Is Now the Time to Revisit Addus HomeCare After Recent Share Price Weakness?

- If you have been wondering whether Addus HomeCare is quietly turning into a value opportunity, you are not alone. Now may be a good time to take a closer look at the numbers.

- The stock has slipped about 1.7% over the last week and 4.2% over the past month, extending a 10.6% drop year to date and a 13.9% decline over the last year, even though it is still up 12.8% over three years.

- Recent headlines have focused on Addus expanding its footprint in personal care and home health through targeted acquisitions and new state program wins, reinforcing its position in non acute, home based services. At the same time, ongoing policy debates around Medicaid reimbursement and home care funding have kept a spotlight on the risks and opportunities that can move the share price.

- Despite those mixed signals, Addus currently posts a valuation score of 4/6. This suggests it screens as undervalued on several key checks. Next, we will break down what that means across different valuation approaches, before ending with a more holistic way to think about what the stock is really worth.

Find out why Addus HomeCare's -13.9% return over the last year is lagging behind its peers.

Approach 1: Addus HomeCare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back to a present value. For Addus HomeCare, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

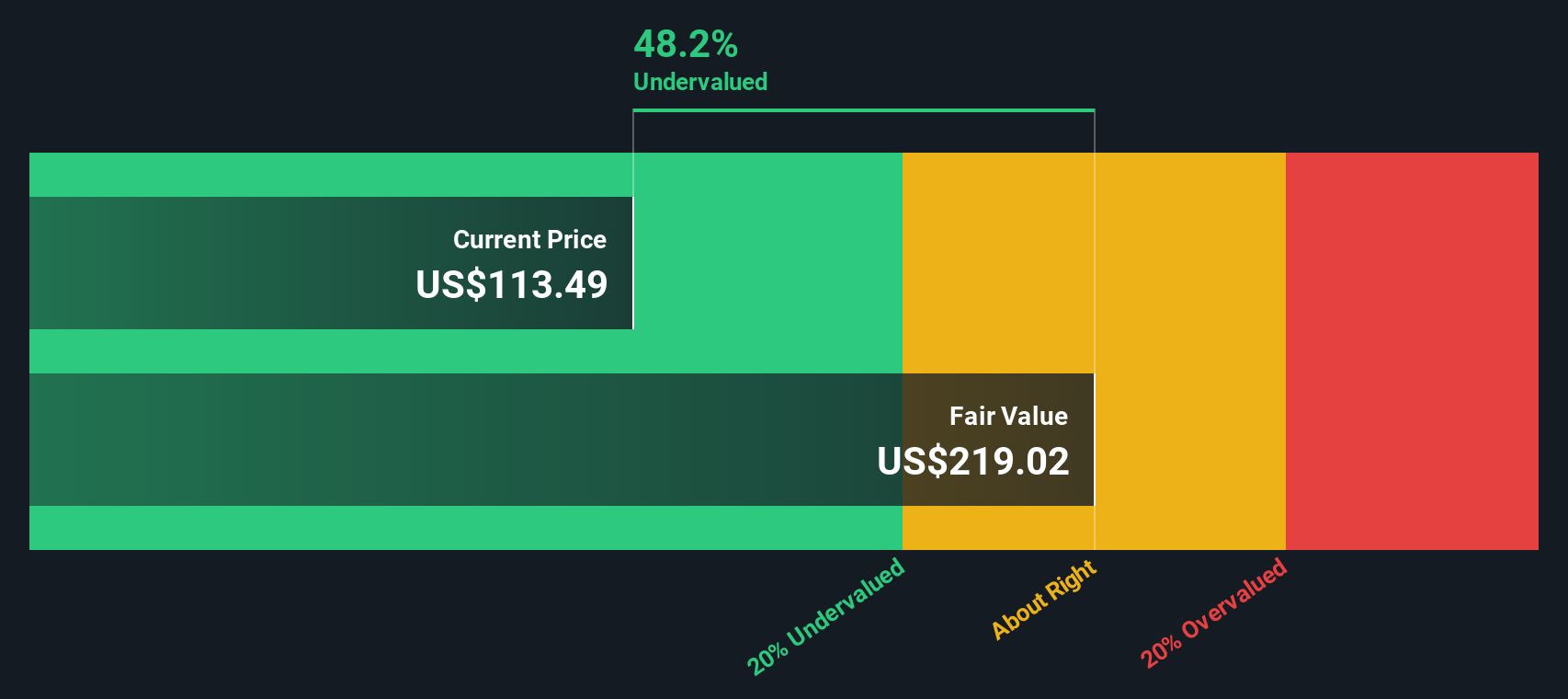

Addus generated about $93.2 million of free cash flow over the last twelve months, and analysts expect this to rise to roughly $133.4 million in 2026 and $143.4 million in 2027. Beyond those analyst years, Simply Wall St extrapolates a steady expansion, with free cash flow projected to reach around $199.0 million by 2035, all in dollar terms. When these future cash flows are discounted back, the implied intrinsic value comes out at about $219.02 per share.

