Unearthing US Market's 3 Undiscovered Gem Stocks

Amidst a backdrop of record-setting highs for major indices like the S&P 500 and Dow Jones Industrial Average, the U.S. stock market continues to capture investor attention with its robust performance. In this thriving environment, discovering stocks that are not yet in the spotlight but show potential can be rewarding for investors seeking growth opportunities beyond blue-chip names.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We'll examine a selection from our screener results.

CEA Industries (BNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CEA Industries Inc., operating through its subsidiary Surna Cultivation Technologies LLC, specializes in providing environmental control technologies and services to the controlled environment agriculture industry in the United States and Canada, with a market cap of $294.34 million.

Operations: Revenue primarily stems from designing, manufacturing, and distributing indoor climate control systems, totaling $3.72 million.

CEA Industries, a small company in the digital asset space, has seen significant board changes and investor activism recently. The firm added two independent directors, Annemarie Tierney and Carly Howard, to enhance governance amidst shareholder concerns. Despite challenges like stock price underperformance and strategic execution issues highlighted by YZi Labs, CEA remains committed to its BNB Digital Asset Treasury strategy. The company faced a reprimand from Nasdaq for compliance lapses but resolved the issue promptly. With a focus on digital assets and new leadership expertise, CEA aims to strengthen its market position while addressing investor concerns about communication and oversight.

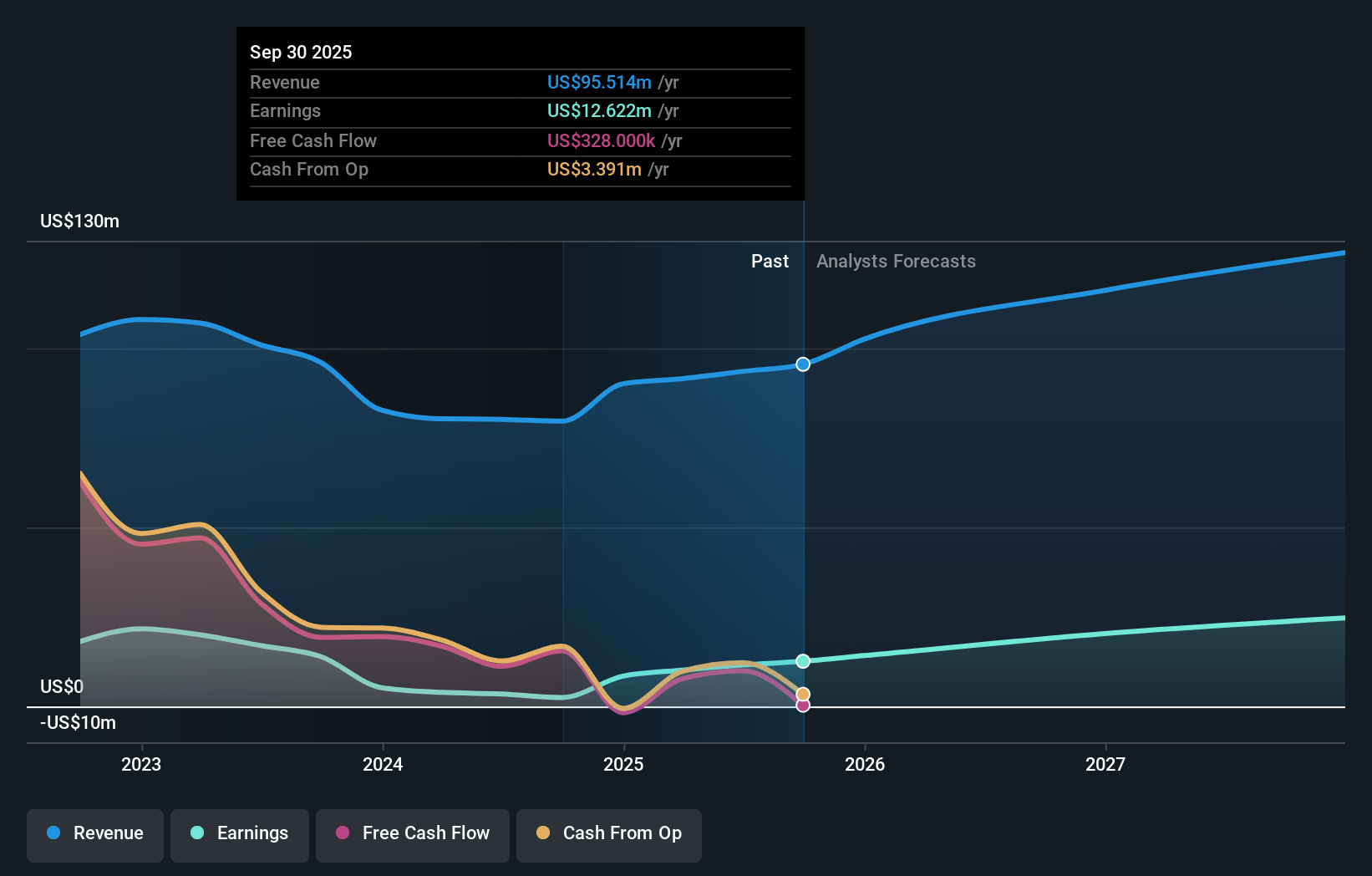

First Western Financial (MYFW)

Simply Wall St Value Rating: ★★★★★★

Overview: First Western Financial, Inc. is a financial holding company that offers wealth advisory, private banking, personal trust, investment management, mortgage lending, and institutional asset management services to individual and corporate clients with a market cap of $253.75 million.

