Helios Underwriting Leads The Charge In UK Penny Stock Spotlight

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting the interconnectedness of global economies. Amid such volatility, investors often look for stocks that offer potential growth at lower price points. Penny stocks, though considered a niche area today, can present opportunities in smaller or newer companies that possess strong financial health and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.255 | £488.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.975 | £159.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.86 | £12.98M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.865 | £78.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.504 | £182.15M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.47 | £40.51M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Helios Underwriting (AIM:HUW)

Simply Wall St Financial Health Rating: ★★★★☆☆

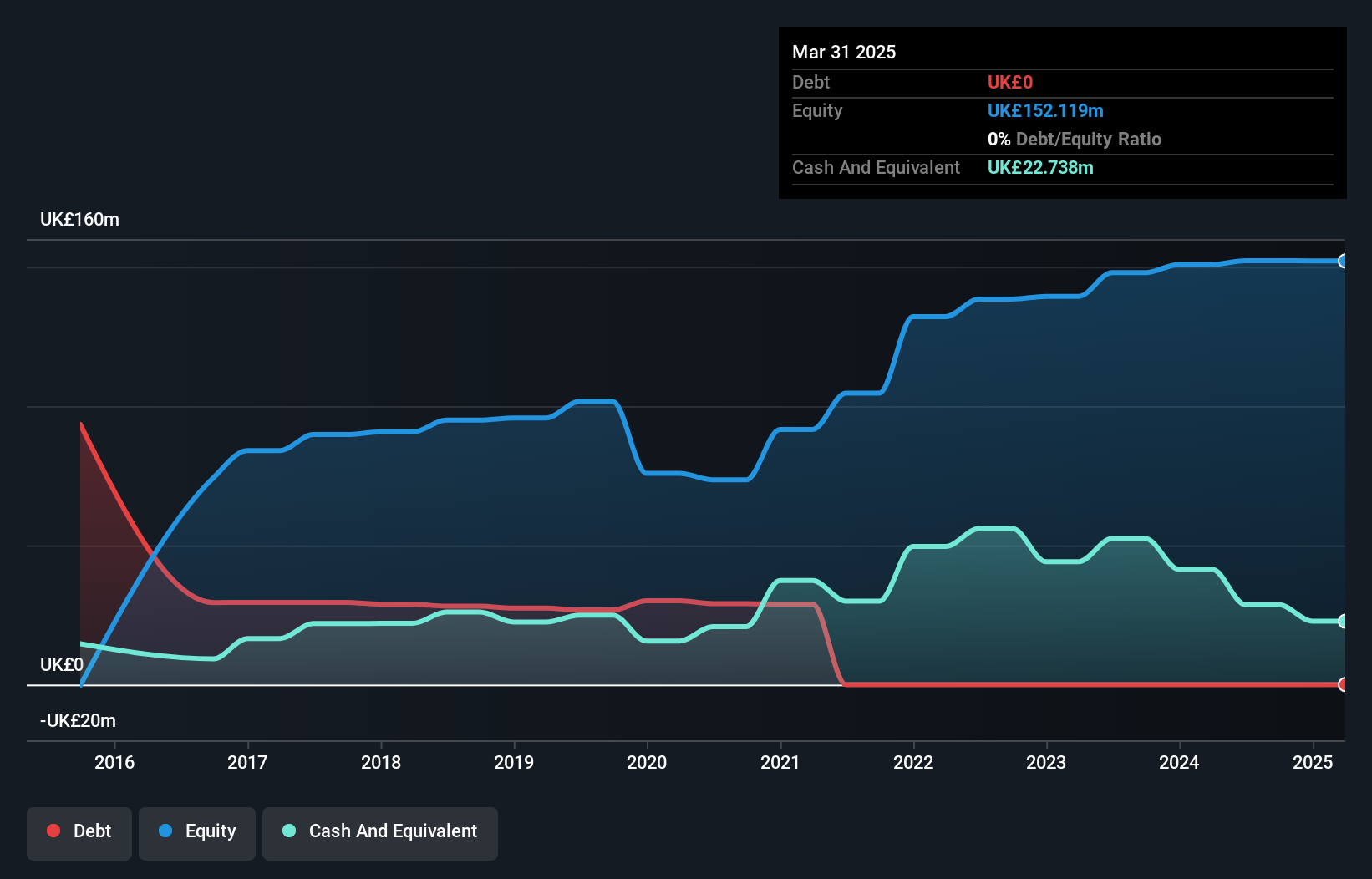

Overview: Helios Underwriting plc, with a market cap of £151.81 million, offers limited liability investments for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Operations: The company's revenue segment is derived entirely from the United Kingdom, amounting to £32.05 million.

