Assessing Qualys (QLYS) Valuation After Recent Sideways Trading and Cooling Momentum

Qualys (QLYS) has been drifting sideways lately, but the stock’s mixed near term performance contrasts with its steadier multi year gains. This raises a simple question for investors: is this consolidation offering reasonable value?

See our latest analysis for Qualys.

Over the past year Qualys has seen modest 90 day share price gains alongside a slightly negative 1 year total shareholder return. This suggests momentum has cooled a bit as investors reassess growth versus valuation after a strong multi year run.

If Qualys has you thinking about where security and software growth might go next, it is worth exploring high growth tech and AI stocks for other potential opportunities in the same space.

With shares roughly in line with analyst targets yet still trading at a modest intrinsic discount, investors now face a pivotal question: Is Qualys quietly undervalued after its pause, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 2.1% Undervalued

With Qualys last closing at $139.54 against a most popular narrative fair value of $142.56, the story leans toward modest upside grounded in execution and cash generation assumptions.

Adoption of Qualys' new cloud-native risk operations center (ROC) and Agentic AI platform positions the company as a leading pre-breach risk management provider, offering unified orchestration, automation, and remediation across both Qualys and non-Qualys data; this opens incremental greenfield opportunities and should support higher ARPU and expanded TAM, leading to durable revenue and earnings growth.

Want to see how steady, mid single digit growth, resilient margins, and a richer earnings multiple come together to justify that price tag? The narrative leans on compounding earnings, share count shrinkage, and a future valuation level that would still sit below many software peers. Curious which specific profitability step down and multiple expansion the story quietly bakes in for the next few years? Read on to unpack the assumptions driving this fair value.

Result: Fair Value of $142.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid shifts in AI security and potential customer spend optimization under Flex pricing could challenge Qualys’ growth, margins, and the modest undervaluation thesis.

Find out about the key risks to this Qualys narrative.

Another View: Market Ratios Point to a Tighter Margin of Safety

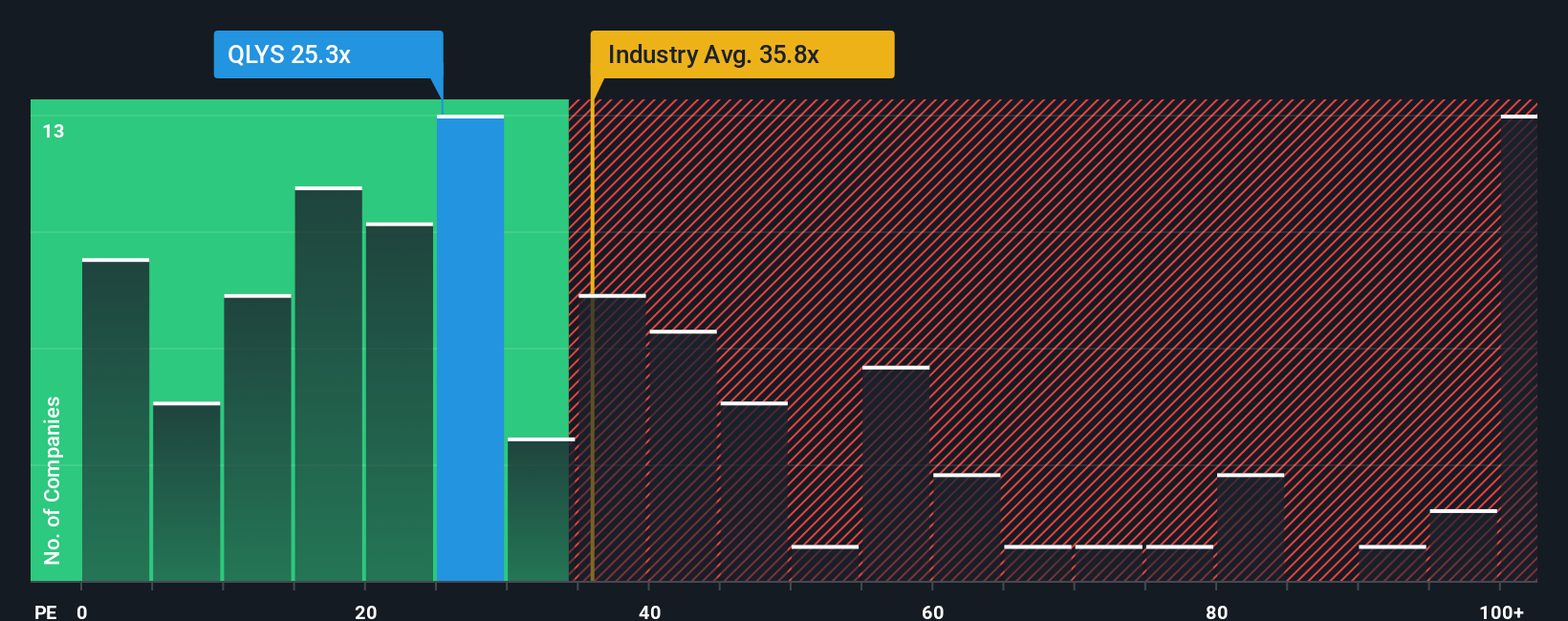

Our SWS fair ratio suggests Qualys should trade closer to 24.9 times earnings, yet the market currently pays about 26.5 times. That is cheaper than US software peers at 31.9 times, but still above the fair ratio, leaving investors with less room for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qualys Narrative

If this perspective does not fully align with your own, or you prefer to dive into the numbers yourself, you can build a custom narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Qualys.

Looking for more investment ideas?

Before you move on, put your research momentum to work by scanning a few focused stock ideas that could sharpen your watchlist and uncover your next opportunity.

- Capitalize on potential mispricings by scanning these 902 undervalued stocks based on cash flows to spot companies where the market may be underestimating future cash flows.

- Ride powerful technology tailwinds by checking out these 24 AI penny stocks that are building real businesses around artificial intelligence, not just hype.

- Explore potential income streams by reviewing these 10 dividend stocks with yields > 3% that offer yields above 3 percent without abandoning fundamental quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報