GGII: From January to November 2025, the installed share of domestic lithium iron phosphate power batteries reached 78.5%, and the market is expected to break through the historical peak

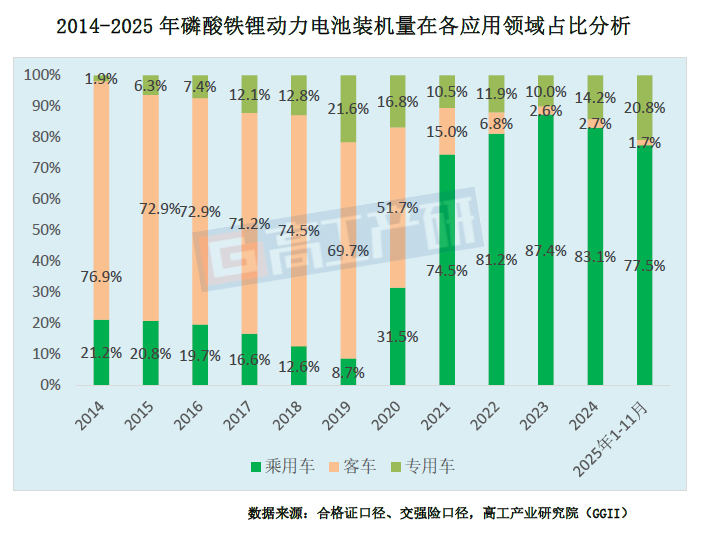

The Zhitong Finance App learned that according to NEV Jiaotong Insurance Calibration Data Statistics, the installed capacity of domestic lithium iron phosphate power batteries from January to November 2025 was about 490 GWh, up 55% year on year, and the market share was as high as 78.5%, an increase of 10 percentage points over the same period last year. This is only a difference of 2.5% from the peak of the installed market share of lithium iron phosphate power batteries in 2014. According to GGII, the installed share of domestic lithium iron phosphate power batteries is expected to reach a new high. Combined, they have significant advantages in safety, cost efficiency, service life, and resource sustainability, and have been fully accepted and recognized by the market.

The driving force behind the current sharp increase in the installed share of lithium iron phosphate power batteries is fundamentally different from 2014. Currently, it is mainly market-oriented driving, which is reflected in the sharp increase in the share of the NEV passenger vehicle sector, while 2014 was mainly driven by policy orientation, as evidenced by the sharp rise in the share of the NEV sector.

Whether the installed share of lithium iron phosphate power batteries can reach a new high depends on whether the driving force of future market promotion is strong.

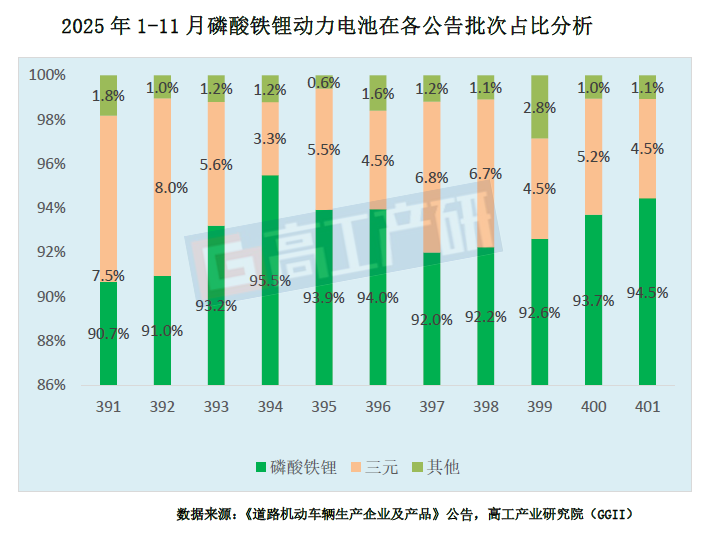

Judging from NEV announcements, statistics on new vehicle announcements from January to November this year show that the proportion of vehicles equipped with lithium iron phosphate batteries has been fluctuating in the 90%-96% range. In particular, the share gradually climbed from 92% to 94.5% in the second half of the year, indicating that OEMs plan to choose the route equipped with lithium iron phosphate technology.

