USA Compression Partners (USAC): Is the Recent Pullback Creating a Valuation Opportunity?

USA Compression Partners (USAC) has quietly pulled back over the past month even as its underlying business keeps growing. That disconnect between sliding unit price and improving fundamentals is exactly what income focused investors should notice.

See our latest analysis for USA Compression Partners.

At around $23.11 today, USA Compression Partners’ recent pullback follows a modestly negative 3 month share price return but sits against a much stronger backdrop, with a 1 year total shareholder return above 9 percent and a powerful multiyear total shareholder return track record suggesting longer term momentum remains intact.

If USAC’s steady cash flows appeal, this could be a good moment to also explore energy infrastructure peers and what is moving across fast growing stocks with high insider ownership.

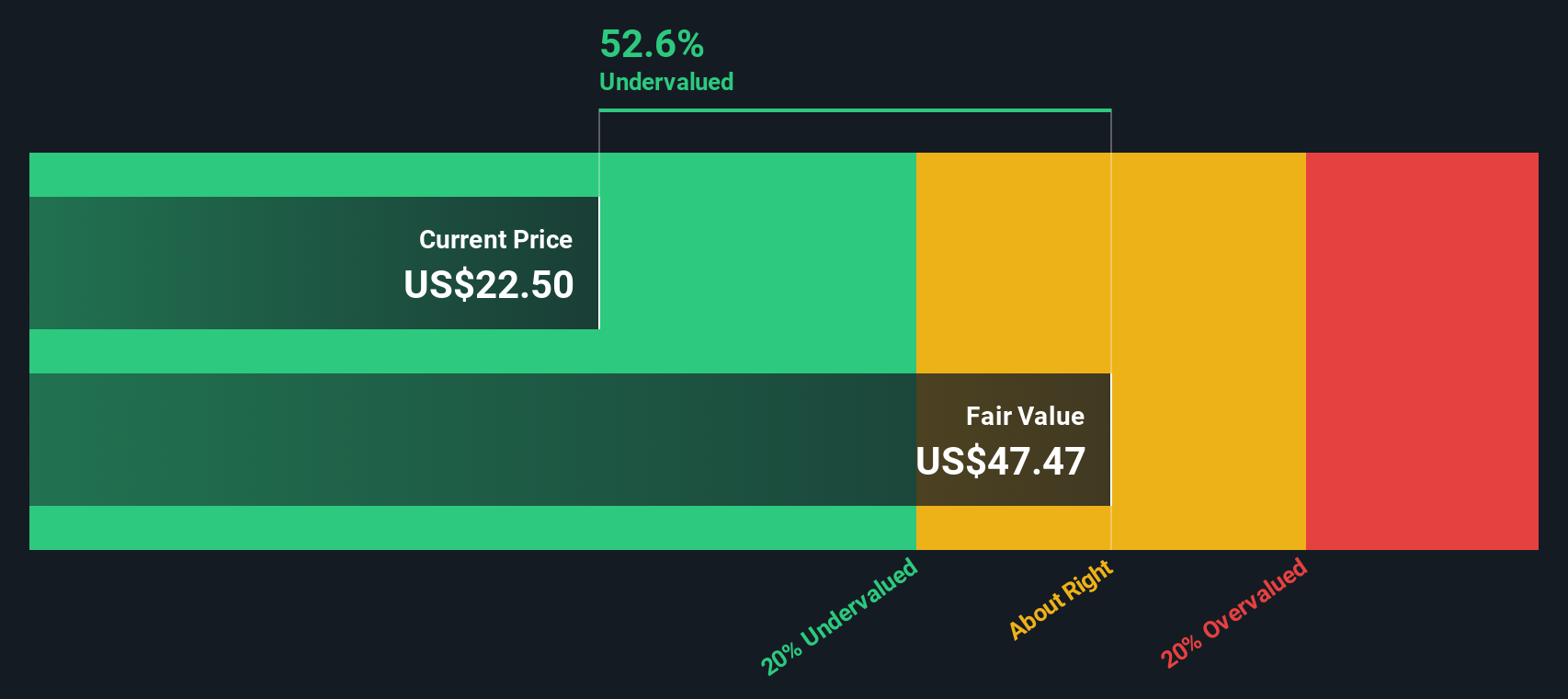

With units drifting lower despite healthy revenue and profit growth, USA Compression Partners now trades at a discount to analyst targets. This raises the key question: is this a timely entry point or is future growth already priced in?

Most Popular Narrative: 12.8% Undervalued

With USA Compression Partners closing at $23.11 against a narrative fair value of $26.50, the story leans toward upside potential if the projections land.

Early stage implementation of shared services with Energy Transfer is generating operational efficiencies and anticipated cost savings (notably in G&A and procurement), setting up for net margin expansion and improved free cash flow as these benefits are fully realized over 2026 and beyond.

Curious how steady contract renewals, margin expansion, and ambitious profit targets all mesh into one valuation playbook? The narrative breaks down the growth math driving that upside case.

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a handful of large customers, along with rising capital and labor costs, could quickly squeeze margins and undermine that upside case.

Find out about the key risks to this USA Compression Partners narrative.

Another Lens on Value

Our DCF model paints a very different picture, with fair value closer to $11.72, suggesting USA Compression Partners might be trading well above what its future cash flows justify. If the cash really comes in weaker than hoped, how much downside are investors taking on here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out USA Compression Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own USA Compression Partners Narrative

If you see the story differently or want to stress test your own assumptions, dig into the numbers yourself and build a custom thesis in minutes: Do it your way.

A great starting point for your USA Compression Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall Street Screener to uncover other compelling setups that could sharpen your portfolio and accelerate your returns.

- Capture potential multi baggers by targeting mispriced companies through these 901 undervalued stocks based on cash flows before the market fully catches on.

- Position yourself at the front of the next tech wave by examining these 24 AI penny stocks transforming entire industries with intelligent automation.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that combine attractive yields with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報