Exploring Omega Flex And 2 Other Undervalued Small Caps With Insider Buying

As the U.S. stock market continues to set new records, with the S&P 500 achieving an all-time high, investors are increasingly turning their attention to small-cap stocks, which often offer unique opportunities for growth in a buoyant economic environment. In this context, identifying undervalued small-cap companies with insider buying can be particularly appealing as these factors may signal confidence from those closest to the company's operations and potential for future appreciation.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.8x | 2.6x | 48.74% | ★★★★★★ |

| Wolverine World Wide | 16.7x | 0.8x | 39.02% | ★★★★★☆ |

| First United | 10.2x | 3.1x | 42.96% | ★★★★★☆ |

| Union Bankshares | 9.5x | 2.1x | 21.74% | ★★★★☆☆ |

| S&T Bancorp | 11.6x | 4.0x | 36.15% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.4x | 6.2x | 43.79% | ★★★★☆☆ |

| Stock Yards Bancorp | 14.6x | 5.2x | 34.92% | ★★★☆☆☆ |

| Metropolitan Bank Holding | 12.7x | 3.1x | 30.16% | ★★★☆☆☆ |

| MVB Financial | 10.3x | 2.0x | -10.87% | ★★★☆☆☆ |

| Infinity Natural Resources | NA | 0.7x | -8.89% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