Operations: Revenue primarily comes from wealth management services, generating $90.23 million, while mortgage services contribute $5.29 million.

First Western Financial, with total assets of US$3.2 billion and equity of US$261.5 million, showcases a robust financial position in the banking sector. The company has total deposits amounting to US$2.8 billion and loans totaling US$2.6 billion, backed by a sufficient bad loan allowance at 0.7% of total loans, ensuring stability against potential defaults. Earnings growth over the past year reached an impressive 403%, outpacing industry norms significantly, reflecting its high-quality earnings profile and strategic management decisions such as recent share buybacks worth US$0.3 million for 13,946 shares to enhance shareholder value further.

- Click here to discover the nuances of First Western Financial with our detailed analytical health report.

Gain insights into First Western Financial's past trends and performance with our Past report.

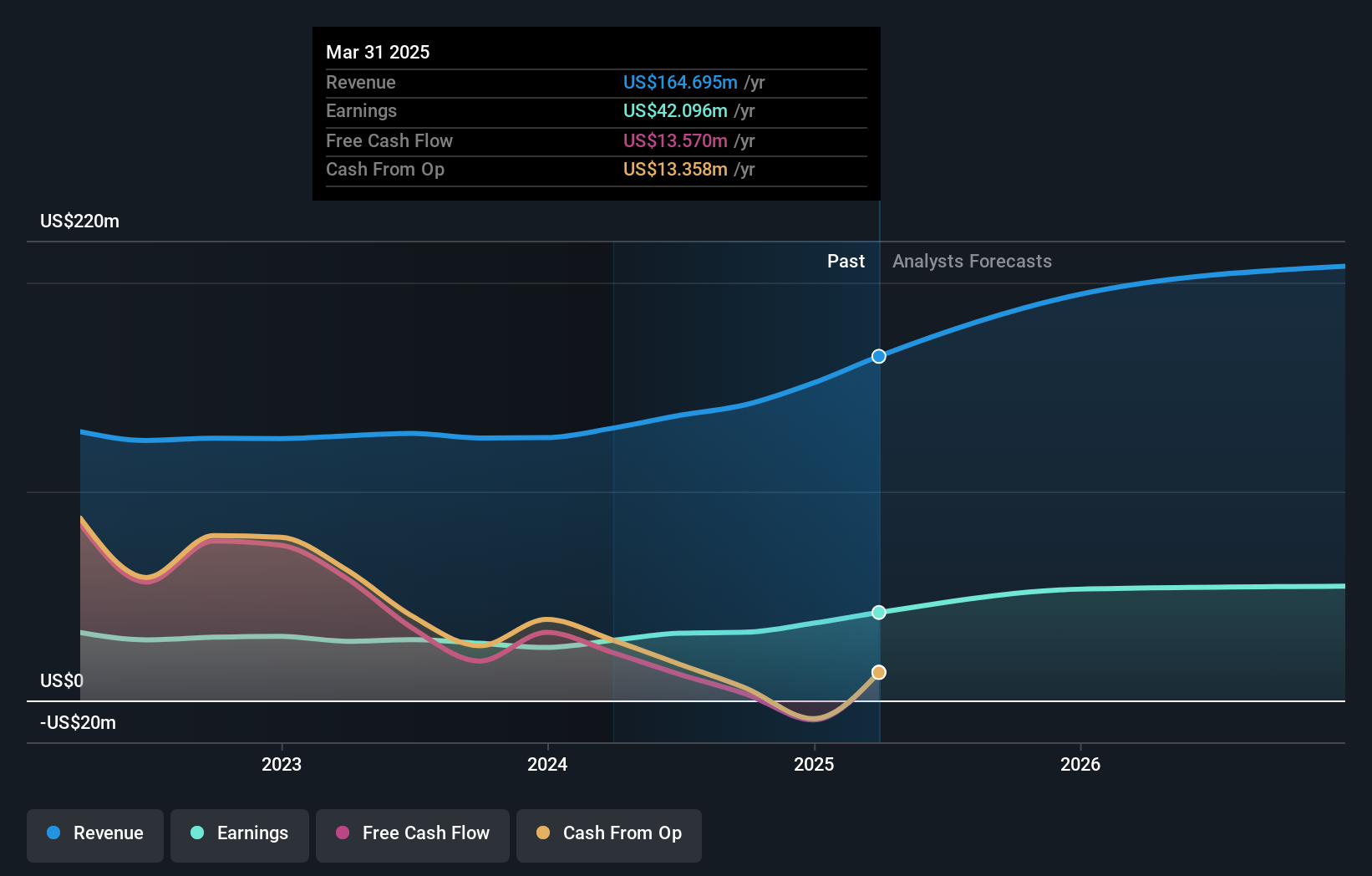

Northrim BanCorp (NRIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market cap of $609.26 million.

Operations: Northrim BanCorp generates revenue primarily from Community Banking, contributing $141.80 million, and Home Mortgage Lending, adding $36.89 million. Specialty Finance also plays a role with $21.93 million in revenue. The company has a market cap of approximately $609.26 million.

With total assets of US$3.3 billion and equity standing at US$315.7 million, Northrim BanCorp shows robust financial health. It holds deposits worth US$2.9 billion against loans totaling US$2.2 billion, reflecting a solid deposit-to-loan ratio that supports its low-risk profile with 97% liabilities from customer deposits. The company has a sufficient allowance for bad loans at 0.6% of total loans, ensuring stability in uncertain times. Recent earnings growth of 93% outpaces the industry average significantly, highlighting strong operational performance and value potential as it trades below estimated fair value by 12%.

Make It Happen

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 300 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報