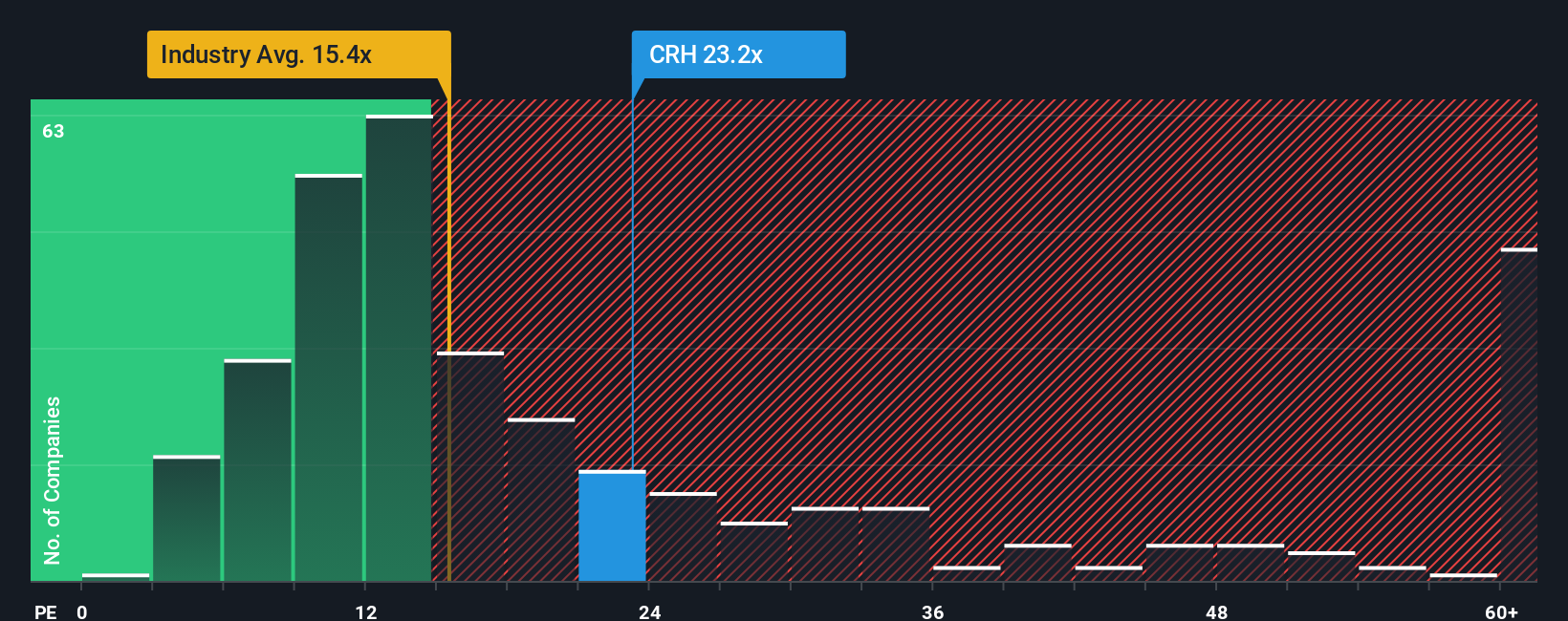

Not everyone sees upside from here. On a price to earnings basis, CRH trades at 25.1 times earnings, well above the global Basic Materials average of 14.8 times but close to its fair ratio of 25.6 times. That leaves less obvious mispricing and raises the question of how much safety margin is really left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRH Narrative

If you see the story differently or want to stress test the assumptions with your own research, build a custom view in minutes using Do it your way.

A great starting point for your CRH research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

CRH might fit your strategy today, but you could miss fresh opportunities if you ignore other ideas emerging from the Simply Wall Street Screener.

- Explore potential mispricings by targeting companies trading below their cash flow value using these 901 undervalued stocks based on cash flows before the market fully reacts.

- Position yourself early in developments in automation and intelligent software by screening for scalable innovators through these 24 AI penny stocks.

- Seek stronger income potential by focusing on reliable payers and growing distributions via these 10 dividend stocks with yields > 3% while yields remain attractive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報