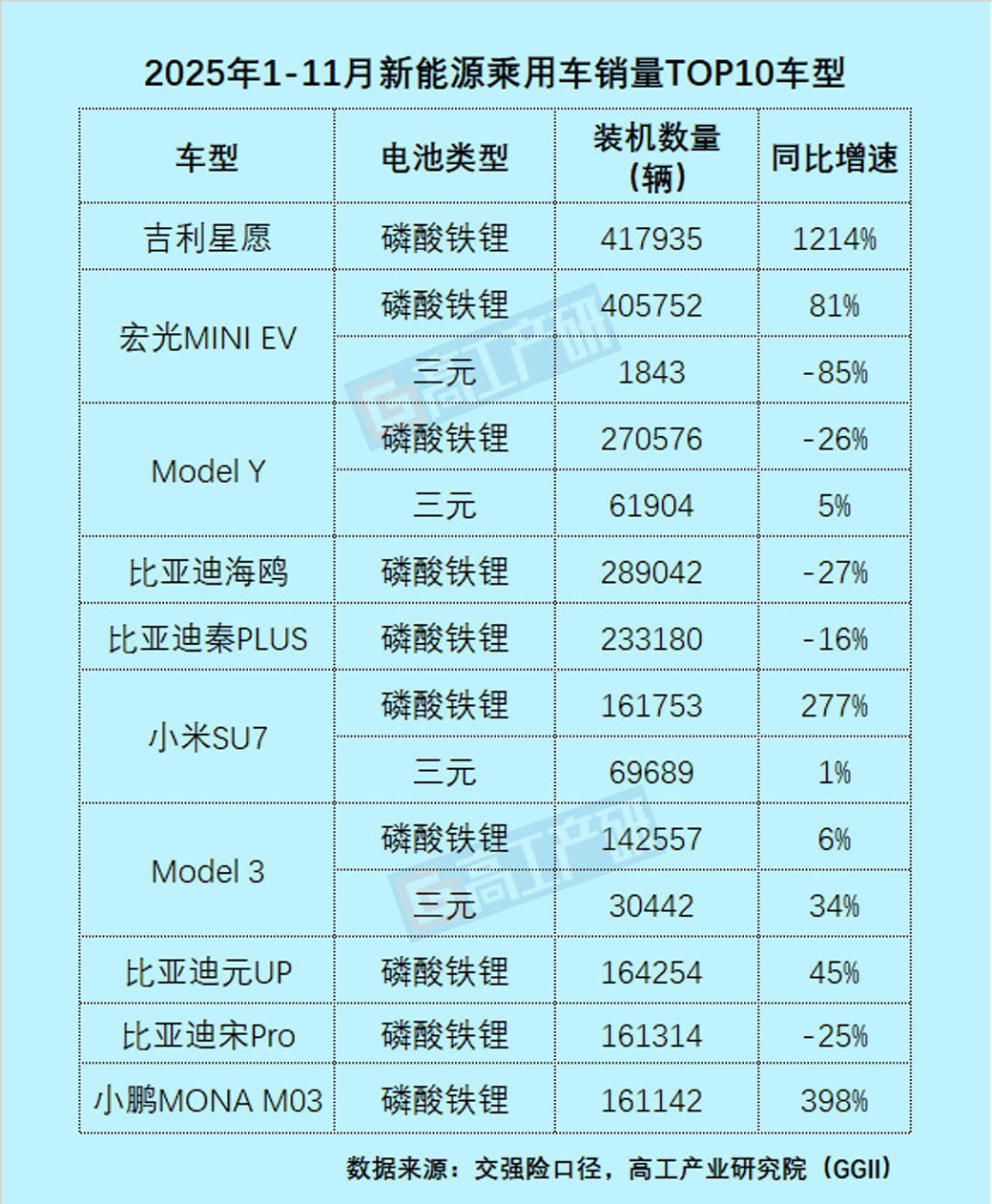

Judging from the number of new energy passenger car models currently on sale and equipped with lithium iron phosphate power batteries, the past three years have risen from 213 to 536 in the first November of this year, and with the increase in production capacity of the best-selling models Geely Xingyuan, Xiaomi SU7, and Xiaopeng MONA M03, the acceleration of delivery will further drive an increase in the installed share of lithium iron phosphate power batteries.

Judging from the competitive landscape, the top 10 domestic lithium iron phosphate power battery installed companies accounted for 95.3% in total from January to November 2025. Among them, the five companies in Ningde Era, Everweft Lithium Energy, Sunwoda, Zhengli Xinneng, and Quzhou Jidian have shown a steady growth trend for three consecutive years, and as the layout of various battery companies in the field of new energy heavy trucks progresses, there is still some room for growth in the installed share of lithium iron phosphate power batteries.

Nasdaq

Nasdaq 華爾街日報

華爾街日報