Brookfield Infrastructure Partners (NYSE:BIP): Revisiting Valuation After a Year of Market-Beating Returns

Brookfield Infrastructure Partners Stock: Why Investors Are Paying Attention

Brookfield Infrastructure Partners (NYSE:BIP) has quietly outperformed the broader market over the past year, and that steady climb has some income focused investors revisiting the partnership’s mix of yield, growth, and global assets.

See our latest analysis for Brookfield Infrastructure Partners.

After a solid run this year, with a roughly 10 percent year to date share price return and a 15 percent one year total shareholder return, the recent pullback toward 35 dollars looks more like consolidation than a crack in the story. It hints that momentum is cooling slightly but not reversing.

If Brookfield’s steady climb has you rethinking your income and infrastructure mix, it might also be a good time to explore fast growing stocks with high insider ownership as potential next wave candidates.

With the units trading around 35 dollars, a double digit discount to analyst targets but following years of strong total returns, investors have to ask: Is Brookfield Infrastructure still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 16.4% Undervalued

With units last closing at 35.05 dollars against a narrative fair value near 41.91 dollars, the current gap hinges on ambitious earnings and margin assumptions.

The exponential growth in AI driven data consumption and digital infrastructure requirements, especially in the U.S. and Europe, is fueling record demand for data centers, fiber networks, and digital connectivity; BIP's ongoing and planned investments in these fast growing, high utilization assets are expected to drive significant revenue and earnings growth.

Curious how shrinking top line projections can still support a richer valuation than many utility peers, with earnings and margins moving in the opposite direction? The most followed narrative leans on a powerful mix of profit expansion, capital recycling, and a future earnings multiple that might surprise infrastructure traditionalists. Want to see the exact growth path and valuation logic behind that upside call?

Result: Fair Value of $41.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained acquisition risk and higher for longer interest rates could pressure returns, constrain capital recycling, and challenge assumptions behind today’s optimistic fair value.

Find out about the key risks to this Brookfield Infrastructure Partners narrative.

Another Lens on Valuation

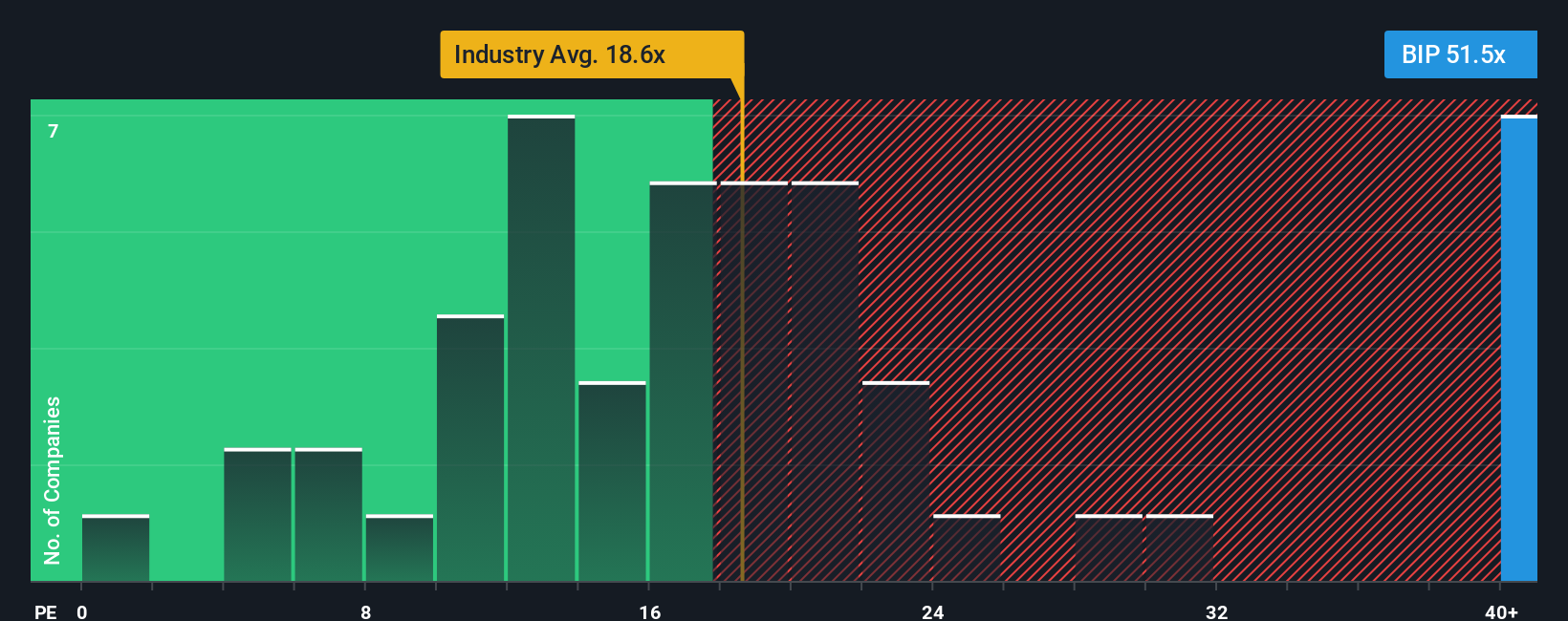

Analysts see Brookfield Infrastructure Partners as meaningfully undervalued, but its 50.1 times earnings multiple tells a tougher story. That is hefty versus the global Integrated Utilities average of 17.9 times, its peer average of 21.5 times, and even its own 33.9 times fair ratio. This suggests real multiple risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brookfield Infrastructure Partners Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized Brookfield view in under three minutes: Do it your way.

A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing ideas?

Do not stop at a single opportunity when you can quickly scan fresh angles across the market using targeted Simply Wall Street screeners built for focused, data driven decisions.

- Capitalize on mispriced opportunities by reviewing these 902 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations before the crowd catches on.

- Position yourself early in powerful technology trends by checking out these 24 AI penny stocks poised to benefit from accelerating demand for intelligent software, automation, and data infrastructure.

- Strengthen your income stream by targeting reliable payers through these 10 dividend stocks with yields > 3% offering yields above 3 percent without abandoning balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報