ASX Growth Stocks Insiders Are Betting On

As the Australian market approaches the holiday season, it's experiencing a slight dip, likely due to profit-taking and early closures, while Wall Street indices near record highs. In this environment of cautious optimism, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 15% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Pure One (ASX:P1E) | 10.4% | 114.6% |

| Polymetals Resources (ASX:POL) | 32.9% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.3% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

We'll examine a selection from our screener results.

Cromwell Property Group (ASX:CMW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cromwell Property Group (ASX:CMW) is a real estate investment manager overseeing $4.2 billion in assets across Australia and New Zealand, with a market cap of approximately A$1.28 billion.

Operations: The company's revenue segments consist of Co-Investments generating A$19.50 million, an Investment Portfolio contributing A$194 million, and Funds and Asset Management bringing in A$54.70 million.

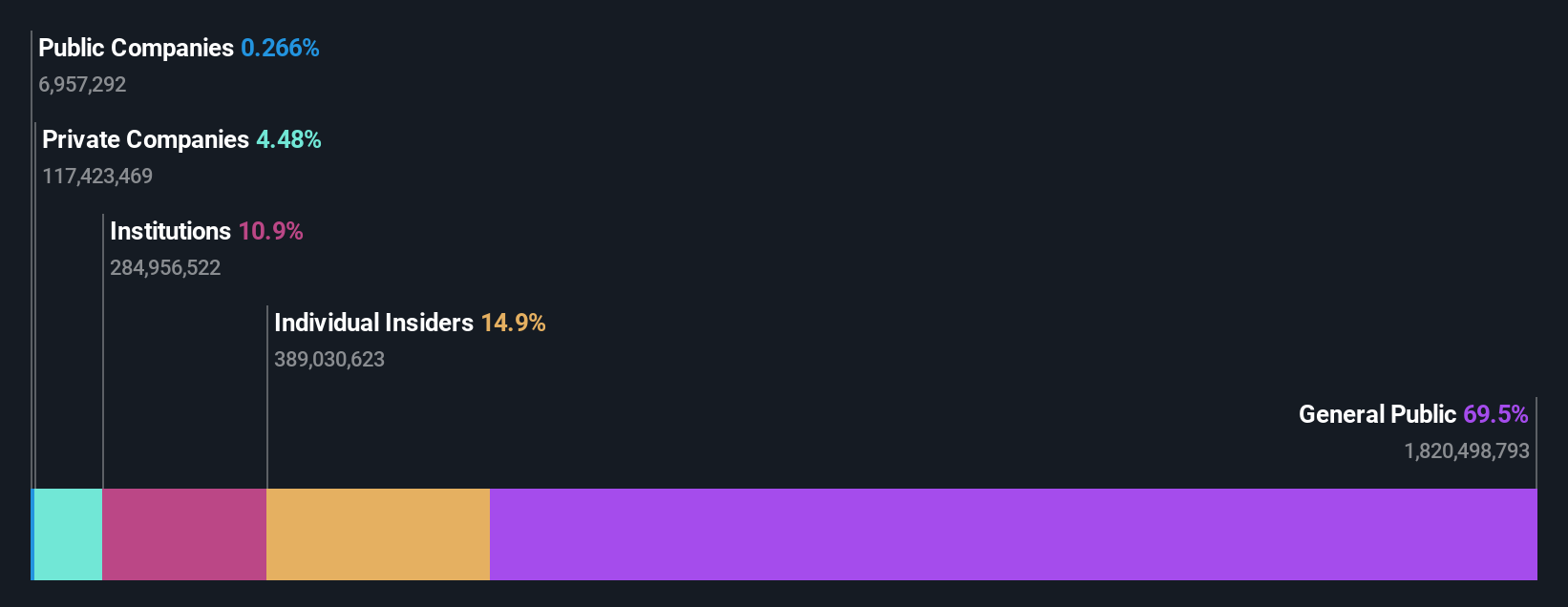

Insider Ownership: 14.9%

Earnings Growth Forecast: 29.7% p.a.

Cromwell Property Group's earnings are expected to grow 29.67% annually, with revenue projected to outpace the Australian market at 7.3% per year, though still below high-growth benchmarks. Despite trading at a significant discount to its estimated fair value, Cromwell's dividend yield of 6.12% is not well covered by earnings, and interest payments remain a concern. While insider trading data is unavailable for the past three months, profitability is anticipated within three years.

- Unlock comprehensive insights into our analysis of Cromwell Property Group stock in this growth report.

