Assessing Pentair (PNR) Valuation After 50th Dividend Hike and New $1 Billion Buyback Plan

Pentair (PNR) just doubled down on rewarding shareholders by lifting its quarterly dividend by 8% for a 50th straight year and rolling out a new $1 billion share repurchase plan.

See our latest analysis for Pentair.

Those richer shareholder returns are landing after a steady year, with a mid single digit year to date share price return and a powerful three year total shareholder return suggesting momentum is still quietly building rather than fading.

If Pentair's mix of dependable cash flows and capital returns appeals, it could be worth scanning fast growing stocks with high insider ownership for other under the radar businesses where insiders are backing long term growth.

Yet with the shares already up strongly over three years and trading only modestly below analyst targets, investors now face a key question: is Pentair still mispriced or is the market already baking in its next leg of growth?

Most Popular Narrative: 13.6% Undervalued

With Pentair closing at $105.38 against a narrative fair value of $122, the storyline leans toward upside, hinging on margin strength and durable growth.

The analysts have a consensus price target of $115.368 for Pentair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $95.0.

Curious what kind of revenue runway, expanding margins, and future earnings power could justify that gap to fair value, even on a lower multiple? The full narrative lays out a detailed earnings and profitability roadmap, plus the forward valuation math that ties it all together.

Result: Fair Value of $122 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in residential pool demand, or rising resistance to further price increases, could quickly pressure margins and challenge that optimistic valuation roadmap.

Find out about the key risks to this Pentair narrative.

Another Angle on Valuation

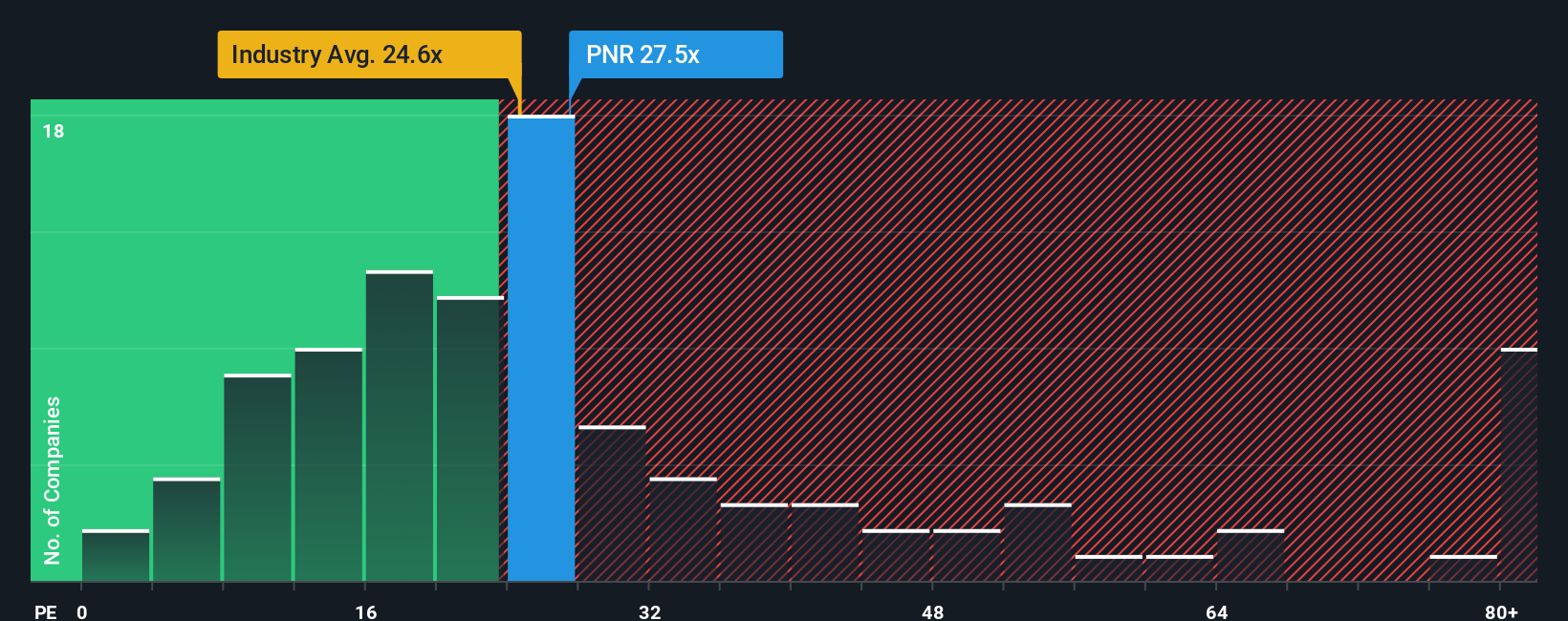

Look past the upbeat narrative and Pentair screens as pricey on earnings, trading at 26.4 times versus 25.5 times for the US Machinery industry and 23.5 times for peers, and only near its 26.6 times fair ratio. Is the market already paying up for that margin story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for more investment ideas?

Before you move on, line up your next opportunities with targeted stock ideas from Simply Wall Street, so you are not relying on Pentair alone.

- Capture long term growth potential by scanning these 901 undervalued stocks based on cash flows for quality companies the market may be mispricing today.

- Turbocharge your income strategy by reviewing these 10 dividend stocks with yields > 3% and zeroing in on businesses with robust, higher yielding payouts.

- Position ahead of financial innovation by evaluating these 80 cryptocurrency and blockchain stocks for companies building real world applications around blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報