Is Ferrari Stock Still a Luxury After a 9.6% 2025 Slide?

- Wondering if Ferrari at around $376 a share is a luxury brand on sale or a status symbol priced for perfection? This breakdown is designed to give you a clear, no nonsense view of what you are really paying for.

- Despite being down about 9.6% year to date and roughly 12.6% over the last year, Ferrari is still sitting on a 3 year gain of about 82.8% and around 69.3% over 5 years. This indicates that long term holders have still done very well even after the recent wobble.

- Recent moves in the share price have been shaped by a mix of macro worries around high end discretionary spending and ongoing excitement about Ferrari expanding its brand beyond traditional combustion supercars, including its push into hybrid models and broader lifestyle partnerships. At the same time, market conversation has increasingly focused on whether Ferrari should be valued like a high growth luxury house or a more cyclical automaker, and that debate has fed directly into the recent volatility.

- Ferrari currently scores a valuation check of 0/6 for being undervalued. In the sections ahead we will unpack what different valuation methods are implying about the stock today and outline a more nuanced way to think about value that moves beyond the usual models.

Ferrari scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ferrari Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting those euros back to today to reflect risk and the time value of money.

Ferrari generated trailing twelve month free cash flow of about €1.28 billion, and analysts expect this to grow steadily, with Simply Wall St using a two stage Free Cash Flow to Equity model. Their projections see free cash flow rising to roughly €1.96 billion by 2029, and then continuing to climb through the early 2030s based on gradually slowing growth assumptions beyond explicit analyst forecasts.

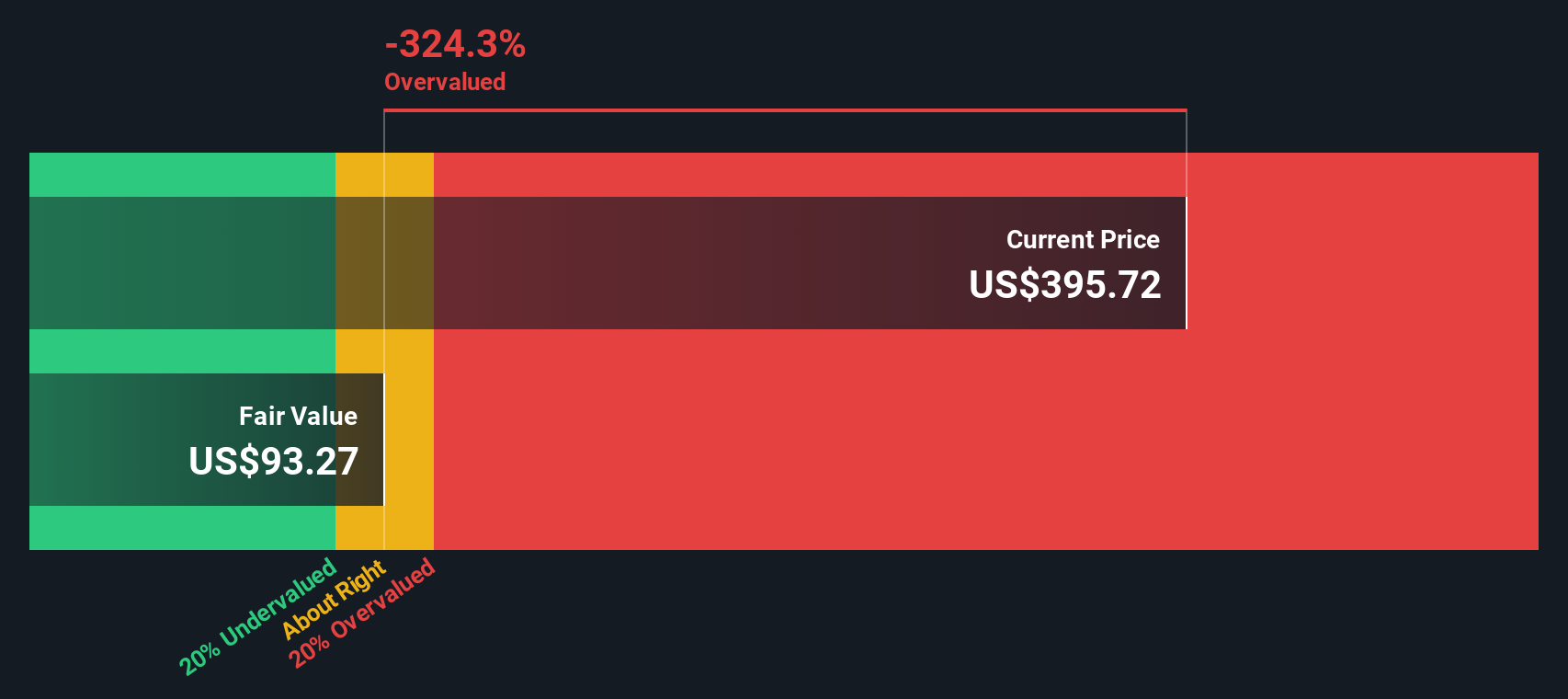

When all these future cash flows are discounted back and divided by the number of shares, the model arrives at an intrinsic value of about €107.04 per share. Compared with the current share price around $376, this implies the stock is roughly 251.6% overvalued on this DCF view. This suggests investors are paying a steep premium for Ferrari’s brand and growth story.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ferrari may be overvalued by 251.6%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ferrari Price vs Earnings

