Emerson Electric (EMR): Valuation Check as Cold Chain IoT Demand and Automation Tailwinds Lift Investor Optimism

Emerson Electric (EMR) is back in focus as investors connect its industrial IoT and automation portfolio with accelerating demand for smarter cold chain monitoring across pharmaceuticals, biologics, and perishable foods, where reliability and compliance really matter.

See our latest analysis for Emerson Electric.

That backdrop helps explain why investors have kept bidding Emerson higher, with an 11.6% year to date share price return and a robust 5 year total shareholder return near 90%, suggesting that momentum is still firmly building.

If this kind of industrial IoT theme interests you, it could be worth exploring other high growth tech and AI stocks that might benefit from similar demand for smarter automation and data driven infrastructure.

Still, with shares up strongly over 3 and 5 years and analysts pricing in more upside from here, is Emerson Electric undervalued relative to its growth runway, or is the market already baking in years of accelerated demand?

Most Popular Narrative Narrative: 9.6% Undervalued

With Emerson Electric last closing at $136.30 against a most popular narrative fair value near $150, the story hinges on how durable its software and automation push really is.

The company's transformation toward a pure-play automation leader, emphasizing innovation, commercialization of new products, and operational excellence, continues to yield improved profitability (e.g., margin expansion, higher free cash flow) and positions Emerson to capitalize on long-term modernization and infrastructure trends.

Want to see what kind of growth and margin profile could elevate an industrial name into a software like valuation bracket? Curious how recurring revenues, portfolio reshaping, and disciplined capital returns all plug into that future earnings path and still clear a relatively demanding earnings multiple? The full narrative lays out the specific revenue, profit and valuation hurdles Emerson needs to clear.

Result: Fair Value of $150.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained tariff and currency volatility, or slower than hoped software integration and adoption, could derail margin expansion and challenge today’s growth assumptions.

Find out about the key risks to this Emerson Electric narrative.

Another Lens On Valuation

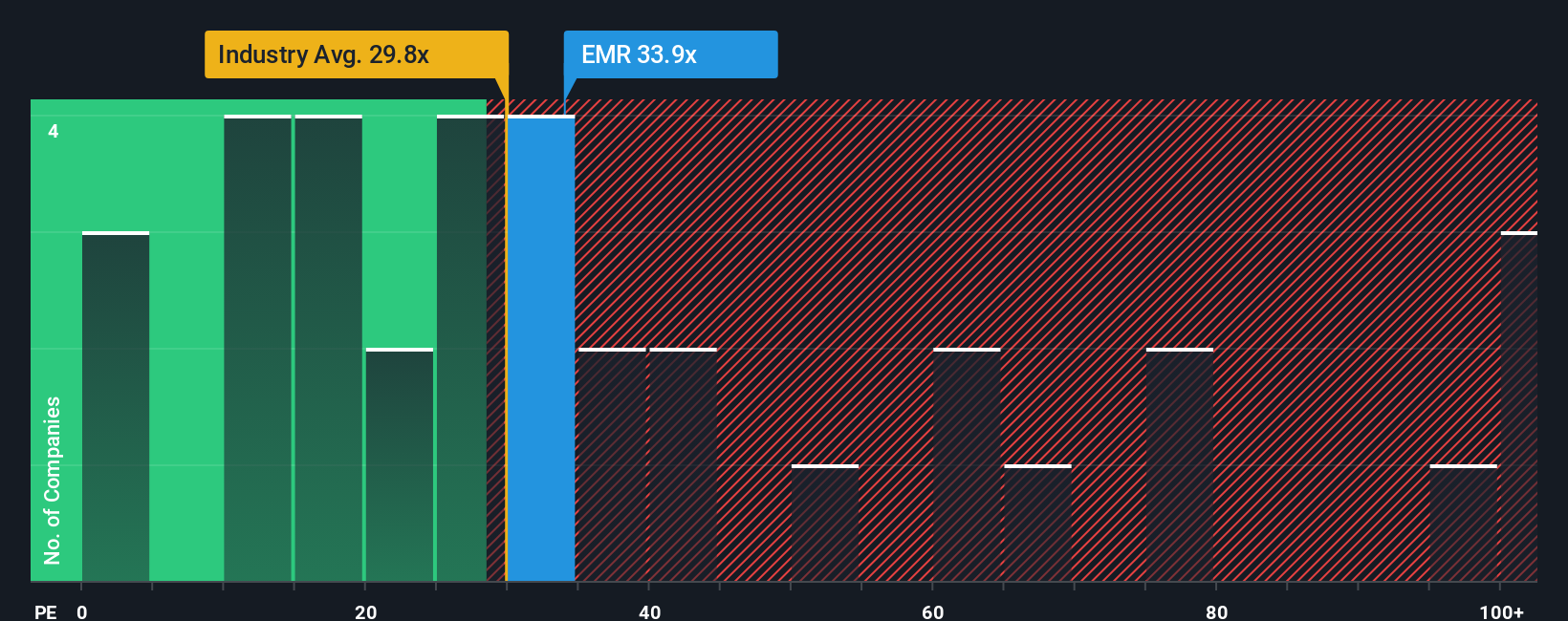

Our valuation checks using a single earnings based ratio paint a more cautious picture. Emerson trades at 33.5 times earnings, richer than the US Electrical industry at 30.2 times and above a fair ratio of 31.8 times. This implies less margin of safety if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Emerson Electric Narrative

If you see the numbers differently or prefer to dig into the metrics yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by scanning other opportunities that match your strategy and keep your watchlist truly ahead of the crowd.

- Capitalize on mispriced quality by targeting companies flagged as undervalued through these 902 undervalued stocks based on cash flows, where strong cash flows may not yet be fully recognized by the market.

- Ride powerful technology shifts by focusing on businesses at the forefront of intelligent automation and data driven tools, starting with these 24 AI penny stocks.

- Strengthen your portfolio's income engine by zeroing in on reliable payers using these 10 dividend stocks with yields > 3%, filtering for yields above 3% with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報