This DCF estimate suggests the stock trades at a 49.3% discount to its intrinsic value, indicating that the current price is well below the level suggested by this cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Addus HomeCare is undervalued by 49.3%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: Addus HomeCare Price vs Earnings

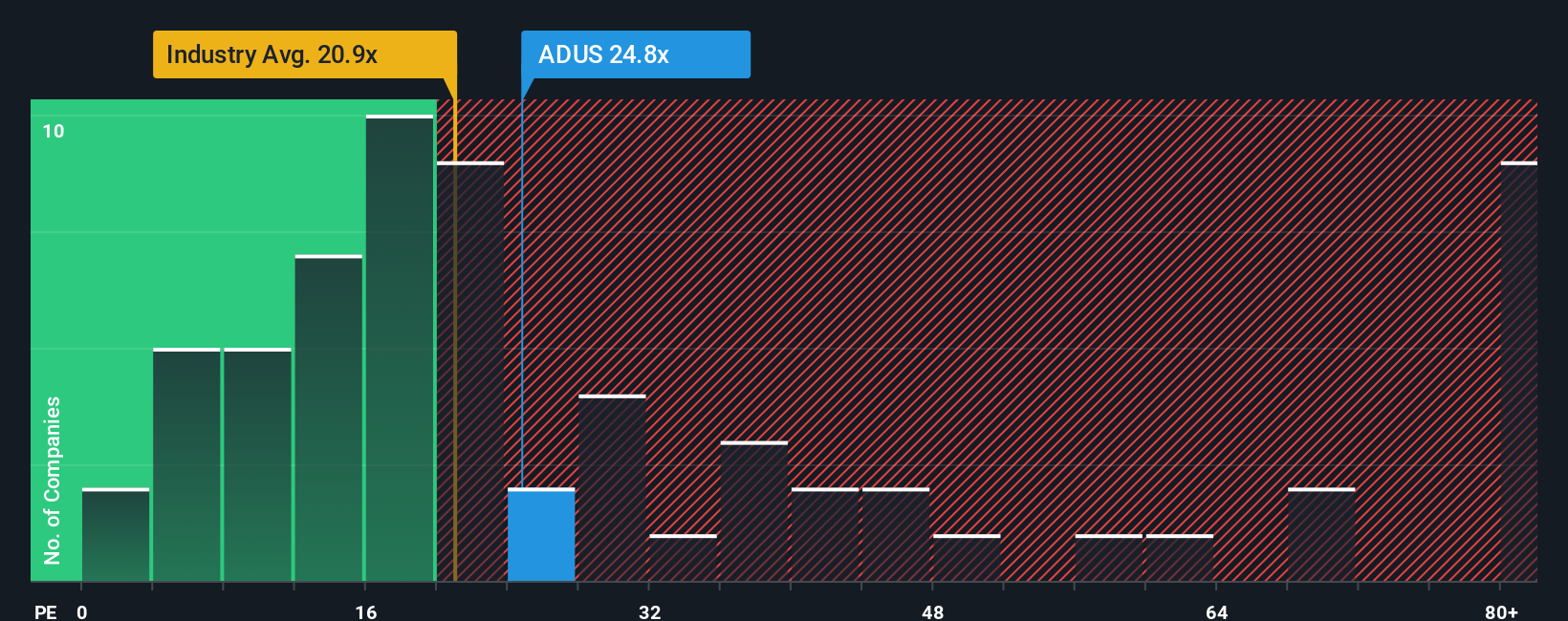

For profitable companies like Addus, the price to earnings (PE) ratio is a straightforward way to gauge whether investors are paying a reasonable price for each dollar of current profits. A higher PE can be justified when a business has strong growth prospects and relatively low risk, while slower growing or riskier companies usually deserve a lower, more conservative PE multiple.

Addus currently trades on a PE of 23.6x, which is roughly in line with the broader Healthcare industry average of about 23.3x, but well below the 76.9x average of its listed peers. To move beyond these blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE the market should reasonably pay after considering Addus HomeCare earnings growth profile, profit margins, industry characteristics, market cap and company specific risks.

This Fair Ratio for Addus is 21.9x, slightly below the current 23.6x. Because it incorporates growth, risk and profitability rather than just comparing with peers or the sector, it gives a more tailored view of value. On this basis, the shares look modestly expensive relative to what would be considered fair.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Addus HomeCare Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of Addus HomeCare into a story that links its business drivers, your forecasts for revenue, earnings and margins, and a resulting fair value estimate you can act on.

On Simply Wall St, Narratives live in the Community page and are designed to be easy to use, letting you combine qualitative beliefs, such as how resilient Medicaid funding will be or how fast acquisitions might compound growth, with quantitative assumptions that flow straight into a dynamic valuation model.

Each Narrative creates a clear line from story to forecast to fair value. It then compares that fair value with the current share price so you can quickly see whether your view implies Addus is a buy, a hold, or a sell at today’s levels.

Because Narratives automatically update when new earnings, news or estimates arrive, they help you keep your investment thesis current. With Addus today you might see one Narrative arguing for upside toward about 160 dollars while another more cautious view anchors closer to 111 dollars, highlighting how different perspectives translate into different target prices.

Do you think there's more to the story for Addus HomeCare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報