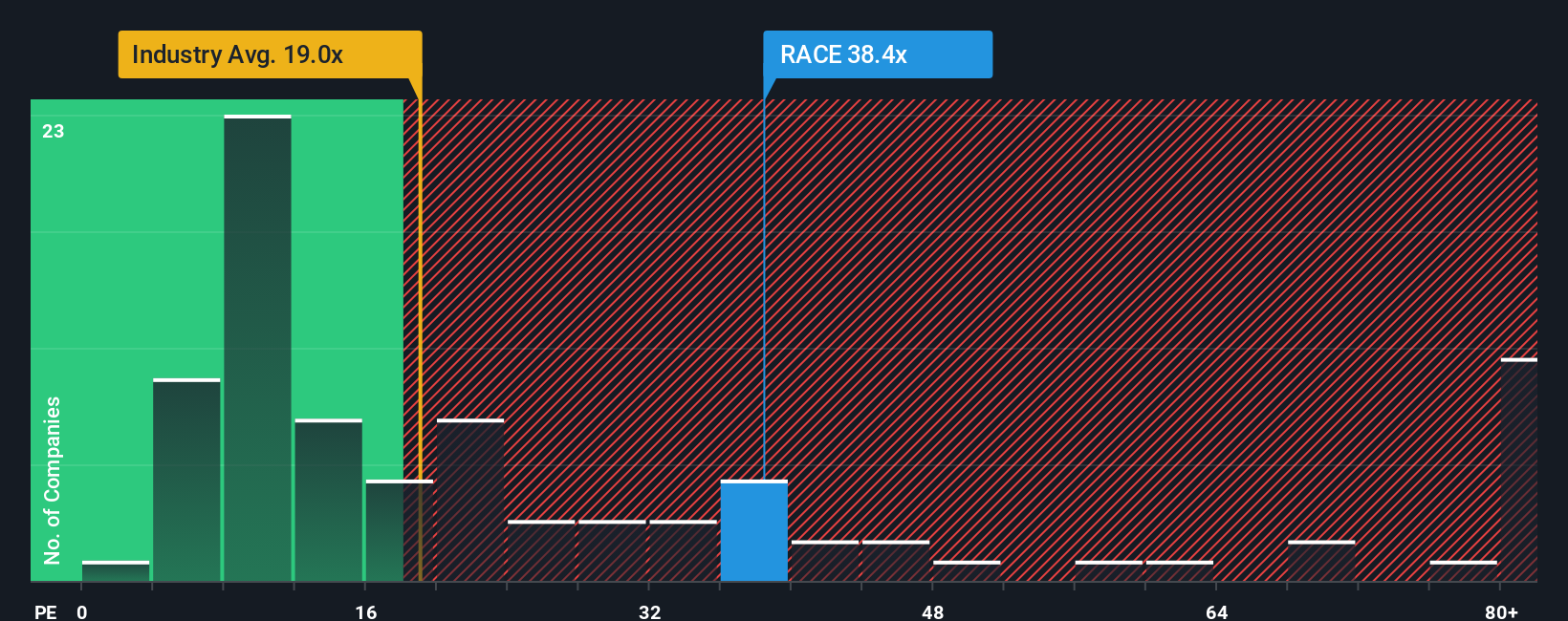

For a consistently profitable company like Ferrari, the price to earnings (PE) ratio is a useful way to gauge what investors are paying today for each dollar of current profits. A higher PE can be justified when a business has strong, durable growth prospects and relatively low risk, while slower or more uncertain earnings growth usually calls for a lower, more conservative multiple.

Ferrari currently trades on a PE of about 35.42x, which is almost double both the auto industry average of roughly 18.39x and the broader peer group at around 18.27x. To move beyond simple comparisons, Simply Wall St estimates a proprietary Fair Ratio of 17.05x for Ferrari, which is the PE you might expect given its growth outlook, profitability, size and risk profile. This approach is more informative than looking at peers alone, because it explicitly adjusts for Ferrari’s superior margins, premium positioning and the volatility that comes with a concentrated, high end product lineup.

Stacking the current 35.42x against the 17.05x Fair Ratio suggests the market is paying a substantial premium for the Ferrari story, leaving limited margin of safety at today’s price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ferrari Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story of Ferrari, written in numbers, where you connect your view of its brand, strategy and risks to a concrete forecast for revenue, earnings and margins, and from there to a fair value that you can easily compare with the current share price to decide whether to buy, hold or sell. On Simply Wall St, millions of investors can create and follow Narratives on the Community page, and these are updated dynamically as new information like earnings, guidance or major news comes in, so your story and fair value estimate do not go stale. For Ferrari, one investor might build a bullish Narrative that leans into electrification, a higher Special Series mix and luxury-like pricing power, landing close to the upper analyst fair value band around $597. A more cautious investor, worried about brand dilution, macro risks and execution, could sit nearer the lower band around $397, and Narratives makes both perspectives visible, comparable and actionable.

Do you think there's more to the story for Ferrari? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報