- In light of our recent valuation report, it seems possible that Cromwell Property Group is trading behind its estimated value.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★★☆

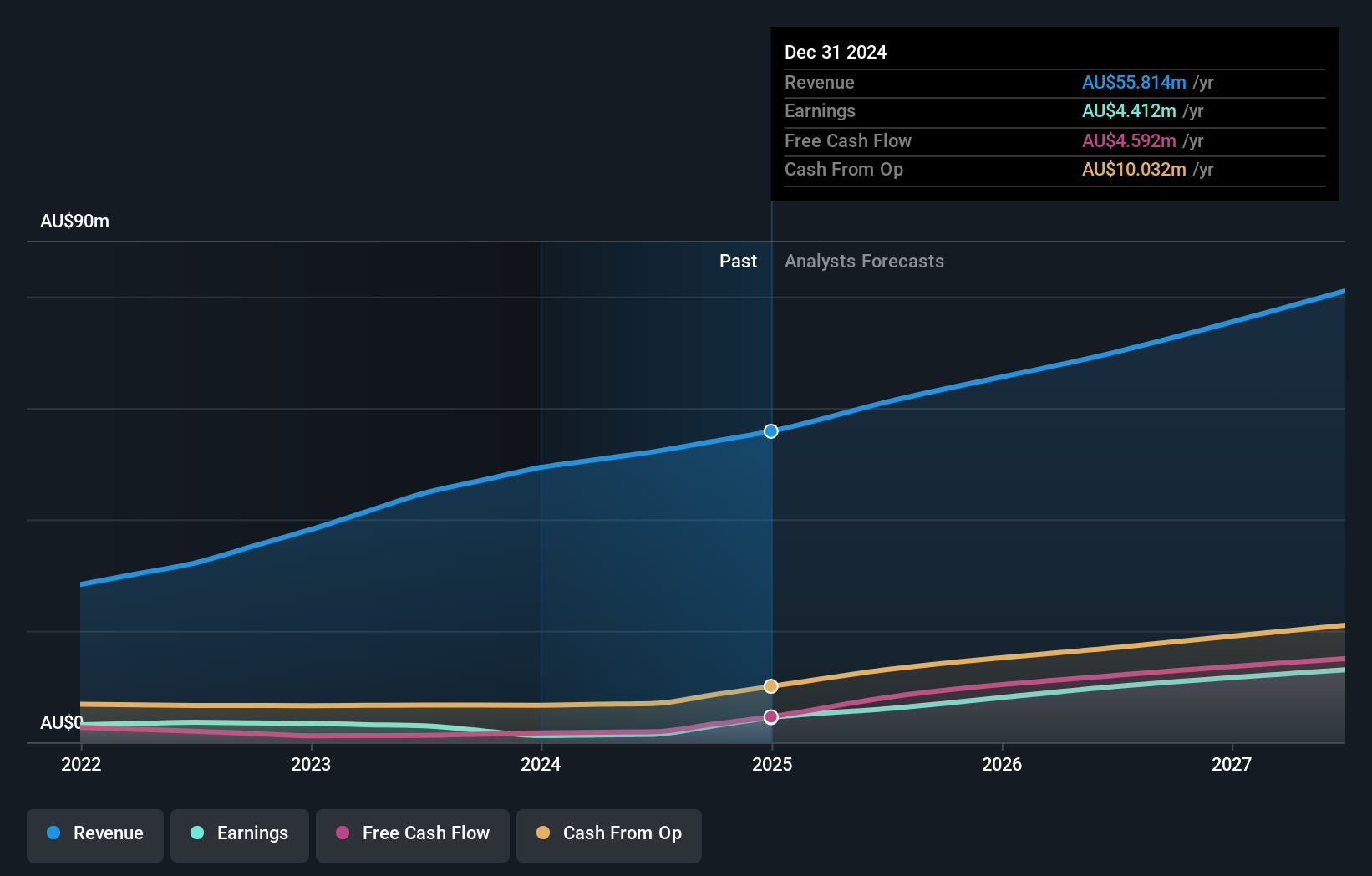

Overview: Energy One Limited provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in Australasia and Europe, with a market cap of A$537.30 million.

Operations: The company's revenue primarily comes from the Energy Software Industry segment, generating A$61.12 million.

Insider Ownership: 23.6%

Earnings Growth Forecast: 33.5% p.a.

Energy One's earnings are forecast to grow 33.47% annually, surpassing Australian market averages. Despite significant insider selling recently, the company shows potential with a high expected Return on Equity of 22.9% in three years and revenue growth projected at 14.6% per year, faster than the broader market. Analysts anticipate a stock price increase of 26.9%, reflecting confidence in its growth trajectory despite no substantial insider buying in the past quarter.

