What GXO Logistics (GXO)'s New C-Suite Lineup and Chair Transition Means For Shareholders

- GXO Logistics has announced a series of leadership changes, including appointing Karen Bomber as Chief Commercial Officer and Bart Beeks as Chief Operating Officer effective in early 2026, alongside a transition from Brad Jacobs to Patrick Byrne as Non-Executive Chairman after December 31, 2025.

- Together, these shifts signal an intensified emphasis on commercial excellence and global operational discipline as GXO integrates Wincanton and refines its go-to-market approach.

- We’ll now examine how the incoming COO’s focus on standardized global execution could reshape GXO’s investment narrative and future performance assumptions.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

GXO Logistics Investment Narrative Recap

To own GXO Logistics, you need to believe it can convert its scale, Wincanton integration and automation push into stronger margins and more resilient earnings. The latest leadership changes sharpen that execution focus but do not fundamentally alter the near term catalyst around successful Wincanton integration or the key risk that extensive leadership turnover could unsettle strategy and delay synergy capture.

Among the recent announcements, Bart Beeks’ appointment as COO is most relevant, as his remit is to drive standardized global execution just as GXO integrates Wincanton and ramps automation. For investors watching whether GXO can deliver its targeted US$60,000,000 in Wincanton cost synergies and improve margins despite past earnings volatility, having a dedicated operational leader may help clarify how execution risk is being managed.

But while leadership depth is improving, investors should still be aware of the heightened execution risk around Wincanton and the possibility that...

Read the full narrative on GXO Logistics (it's free!)

GXO Logistics' narrative projects $15.3 billion revenue and $440.6 million earnings by 2028. This requires 6.5% yearly revenue growth and about a $377.6 million earnings increase from $63.0 million today.

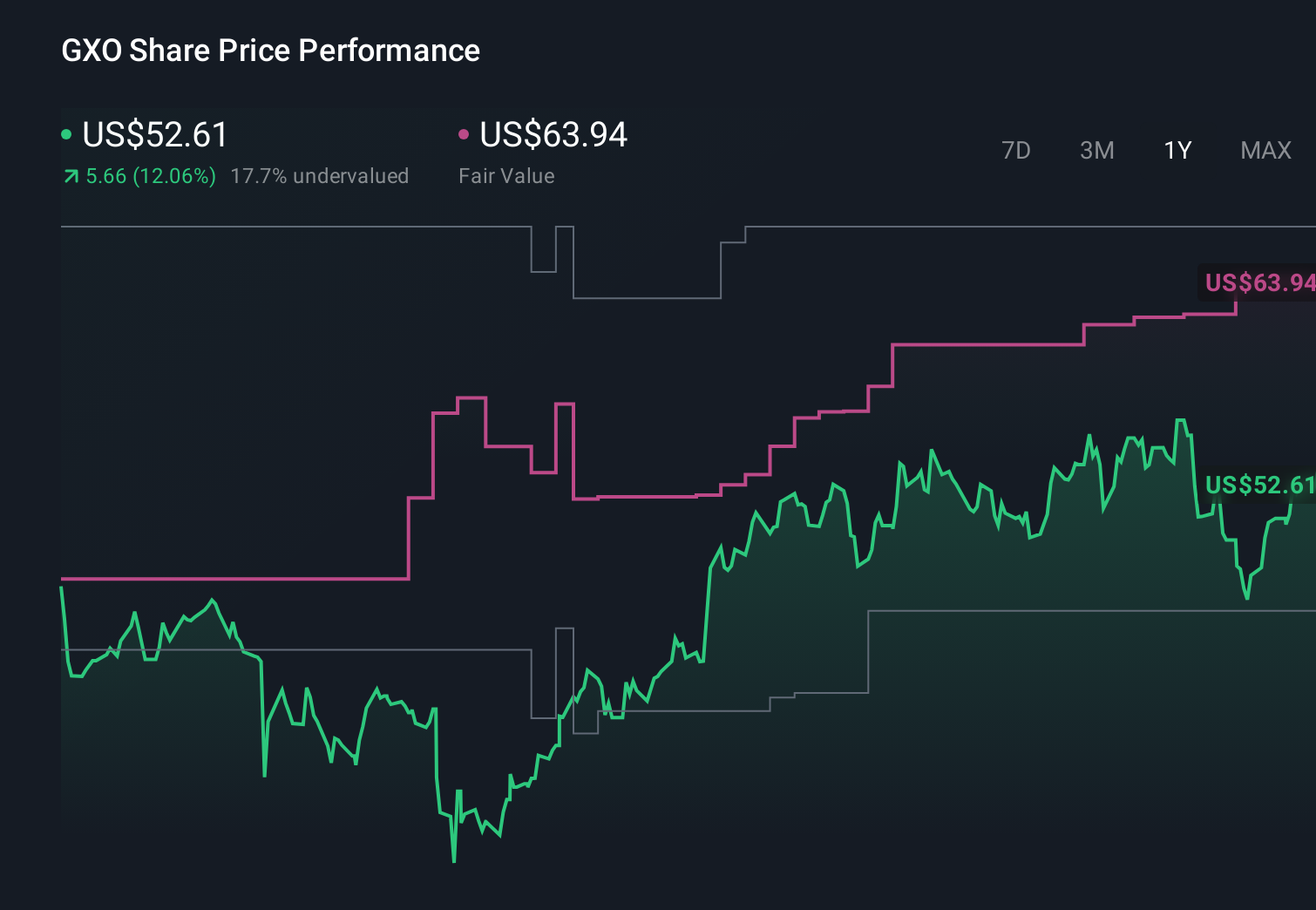

Uncover how GXO Logistics' forecasts yield a $63.94 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members value GXO between US$58.96 and US$64.27 per share, reflecting a tight cluster of personal fair value views. You can set those side by side with the execution risk around Wincanton integration and leadership turnover to consider how different assumptions about margins and growth might shape the company’s longer term performance.

Explore 3 other fair value estimates on GXO Logistics - why the stock might be worth as much as 18% more than the current price!

Build Your Own GXO Logistics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GXO Logistics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GXO Logistics' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報