Veidekke (OB:VEI) Valuation Check After New NOK 261m Sustainable Public-Sector Contract

Veidekke (OB:VEI) just picked up a NOK 261 million turnkey contract in Porsgrunn, adding a BREEAM-NOR certified nursing home wing and emergency clinic. This represents a clear boost to its public-sector order book.

See our latest analysis for Veidekke.

That focus on sustainable public projects helps explain why sentiment has been firm lately. A roughly 24 percent year to date share price return, together with a powerful multi year total shareholder return above 100 percent, suggests momentum is still building rather than fading.

If Veidekke’s contract pipeline has you thinking about where else capital and expertise are quietly compounding, it could be worth discovering fast growing stocks with high insider ownership today.

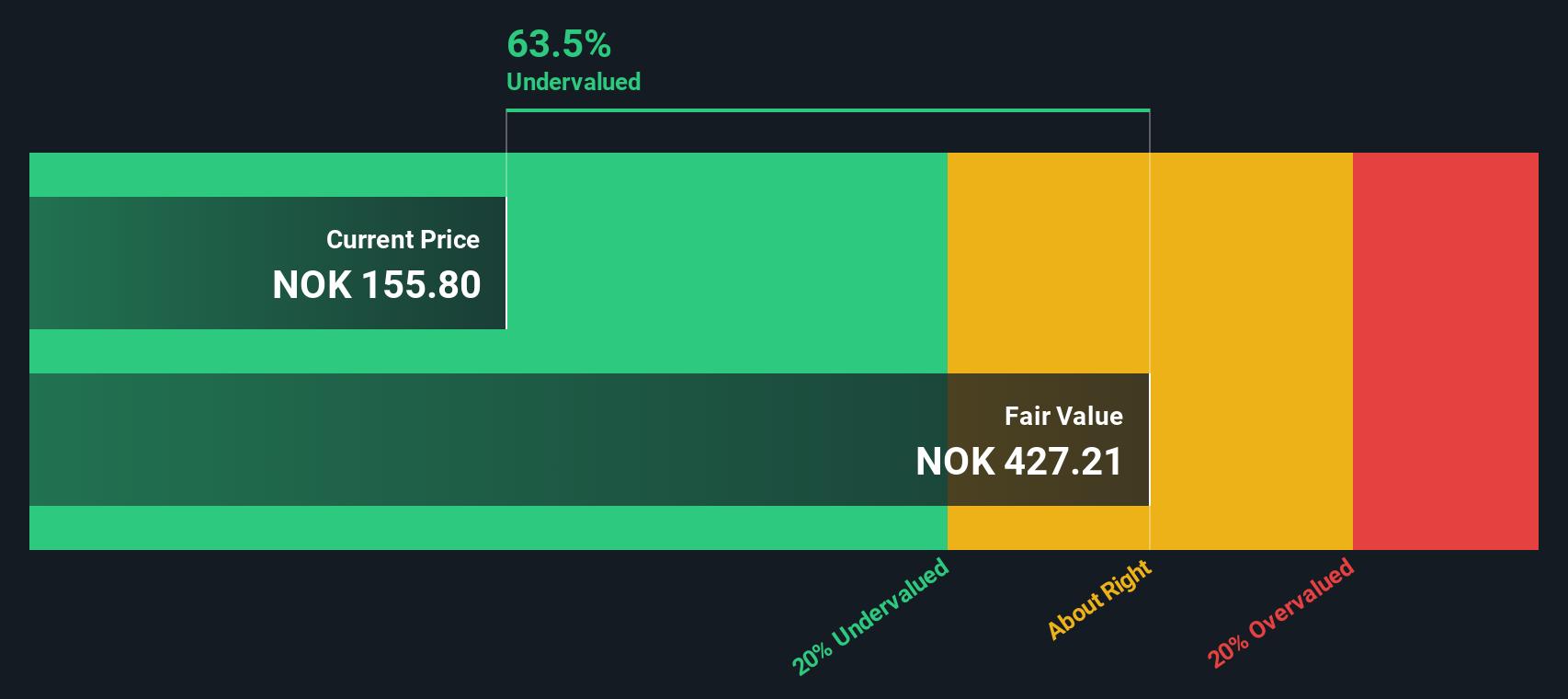

With Veidekke trading strongly after years of double digit total returns, yet still screening as deeply discounted on some intrinsic metrics, is this construction champion quietly undervalued, or is the market already baking in years of growth?

Price to Earnings of 17.5x: Is it justified?

On a price to earnings ratio of 17.5 times against a last close of NOK 174.60, Veidekke looks fully priced rather than overlooked, especially when stacked against fair value and peers.

The price to earnings ratio compares the company’s share price with its per share earnings, a common yardstick for mature, profitable construction and infrastructure businesses like Veidekke. At 17.5 times earnings, investors are paying a premium to access its steady profit base and long track record of growth, which signals confidence that current profitability can at least be maintained.

However, that premium stands out when you consider both the market and the modelled fair value. Veidekke trades on a higher multiple than the European construction industry average of 15.2 times and even edges above the peer average of 17.3 times. At the same time, our DCF work suggests the share price is materially below an intrinsic value of NOK 465.01. If the market converges toward the estimated fair price to earnings ratio of 13.4 times, there is scope for the valuation lens to shift, with the multiple adjusting as expectations around future earnings and returns on equity evolve.

Explore the SWS fair ratio for Veidekke

Result: Price-to-Earnings of 17.5x (OVERVALUED)

However, execution missteps on large public projects or a sharper slowdown in Nordic construction could quickly reverse today’s upbeat, rerating narrative.

Find out about the key risks to this Veidekke narrative.

Another View on Value

Our DCF model points in the opposite direction to the earnings multiple. While the 17.5 times price to earnings ratio hints at an expensive stock, the SWS DCF model suggests Veidekke is trading roughly 62 percent below an intrinsic value of about NOK 465.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veidekke for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veidekke Narrative

If you would rather examine the numbers yourself and form an independent view of Veidekke’s trajectory, you can build a custom story in minutes, Do it your way.

A great starting point for your Veidekke research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by widening your opportunity set with a few targeted stock ideas that match different strategies and risk levels.

- Capture potential turnaround stories by scanning these 3626 penny stocks with strong financials that already show financial strength instead of pure speculation.

- Position your portfolio for the next wave of innovation by targeting these 24 AI penny stocks that are pushing real world AI adoption.

- Boost your income stream by focusing on these 10 dividend stocks with yields > 3% that combine solid yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報