Assessing Marzetti (MZTI)’s Valuation as Earnings Grow but Share Price Momentum Softens

Marzetti (MZTI) has been drifting slightly lower over the past month, even as its earnings and revenue continue to inch higher. That gap between operational progress and share performance is what makes the stock interesting now.

See our latest analysis for Marzetti.

Over the past year, the share price has drifted lower despite steady fundamental growth, with a slightly negative year to date share price return and a modestly negative 1 year total shareholder return suggesting momentum has been fading rather than accelerating.

If Marzetti’s slow burn has you thinking about where stronger momentum might be hiding, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings rising, a near 20 percent gap to analyst targets, and a recent rebrand reshaping its identity, is Marzetti quietly trading below its true potential, or are markets already baking in every slice of future growth?

Most Popular Narrative: 16.8% Undervalued

Based on the most followed narrative, Marzetti's fair value of $199 sits meaningfully above the recent $165.49 close, framing a valuation gap worth examining.

The launch of newly licensed and branded products (like national rollout of Texas Roadhouse dinner rolls and new core brand innovations) is expected to drive retail volume growth and further premiumization, directly supporting top-line revenue and, given the mix shift, potentially expanding net margins.

Strategic focus on optimizing the supply chain, through the closure of higher-cost facilities, ramp-up of the new Atlanta plant, and ongoing productivity initiatives, is set to provide meaningful cost savings, driving operating margin improvement and supporting higher overall profitability.

Curious how steady mid single digit growth assumptions, richer margins, and a punchy future earnings multiple combine to justify that upside target? The full narrative unpacks the exact revenue trajectory, profit margin lift, and valuation multiple the market might grow into, step by step.

Result: Fair Value of $199 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Marzetti still faces pressure from retailer private labels and shifting demand toward fresher, cleaner foods, which could cap pricing power and volumes.

Find out about the key risks to this Marzetti narrative.

Another View: Valuation Looks Stretched

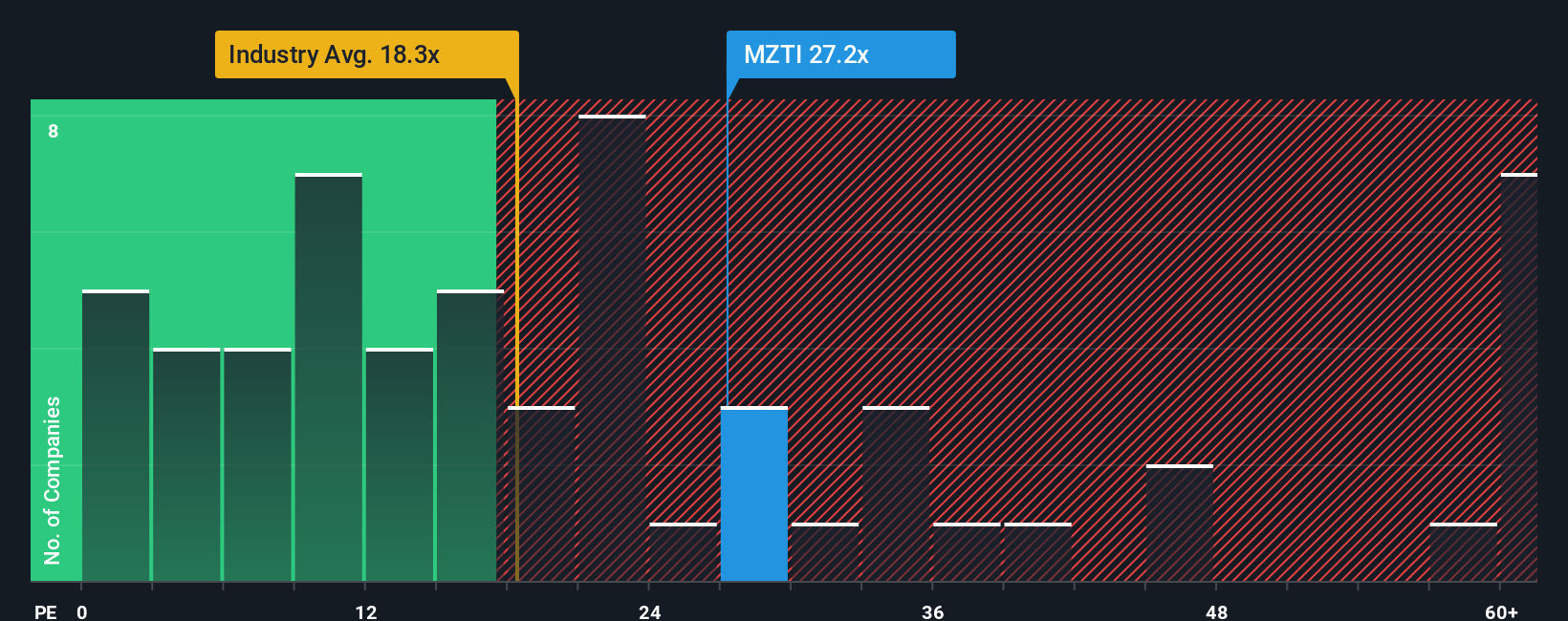

While the popular narrative sees around 16.8 percent upside, the usual earnings yardstick tells a different story. Marzetti trades on 26.9 times earnings versus 20.3 times for the US Food industry and 14.6 times for peers, well above a fair ratio of 16.3 times.

That premium suggests investors are already paying up for its steady, but not spectacular, growth. This raises the question of how much upside is really left if expectations slip even slightly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marzetti Narrative

If this perspective does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Marzetti.

Ready for your next investing move?

Marzetti might be one opportunity, but your portfolio deserves more than one story. Let us help uncover fresh ideas that others could overlook.

- Target reliable income streams by reviewing these 10 dividend stocks with yields > 3% that may help keep cash flowing even when markets turn choppy.

- Seek exposure to innovation with these 24 AI penny stocks connected to developments in machine learning and automation.

- Explore ways to strengthen long term returns by focusing on these 902 undervalued stocks based on cash flows where prices may not fully reflect underlying cash flow characteristics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報