FanDuel Predicts Launch and New Board Appointment Might Change The Case For Investing In Flutter (FLUT)

- Flutter Entertainment recently launched FanDuel Predicts with CME Group in five U.S. states, offering event contracts on financial indicators and sports outcomes as it pushes further into regulated online betting.

- Alongside this product expansion, the company has moved to deepen its governance and external affairs expertise by appointing Pfizer executive Sally Susman as a future non-executive director, effective after its May 2026 AGM.

- We’ll now explore how FanDuel Predicts’ early U.S. rollout could influence Flutter’s growth narrative, regulatory positioning, and long-term earnings profile.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Flutter Entertainment Investment Narrative Recap

To own Flutter, you have to believe that regulated online betting and iGaming can keep expanding in key markets like the U.S. while the group manages tightening taxes, high leverage and integration demands. FanDuel Predicts is directionally aligned with the product innovation catalyst but, at this stage, does not materially change the near term focus on U.S. growth and regulatory risk, which still looks like the most important swing factor for the share price.

Among recent announcements, the appointment of Pfizer executive Sally Susman as a future non executive director stands out here, given Flutter’s growing exposure to regulatory scrutiny and public policy debate around gambling. Her background in corporate affairs and stakeholder engagement may support the company’s push into more complex markets such as Brazil and new U.S. states, where product innovation like FanDuel Predicts intersects directly with licensing, taxation and long term political risk.

Yet while product innovation can help offset tax and regulatory headwinds, investors should also be aware of how rising effective tax burdens could...

Read the full narrative on Flutter Entertainment (it's free!)

Flutter Entertainment's narrative projects $23.5 billion revenue and $2.5 billion earnings by 2028.

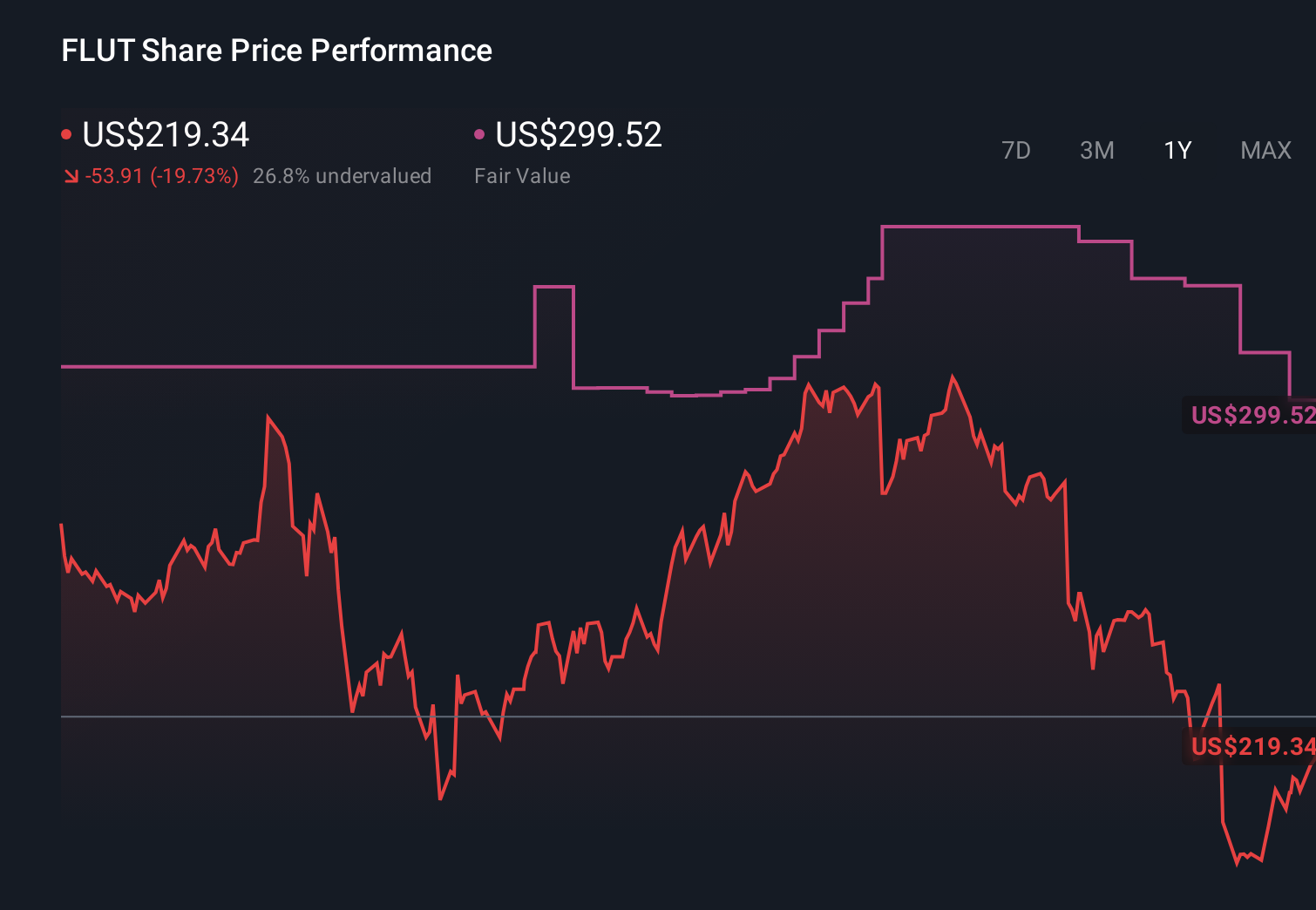

Uncover how Flutter Entertainment's forecasts yield a $299.52 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see fair value for Flutter anywhere between US$162.65 and US$1,000, highlighting just how far apart views can be. Set against this spread, the key question is how you weigh the upside from product innovation like FanDuel Predicts against the risk that higher gambling taxes and fees in markets such as Illinois could steadily eat into future margins and cash generation.

Explore 7 other fair value estimates on Flutter Entertainment - why the stock might be worth over 4x more than the current price!

Build Your Own Flutter Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flutter Entertainment research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Flutter Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flutter Entertainment's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報