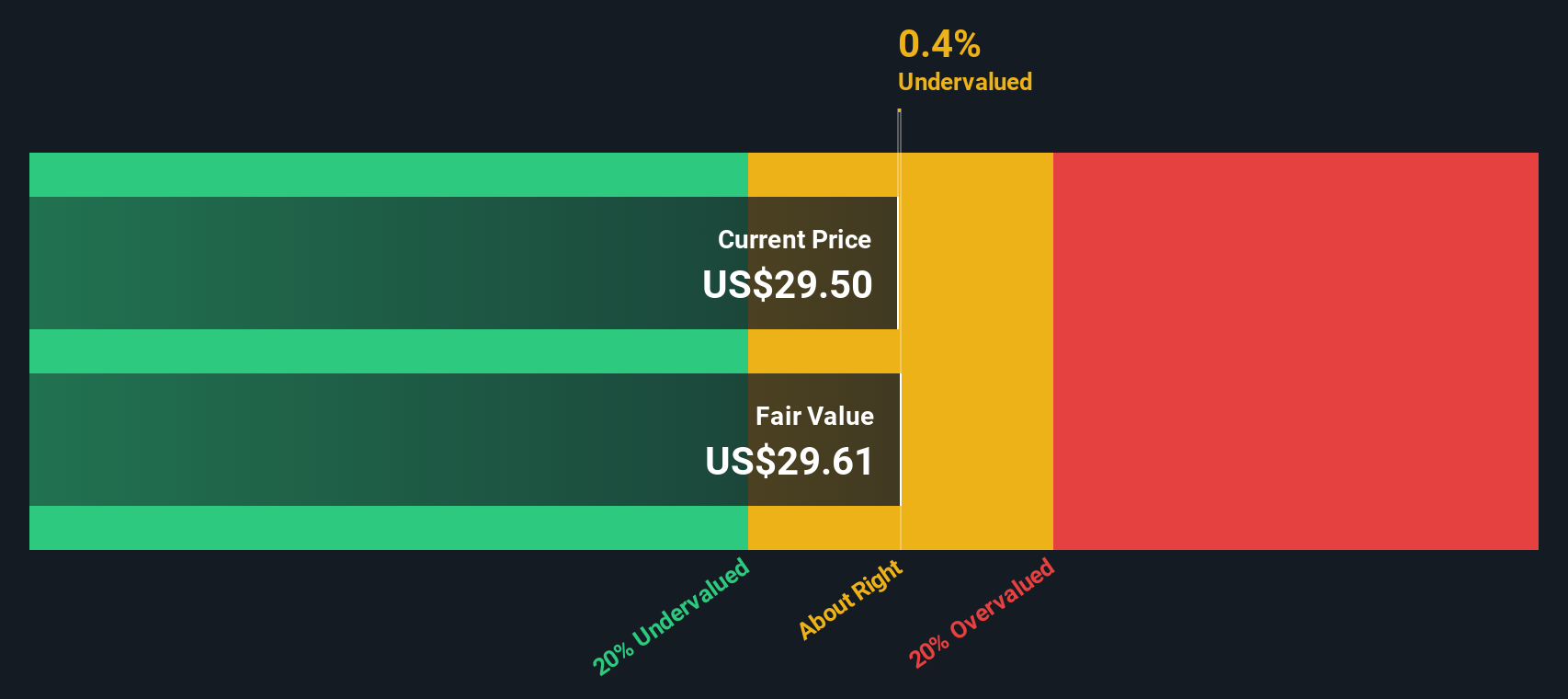

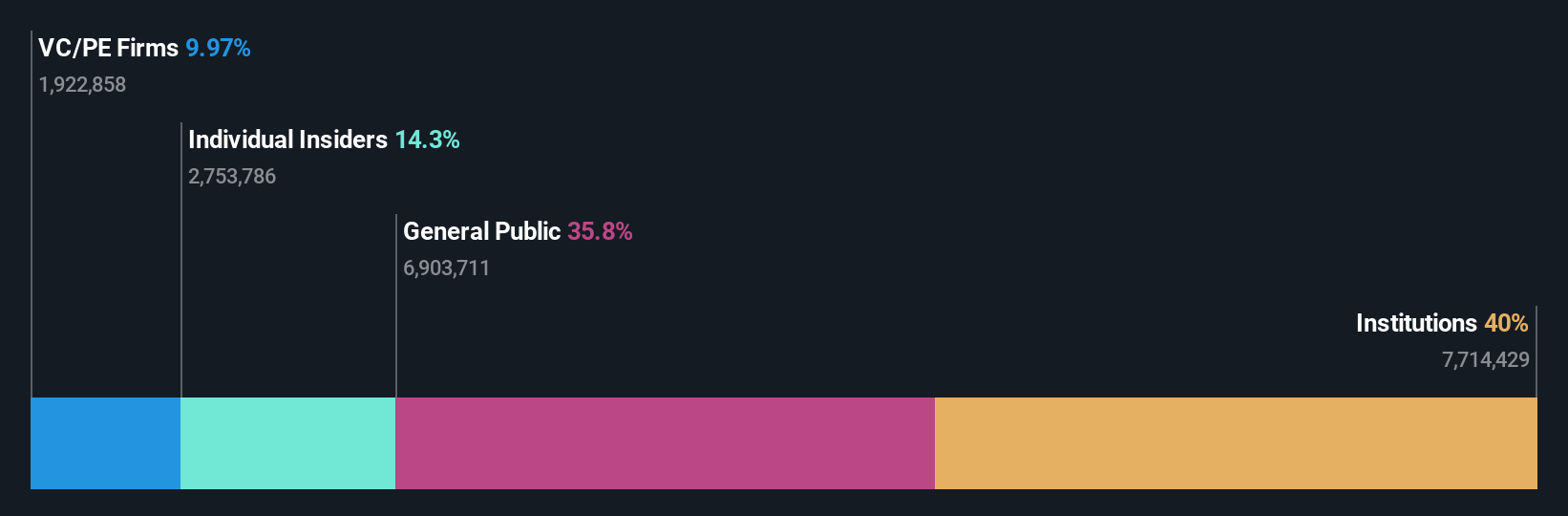

Omega Flex (OFLX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Omega Flex is a company that specializes in the manufacture and sale of flexible metal hose and accessories, with a market capitalization of approximately $1.04 billion.

Operations: The primary revenue stream for Omega Flex is derived from the manufacture and sale of flexible metal hoses and accessories, generating $100.05 million in revenue. The company's gross profit margin has shown fluctuations, with a recent figure of 60.63%. Operating expenses are significant, with sales and marketing expenses reaching $20.55 million and general & administrative expenses at $16.50 million in the latest period analyzed.

PE: 18.4x

Omega Flex, known for its niche in flexible metal hose manufacturing, faces challenges with declining earnings, dropping 6.1% annually over the past five years. They rely entirely on external borrowing for funding, adding risk to their financial structure. Despite this, insider confidence is evident as key stakeholders have been purchasing shares in recent months. Recent earnings show a slight dip with Q3 sales at US$24.23 million and net income at US$3.69 million compared to the previous year’s figures. Looking ahead, maintaining dividends could signal stability amidst financial hurdles.

- Unlock comprehensive insights into our analysis of Omega Flex stock in this valuation report.

Review our historical performance report to gain insights into Omega Flex's's past performance.

Caledonia Mining (CMCL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Caledonia Mining is a mining company focused on gold production and exploration, primarily operating the Blanket Mine in Zimbabwe, with a market capitalization of approximately $0.11 billion.

Operations: Caledonia Mining generates revenue primarily through its gold mining operations, with significant fluctuations in net income margins observed over the years. The company's cost of goods sold (COGS) and operating expenses are substantial components impacting profitability, while non-operating expenses also play a role. Notably, the gross profit margin has varied from 36.29% to 58.92%, indicating variability in operational efficiency and cost management over time.

PE: 10.5x

Caledonia Mining, a smaller player in the U.S. market, has shown promising financial growth with Q3 2025 sales climbing to US$71.44 million from US$46.87 million a year prior and net income rising to US$15.12 million from US$2.26 million. Their strategic move to develop the Bilboes Gold Project, leveraging high gold prices for improved returns, highlights potential for future value creation despite reliance on external borrowing for funding. Recent insider confidence through share purchases underscores management's belief in Caledonia's prospects amidst these developments.

- Click to explore a detailed breakdown of our findings in Caledonia Mining's valuation report.

Understand Caledonia Mining's track record by examining our Past report.

Babcock & Wilcox Enterprises (BW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Babcock & Wilcox Enterprises is a company specializing in thermal, renewable, and environmental energy solutions with a market cap of approximately $0.57 billion.

Operations: Babcock & Wilcox generates revenue primarily from its Thermal, Renewable, and Environmental segments. The company's gross profit margin has shown variability over the years, reaching 26.15% in the most recent quarter of 2025. Operating expenses are a significant part of the cost structure, with general and administrative expenses consistently being a notable component.

PE: -8.9x

Babcock & Wilcox Enterprises, a company with a focus on environmental solutions, recently secured a $40 million contract for its Wet Gas Scrubbing technology at a Canadian refinery. Despite volatile share prices and reliance on higher-risk external borrowing, they redeemed $26 million in senior notes this December. Earnings showed improvement with third-quarter net income of US$35.1 million compared to last year's loss. Their SolveBright carbon capture system is gaining traction in the U.S., potentially enhancing future growth opportunities.

- Navigate through the intricacies of Babcock & Wilcox Enterprises with our comprehensive valuation report here.

Learn about Babcock & Wilcox Enterprises' historical performance.

Make It Happen

- Gain an insight into the universe of 81 Undervalued US Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報