Assessing Associated Banc-Corp (ASB)’s Valuation After Its Recent Share Price Gains

Associated Banc-Corp (ASB) has been quietly rewarding patient shareholders, with the stock up about 4% over the past month and 13% over the past year as earnings and profitability continue trending higher.

See our latest analysis for Associated Banc-Corp.

With the share price now around $26.55 and a 12.5% year to date share price return, Associated Banc-Corp’s momentum looks steady rather than explosive, supported by a solid 13.05% one year total shareholder return and improving earnings.

If this kind of steady compounding appeals to you, it might be worth broadening your search and discovering fast growing stocks with high insider ownership for other ideas with strong backing.

With earnings growing faster than revenue and the stock still trading at a notable discount to analysts’ targets and estimated intrinsic value, the key question is whether ASB remains undervalued or if the market is already pricing in that future growth.

Most Popular Narrative: 9.1% Undervalued

With the narrative fair value at $29.20 versus the $26.55 last close, the story leans toward upside, built on ambitious earnings and margin assumptions.

Analysts expect earnings to reach $720.3 million (and earnings per share of $3.22) by about September 2028, up from $127.1 million today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 33.6x today.

Curious how revenue, margins and that future earnings multiple all line up to support this price? The narrative combines aggressive growth assumptions with a comparatively restrained terminal valuation. Want to see which projections really carry the model?

Result: Fair Value of $29.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained expansion into commercial and CRE lending, combined with intense competition for deposits and digital capabilities, could pressure margins and derail those optimistic earnings projections.

Find out about the key risks to this Associated Banc-Corp narrative.

Another Lens On Valuation

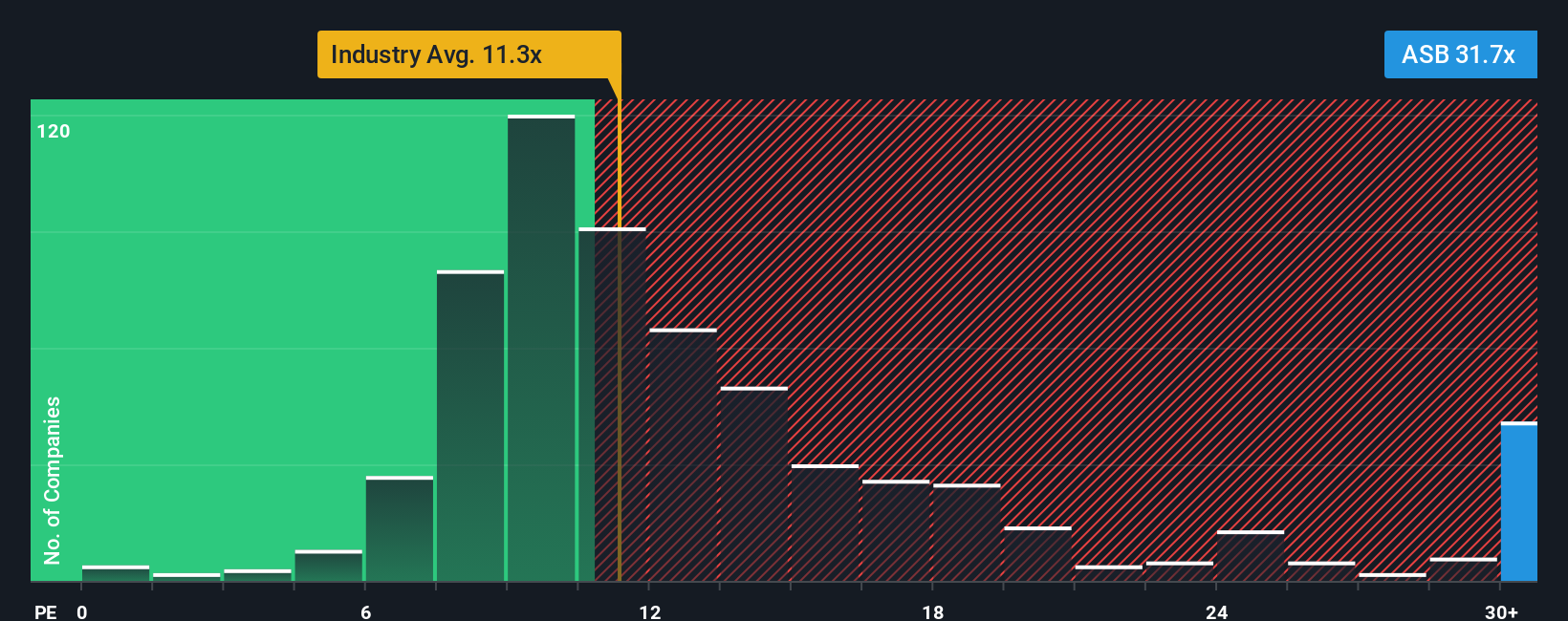

Step back from the narrative fair value and the picture looks very different. On a simple price to earnings basis, Associated Banc-Corp trades at about 26.8 times earnings, versus 11.9 times for US banks, 17.3 times for peers, and a fair ratio of 18.4 times. This suggests the stock looks expensive rather than cheap. Which signal do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Associated Banc-Corp Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Associated Banc-Corp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning curated stock ideas that match different strategies, from growth and innovation to income and long term value.

- Capture potential multi baggers early by reviewing these 3629 penny stocks with strong financials that already show solid financial underpinnings, not just hype.

- Explore the structural shift toward automation and intelligent software with these 24 AI penny stocks that sit at the heart of the AI adoption trend.

- Strengthen your core portfolio by reviewing these 901 undervalued stocks based on cash flows where prices may still lag behind the cash flows supporting them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報