Market Cap: £151.81M

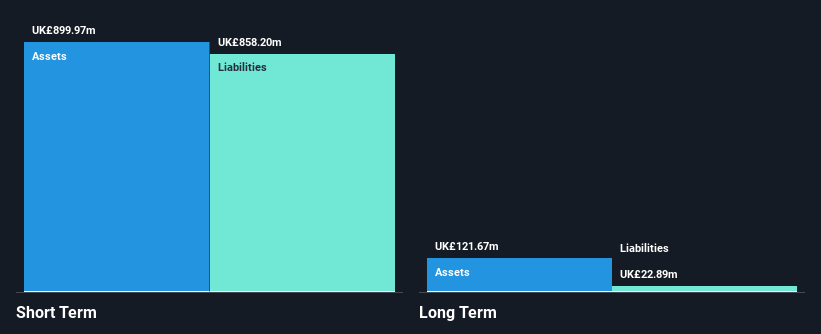

Helios Underwriting plc, trading at a significant discount to its estimated fair value, has shown improved profitability with a net profit margin of 74.7%, compared to last year's negative margin. Despite this, the company faces challenges with declining revenue and earnings growth forecasts. Its debt is well managed, covered by operating cash flow and interest payments are adequately handled by EBIT. Recent board changes include the appointment of Joanna Parsons as an Independent Non-Executive Director, bringing extensive experience in strategic growth and financial oversight within regulated environments. However, insider selling raises some concerns about internal confidence in future prospects.

- Click to explore a detailed breakdown of our findings in Helios Underwriting's financial health report.

- Explore Helios Underwriting's analyst forecasts in our growth report.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally, with a market cap of £461.35 million.

Operations: The company generates revenue from its recreational activities segment, amounting to £250.66 million.

Market Cap: £461.35M

Hollywood Bowl Group, with a market cap of £461.35 million, has shown stable performance in the UK penny stock landscape. The company reported revenue of £250.66 million and net income growth to £34.61 million for the year ended September 30, 2025. Despite an unstable dividend track record, it declared a final ordinary dividend of 9.18 pence per share for 2025, signaling potential shareholder returns. The recent appointment of Antony Smith as CFO brings strategic financial expertise to support its expansion plans in Canada, although short-term assets do not cover liabilities fully (£30.6M vs £50.2M).

- Dive into the specifics of Hollywood Bowl Group here with our thorough balance sheet health report.

- Understand Hollywood Bowl Group's earnings outlook by examining our growth report.

Record (LSE:REC)

