High Growth Companies With Strong Insider Confidence December 2025

As the U.S. stock market celebrates record highs with the S&P 500 and Dow Jones Industrial Average setting new closing records, investors are increasingly focusing on companies that demonstrate both growth potential and strong insider confidence. In this buoyant market environment, stocks with high insider ownership can be particularly appealing as they often signal management's belief in the company's future prospects, aligning their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.7% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Let's review some notable picks from our screened stocks.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market cap of approximately $57.03 billion.

Operations: The company's revenue from its cloud applications segment totals $9.23 billion.

Insider Ownership: 18.5%

Workday demonstrates strong growth potential with forecasted earnings growth of over 32% annually, outpacing the US market. Recent strategic partnerships, such as those with Google Cloud and Tabulera, enhance its AI capabilities and operational efficiency. Despite a dip in profit margins to 7%, Workday's revenue continues to grow steadily. Insider ownership remains significant, reflecting confidence in long-term prospects. The stock is trading below estimated fair value by analysts, indicating potential for price appreciation.

- Take a closer look at Workday's potential here in our earnings growth report.

- Our valuation report unveils the possibility Workday's shares may be trading at a discount.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cloudflare, Inc. is a cloud services provider offering various solutions to businesses globally, with a market cap of $70.99 billion.

Operations: The company generates revenue primarily from its Internet Telephone segment, which accounted for $2.01 billion.

Insider Ownership: 10.2%

Cloudflare's growth trajectory is marked by substantial insider ownership, aligning with its forecasted earnings growth of 43.47% annually, surpassing market averages. Recent strategic expansions with JD Cloud and partnerships in agentic commerce highlight its robust positioning in AI-driven markets. Despite notable insider selling recently, the company's revenue is expected to grow at 21.3% per year, outpacing market trends. Cloudflare's innovative initiatives like NET Dollar and strategic alliances underpin its potential for sustained expansion.

- Navigate through the intricacies of Cloudflare with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Cloudflare's share price might be on the expensive side.

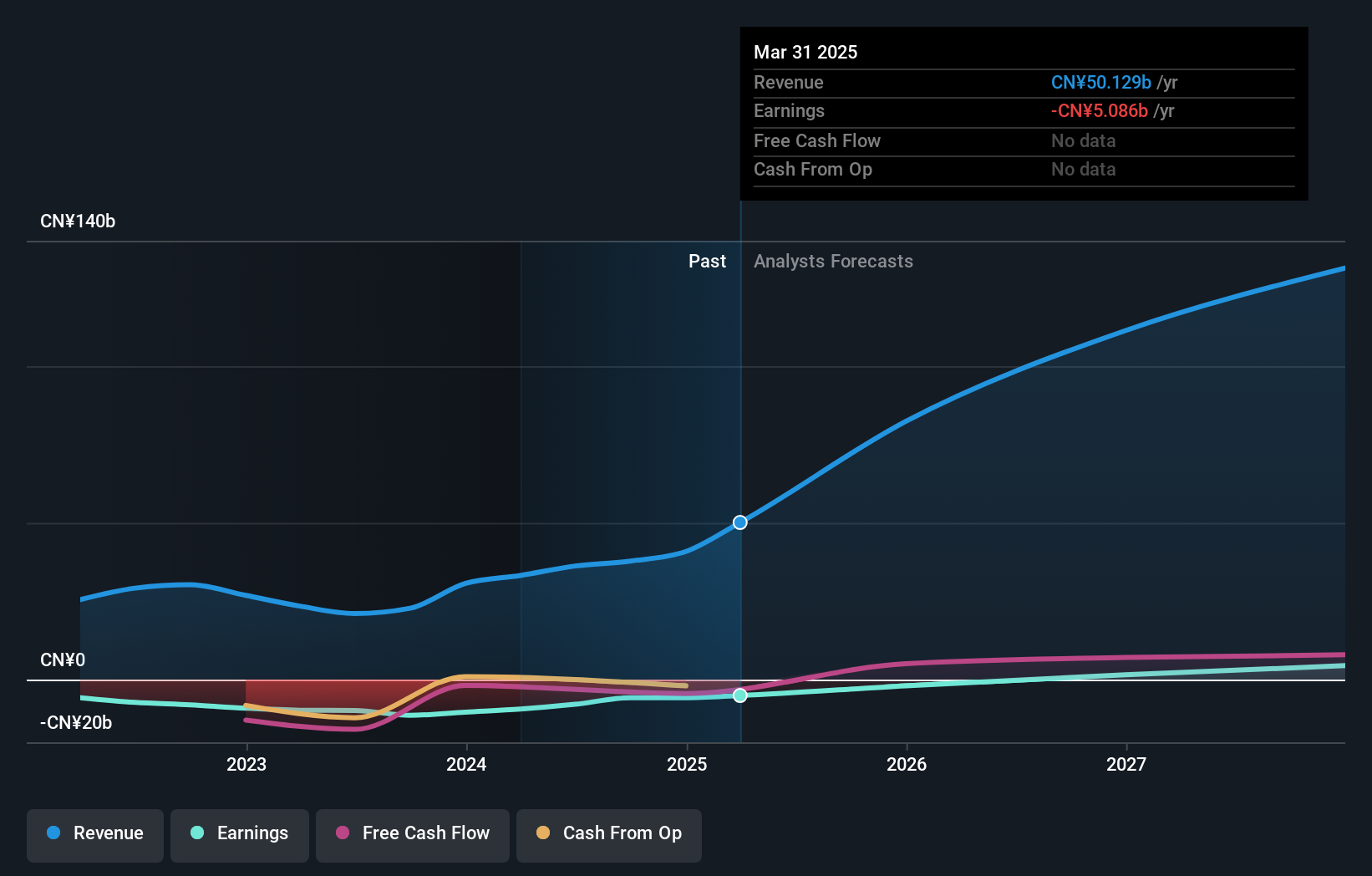

XPeng (XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles in China with a market cap of approximately $18.66 billion.

Operations: The company generates revenue primarily from its Auto Manufacturers segment, which amounts to CN¥70.57 billion.

Insider Ownership: 20.8%

XPeng's growth is characterized by its strategic expansion, including a new partnership in Malaysia for localized production. With vehicle deliveries reaching 391,937 units year-to-date, up 156% year-on-year, the company demonstrates robust market penetration. Despite operating losses narrowing to CNY 380.87 million from CNY 1.81 billion last year, XPeng is trading below its estimated fair value and forecasts revenue growth of 22.6% annually, surpassing US market expectations.

- Click here to discover the nuances of XPeng with our detailed analytical future growth report.

- Our valuation report here indicates XPeng may be overvalued.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 205 more companies for you to explore.Click here to unveil our expertly curated list of 208 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報