Okeanis Eco Tankers (OB:OET): Reassessing Valuation After $90m Debt Deal for New Suezmax Fleet Expansion

Okeanis Eco Tankers (OB:OET) just locked in two new 90 million dollar debt facilities to finance its latest Suezmax newbuilds, a move that tightens fleet expansion plans and reshapes the medium term cash flow picture for shareholders.

See our latest analysis for Okeanis Eco Tankers.

The fresh debt facilities land after a powerful run, with the share price still up about 32 percent year to date and the 1 year total shareholder return near 59 percent. However, recent 1 month share price weakness suggests momentum is cooling as investors reassess risk and growth expectations.

If this kind of shipping expansion has your attention, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With the stock still trading at a steep discount to analyst targets despite stellar multi year returns, the key question now is whether Okeanis Eco Tankers remains undervalued or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 22.5% Undervalued

With Okeanis Eco Tankers last closing at NOK328 against a narrative fair value near NOK423, the valuation debate now centers on how sustainable future profitability could be.

Significant recent refinancing activity has lowered financing costs, staggered maturities, and reduced daily cash break evens, giving Okeanis more financial flexibility and further increasing earnings resilience and potential margin expansion, especially in volatile markets.

Curious how falling revenues can coexist with rising earnings, expanding margins, and a richer future earnings multiple. Want to see the full playbook behind that fair value.

Result: Fair Value of $423.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns around high leverage and heavy crude exposure mean that any slump in charter rates could quickly undermine that upbeat valuation narrative.

Find out about the key risks to this Okeanis Eco Tankers narrative.

Another Angle On Valuation

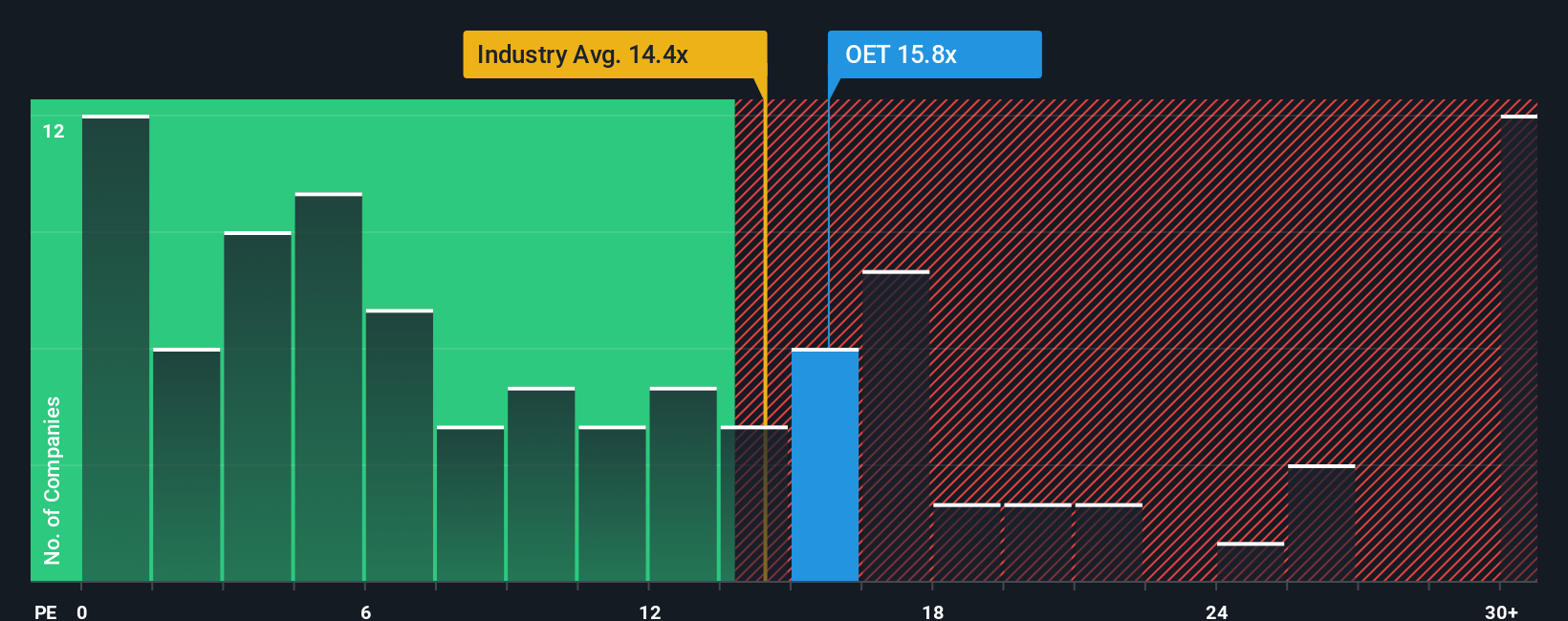

While the narrative fair value points to Okeanis Eco Tankers being meaningfully undervalued, its current price tag looks far less generous when you look at earnings. The stock trades on 15.1 times earnings versus about 11.6 times for the wider European oil and gas group and 12.1 times for close peers.

Our fair ratio for Okeanis Eco Tankers is closer to 8.3 times earnings, which is well below where the market is currently trading it. That gap hints at valuation risk rather than a clear bargain, especially if rates soften or growth underwhelms. Are investors leaning too hard on the optimistic narrative?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okeanis Eco Tankers Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Okeanis Eco Tankers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning focused stock shortlists that can help inform your next investing decision.

- Capture income potential by reviewing these 10 dividend stocks with yields > 3% that may help you build a steadier, yield-focused portfolio.

- Position yourself for the next wave of innovation with these 24 AI penny stocks that are shaping real-world AI adoption.

- Strengthen your value playbook by checking these 901 undervalued stocks based on cash flows that could be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報