Simply Wall St Financial Health Rating: ★★★★★★

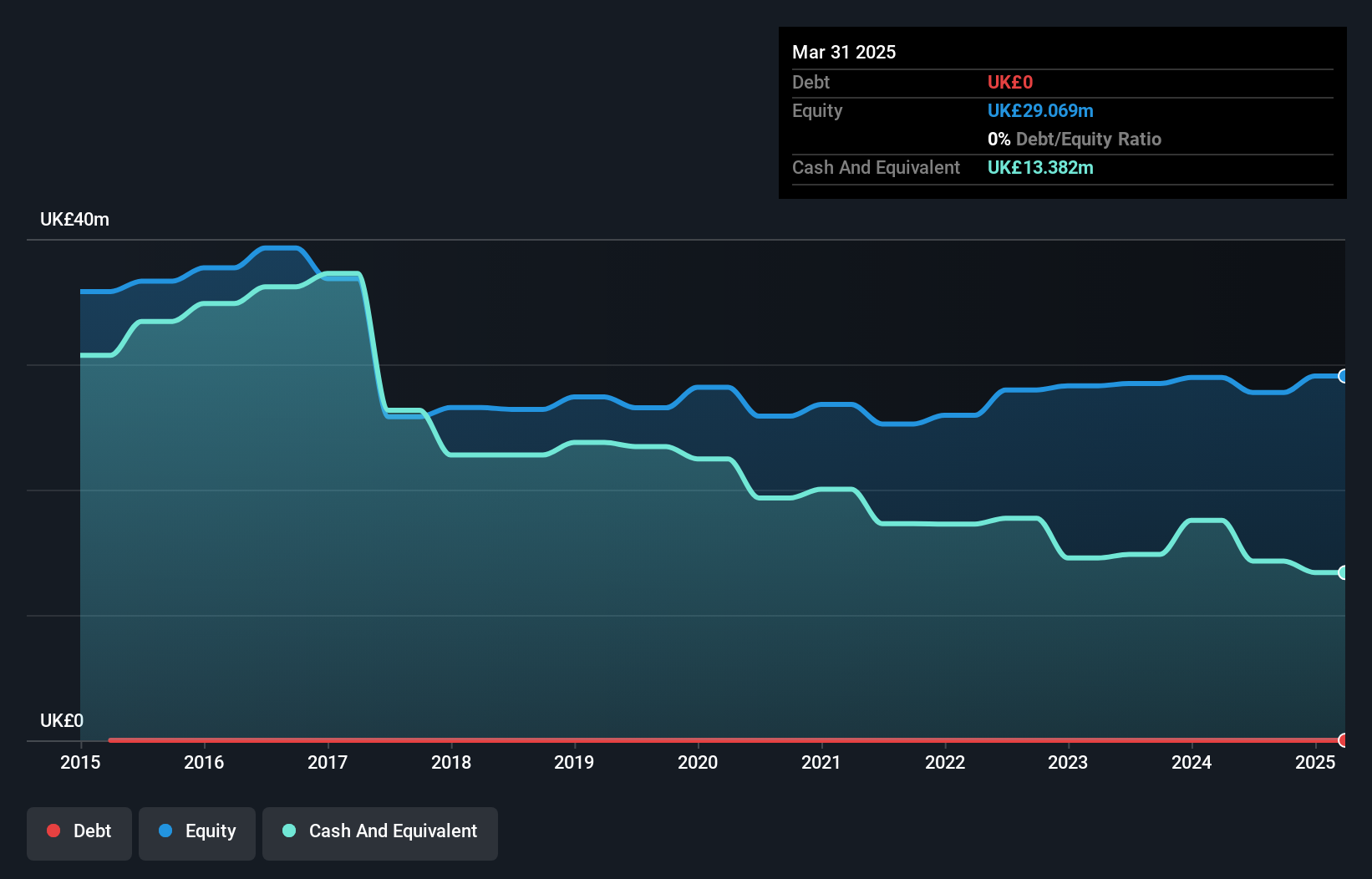

Overview: Record plc offers currency and asset management services across the United Kingdom, North America, Switzerland, Europe, Australia, and other international markets with a market cap of £108.57 million.

Operations: Record plc has not reported any specific revenue segments.

Market Cap: £108.57M

Record plc, with a market cap of £108.57 million, stands out in the UK penny stock arena due to its debt-free status and high return on equity of 29.4%. Despite a recent decline in earnings growth and reduced sales (£19.2M vs £21.12M), it maintains strong short-term asset coverage over liabilities (£26.2M vs £6.6M). However, its dividend yield of 8.3% is not well-supported by earnings or free cash flow, raising sustainability concerns. Recent board changes include the transition of Dr Othman Boukrami to Executive Director and Nick Adams joining as Non-Executive Director from January 2026, reflecting strategic leadership adjustments amidst ongoing executive shifts.

- Click here and access our complete financial health analysis report to understand the dynamics of Record.

- Review our growth performance report to gain insights into Record's future.

Seize The Opportunity

- Embark on your investment journey to our 305 UK Penny Stocks selection here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報