Discovering Hidden Opportunities: 3 Undiscovered Gems in the US Market

As the U.S. market continues to reach new heights with the S&P 500 setting all-time records, investors are increasingly interested in exploring opportunities beyond the well-trodden paths of blue-chip stocks. In this dynamic environment, identifying small-cap stocks that offer unique growth potential can be particularly rewarding, especially when these companies demonstrate resilience and innovation amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Power Solutions International (PSIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Power Solutions International, Inc. is involved in designing, engineering, manufacturing, marketing, and selling engines and power systems across various regions including the United States, North America, the Pacific Rim, Europe, and internationally with a market cap of $1.53 billion.

Operations: PSIX generates revenue primarily from its Engineered Integrated Electrical Power Generation Systems, amounting to $675.48 million. The company's market cap stands at approximately $1.53 billion.

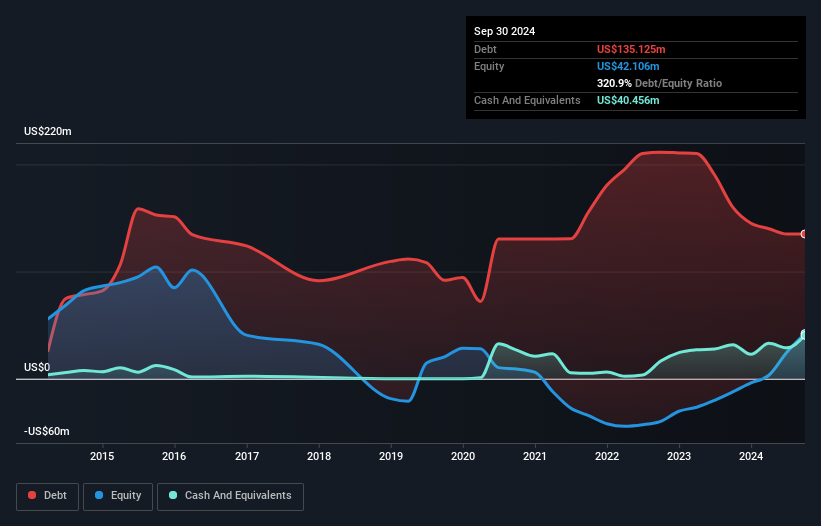

Power Solutions International, with its impressive earnings growth of 122.9% over the past year, stands out in the electrical industry. The company is trading at a significant discount—58.5% below estimated fair value—offering potential upside for investors. Its net debt to equity ratio of 30% is satisfactory, and interest payments are well covered by EBIT at 14.3 times coverage. Despite recent volatility in share price, PSIX has managed to reduce its debt-to-equity ratio from a staggering 1442.9% to just 60.2% over five years, indicating strong financial management and potential for future stability in its operations.

- Click here to discover the nuances of Power Solutions International with our detailed analytical health report.

Gain insights into Power Solutions International's past trends and performance with our Past report.

Northeast Bank (NBN)

Simply Wall St Value Rating: ★★★★★★

Overview: Northeast Bank offers a range of banking services to individual and corporate clients in Maine, with a market cap of $923.09 million.

Operations: Northeast Bank generates revenue primarily from its banking segment, which amounts to $214.70 million.

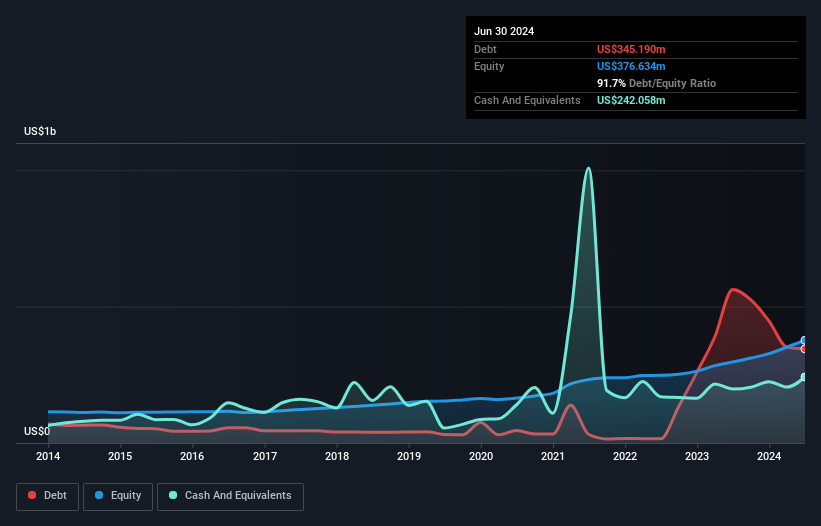

Northeast Bank, with total assets of $4.2 billion and equity of $513.6 million, showcases strong financial health. It holds deposits totaling $3.3 billion against loans of $3.7 billion, maintaining a net interest margin of 4.9%. The bank's allowance for bad loans stands at 0.9% of total loans, reflecting prudent risk management with an allowance coverage ratio at 138%. Recent earnings growth outpaced the industry significantly at 47.7%, and the bank trades at a substantial discount to its estimated fair value by 57%. While competition and regulatory changes pose challenges, strategic digital investments could bolster future growth prospects.

