More Unpleasant Surprises Could Be In Store For Nektar Therapeutics' (NASDAQ:NKTR) Shares After Tumbling 25%

Nektar Therapeutics (NASDAQ:NKTR) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 223% in the last twelve months.

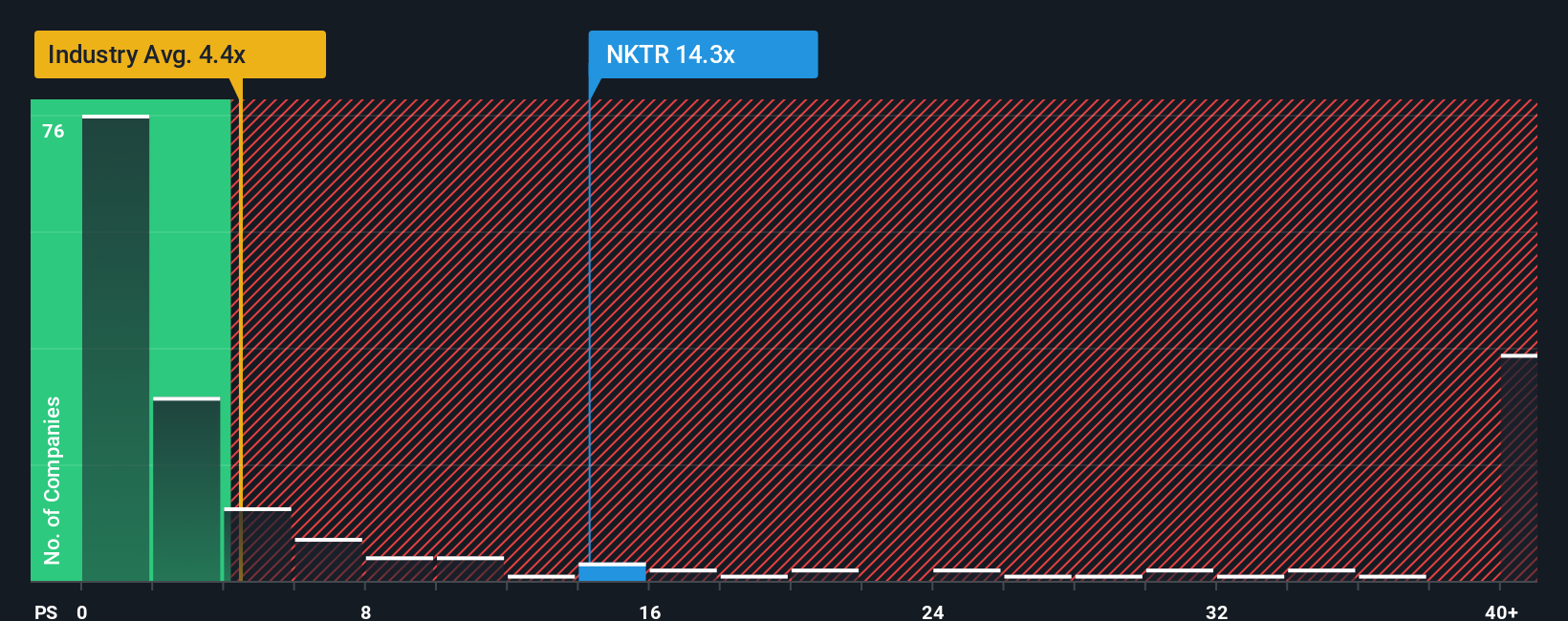

In spite of the heavy fall in price, Nektar Therapeutics' price-to-sales (or "P/S") ratio of 14.3x might still make it look like a strong sell right now compared to other companies in the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 4.4x and even P/S below 1.5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Nektar Therapeutics

How Has Nektar Therapeutics Performed Recently?

Nektar Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Nektar Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Nektar Therapeutics?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Nektar Therapeutics' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. As a result, revenue from three years ago have also fallen 34% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 11% per year as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 30% each year, which paints a poor picture.

With this in mind, we find it intriguing that Nektar Therapeutics' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From Nektar Therapeutics' P/S?

A significant share price dive has done very little to deflate Nektar Therapeutics' very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Nektar Therapeutics' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware Nektar Therapeutics is showing 5 warning signs in our investment analysis, and 2 of those can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報