Evaluating Dow (DOW) After Cautious Earnings Revisions and Expectations of a Revenue Decline

Upcoming earnings put Dow (DOW) under a cautious spotlight

Market attention is turning to Dow (DOW) ahead of its January 29, 2026 earnings release, with Wall Street bracing for a year over year revenue decline and recently trimmed profit expectations.

See our latest analysis for Dow.

The share price has drifted lower over the year, with a year to date share price return of about negative 42 percent and a roughly negative 38 percent one year total shareholder return. This suggests sentiment has weakened even as the stock has edged up modestly in recent months.

If Dow’s mixed momentum has you rethinking your materials exposure, this could be a good moment to scout fast growing stocks with high insider ownership for fresher growth ideas backed by committed insiders.

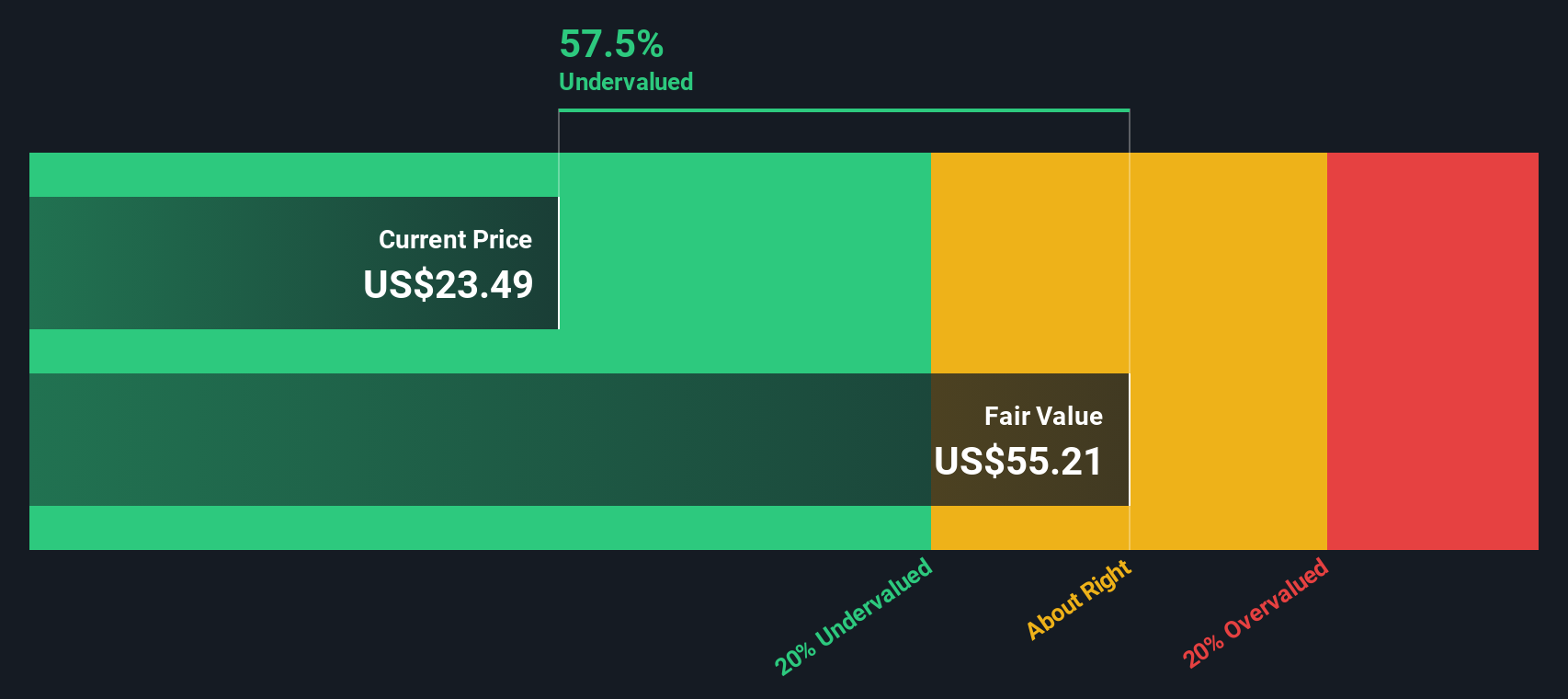

With earnings set to reveal softer revenue and analysts already tempering expectations, is Dow’s steep share price slide now offering patient investors a mispriced value opportunity, or is the market simply recognizing weaker prospects and pricing in limited future growth?

Most Popular Narrative Narrative: 17.1% Undervalued

With Dow last closing at $23.06 against a narrative fair value near $27.82, the story leans toward upside if the long term cash and margin path is met.

The company is expanding their strategic review of European assets, planning to idle or shut down three initial assets. This move aims to optimize asset utilization and enhance near term cash flow, potentially improving earnings by reducing excess capacity and focusing on higher margin operations.

Want to see why modest revenue growth, a sharp profit swing, and a re rated earnings multiple still add up to upside potential? The full narrative reveals the math.

Result: Fair Value of $27.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering margin pressure from elevated energy costs and prolonged macro weakness could quickly erode the upside case if demand fails to stabilize.

Find out about the key risks to this Dow narrative.

Another Lens On Value

Our SWS DCF model paints a very different picture, pointing to a fair value closer to $14.23, which would make Dow look overvalued at today’s $23.06 price. If cash flows do not ramp as quickly as the narrative suggests, could this upside story already be priced in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dow Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity with fresh stock ideas tailored to different strategies so you are not relying on Dow alone.

- Review these 901 undervalued stocks based on cash flows to explore potential mispricings that the market may have overlooked despite strong underlying cash flows.

- Explore these 24 AI penny stocks to build a growth watchlist focused on companies involved in machine learning and automation trends.

- Use these 10 dividend stocks with yields > 3% to help strengthen your income stream with stocks that combine attractive yields and sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報