Photronics (PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc. operates in the manufacture and sale of photomask products and services across several regions, including the United States, Taiwan, China, Korea, and Europe; it has a market cap of approximately $1.99 billion.

Operations: Photronics generates revenue primarily from the manufacture of photomasks, totaling $849.29 million. The company has a market capitalization of approximately $1.99 billion.

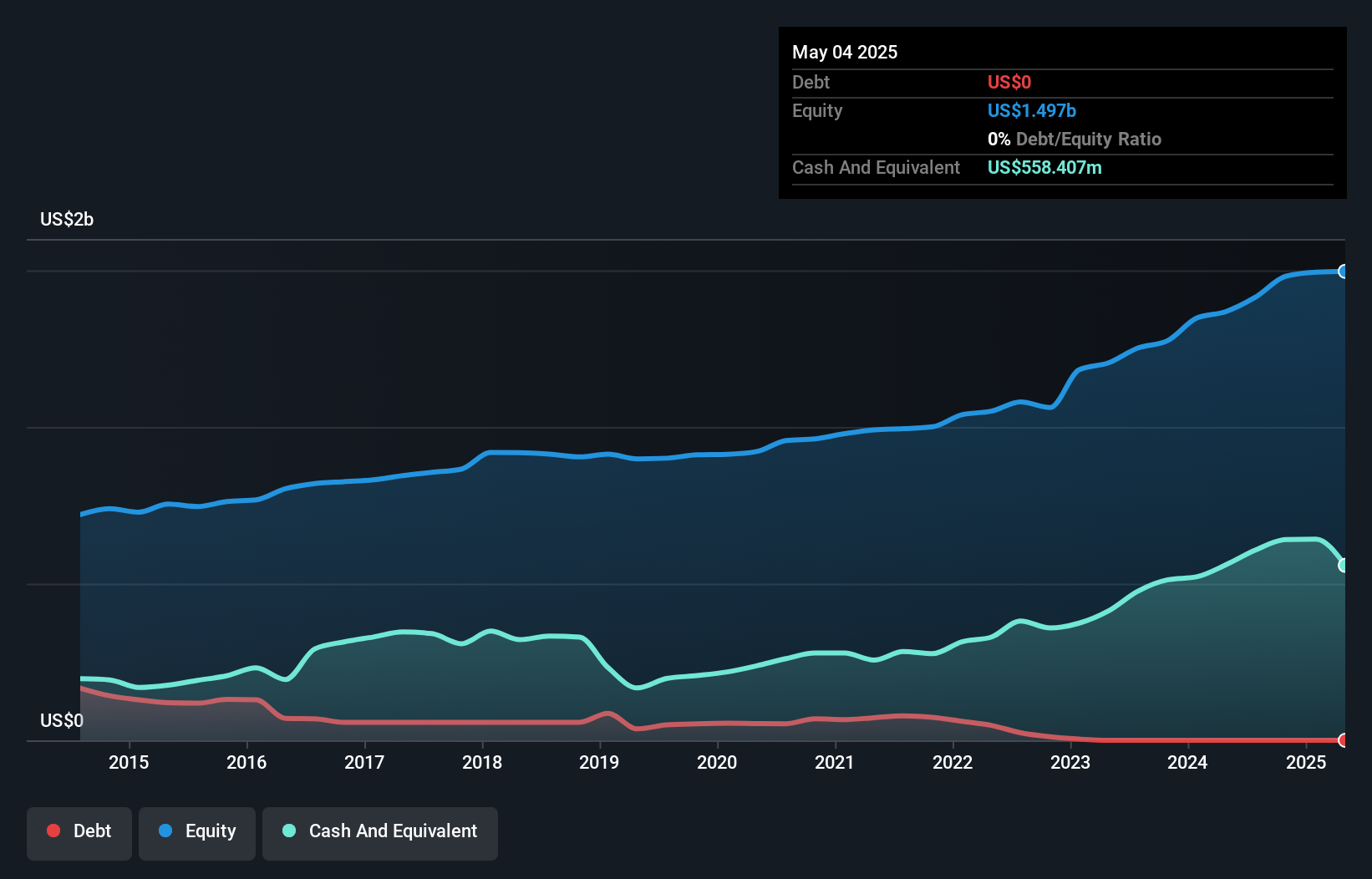

Photronics, a nimble player in the semiconductor arena, has seen its earnings grow at an impressive 22% annually over the past five years. With no debt on its books and a P/E ratio of 14.6x below the US market average of 19.1x, it presents an attractive valuation. Despite recent volatility in share price and significant insider selling, Photronics maintains high-quality earnings and positive free cash flow of US$130 million as of October 2025. However, geopolitical risks and competition are concerns as revenue is forecast to decline by an average of 0.8% annually over the next three years.

Next Steps

- Click this link to deep-dive into the 300 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報