- Navigate through the intricacies of Energy One with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Energy One's current price could be inflated.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

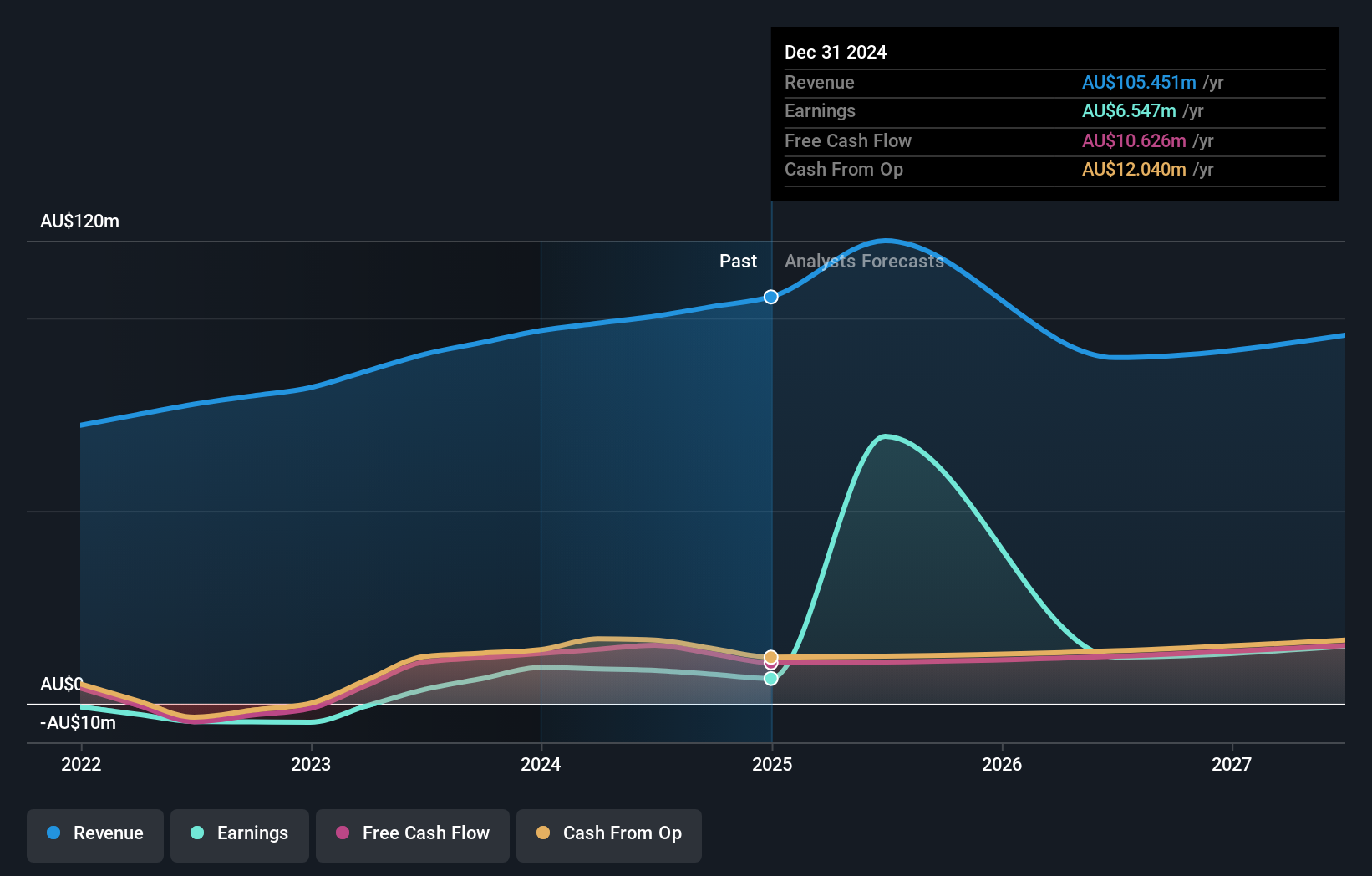

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various regions, including Australia, Asia, the Americas, Africa, and Europe, with a market cap of A$1.10 billion.

Operations: The company's revenue is derived from two main segments: Advisory, contributing A$24.77 million, and Software, generating A$73.96 million.

Insider Ownership: 12%

Earnings Growth Forecast: 55.0% p.a.

RPMGlobal Holdings is poised for significant earnings growth, projected at 55% annually, outpacing the broader Australian market. Revenue is expected to increase by 15% per year, exceeding market averages. Despite a low forecasted Return on Equity of 19.2%, the company remains attractive due to its robust earnings outlook. Recent financials are affected by large one-off items, and profit margins have decreased from last year. No substantial insider trading activity was reported in the past three months.

- Get an in-depth perspective on RPMGlobal Holdings' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that RPMGlobal Holdings is priced higher than what may be justified by its financials.

Make It Happen

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 112 companies by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報