The cumulative shipment volume of enterprise-grade SSDs during the Dapuwei GEM IPO reached more than 4,900 PB

The Zhitong Finance App learned that on December 25, Shenzhen Dapu Microelectronics Co., Ltd. (abbreviation: Dapuwei) Shenzhen Stock Exchange GEM IPO passed the Listing Committee meeting. The sponsor is Cathay Pacific Haitong Securities, which plans to raise 1,887.85 billion yuan.

According to the prospectus, Dapuwei is mainly engaged in the development and sale of enterprise SSD products in data centers. It is a leading semiconductor storage product provider in the industry and is one of the few semiconductor storage product providers in China that has full-stack self-development capabilities for enterprise-grade SSDs “main control chip+firmware algorithm+module” and achieves batch shipment.

Dapuwei focuses on enterprise SSDs in data centers. The products cover PCIe 3.0 to 5.0 from generation to generation, fully meeting the product needs of various types of customers. During the reporting period, the company's cumulative shipment volume of enterprise-grade SSDs reached more than 4,900 PB, of which the proportion of shipments equipped with self-developed main control chips reached more than 75%. According to IDC data, in the last three years, the company's share in the domestic enterprise SSD market has remained at the top of the market, and international manufacturers still dominate.

Dapuwei has always been driven by technology and innovation, grasped the development trend of storage technology, and launched internationally competitive products and solutions first. The company's PCIe SSD series products have excellent read/write speed, durability, low latency, and an average failure rate far below JEDEC (Solid-State Technology Association) standards, and the product performance is at an international advanced level.

At the same time, the company continues to advance in the direction of cutting-edge storage development. It is the world's first storage vendor to mass-produce enterprise-grade PCIe 5.0 SSDs and high-capacity QLC SSDs. It is also one of the few storage vendors in the world that has the capacity to supply cutting-edge storage products such as SCM SSDs and computational storage SSDs. The company has a master control chip and SSD module R&D team with cutting-edge storage technology and rich industry experience, and continues to invest in R&D resources, providing a guarantee for products to maintain market competitiveness.

As of June 30, 2025, the company has obtained 162 domestic and foreign invention patents, and many enterprise-grade SSD technologies such as Computational Storage Drives (Computational Storage Drives), Intelligence Multi-Stream (Intelligence Multi-Stream), and Intelligent Failure Prediction (Intelligent Failure Prediction) are at the leading level in the industry.

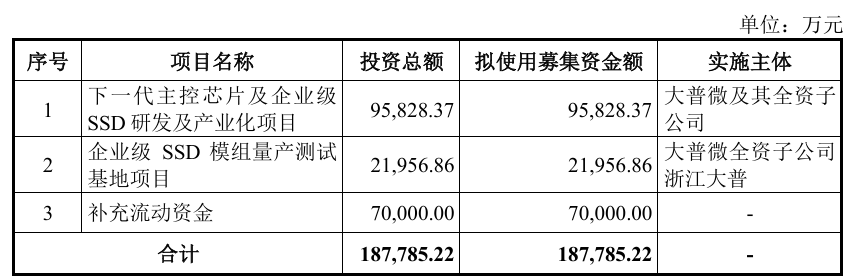

After review and approval by the company's first extraordinary shareholders' meeting in 2025, the funds raised in this offering will be invested in the following projects in order of priority after deducting issuance fees:

On the financial side, in 2022, 2023, 2024, and January-June 2025, Dapuwei achieved operating income of approximately 557 million yuan, 519 million yuan, 962 million yuan, and 748 million yuan; during the same period, the company achieved net profit of about -534 million yuan, -617 million yuan, -191 million yuan, and -354 million yuan, respectively.

Nasdaq

Nasdaq 華爾街日報

華爾街日報