Assessing Annaly Capital Management (NLY) Valuation After Its $2.5 Billion At-The-Market Stock Offering

Capital Raise and Investor Context

Annaly Capital Management (NLY) just moved to raise up to 2.5 billion dollars through an at the market follow on equity offering, a meaningful step that could reshape both its balance sheet and shareholder calculus.

See our latest analysis for Annaly Capital Management.

The move comes after a strong run, with Annaly’s share price up 26.39 percent year to date and its one year total shareholder return at 39.69 percent. This suggests momentum is building as investors reassess income and risk in mortgage REITs.

If this capital raise has you thinking about positioning for the next phase of the cycle, it might be worth exploring fast growing stocks with high insider ownership as potential higher growth complements to an income focused name like Annaly.

With shares now trading slightly above the average analyst target but still showing a sizable intrinsic value gap, the key question is whether Annaly remains undervalued or if the market is already pricing in its next leg of growth?

Most Popular Narrative: 4.8% Overvalued

With Annaly Capital Management’s fair value pegged near 22.18 dollars versus a 23.23 dollar last close, the prevailing narrative leans modestly cautious on upside.

The Fair Value Estimate has risen slightly to approximately $22.18 from $22.10, reflecting a modest upward revision in the intrinsic value assessment.

The Future P/E multiple has risen minimally to around 7.40x from 7.37x, signaling a very modest increase in anticipated valuation relative to forward earnings.

Want to see how rapid revenue expansion, surging margins, and a compressed future earnings multiple all fit together into this fair value call? The full narrative unpacks the bold growth path, the implied profitability shift, and the valuation reset that underpins that seemingly cautious price tag.

Result: Fair Value of $22.18 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising rate volatility and intensifying non agency competition could quickly compress spreads, which may challenge Annaly’s earnings trajectory and undermine the current fair value case.

Find out about the key risks to this Annaly Capital Management narrative.

Another Lens On Value

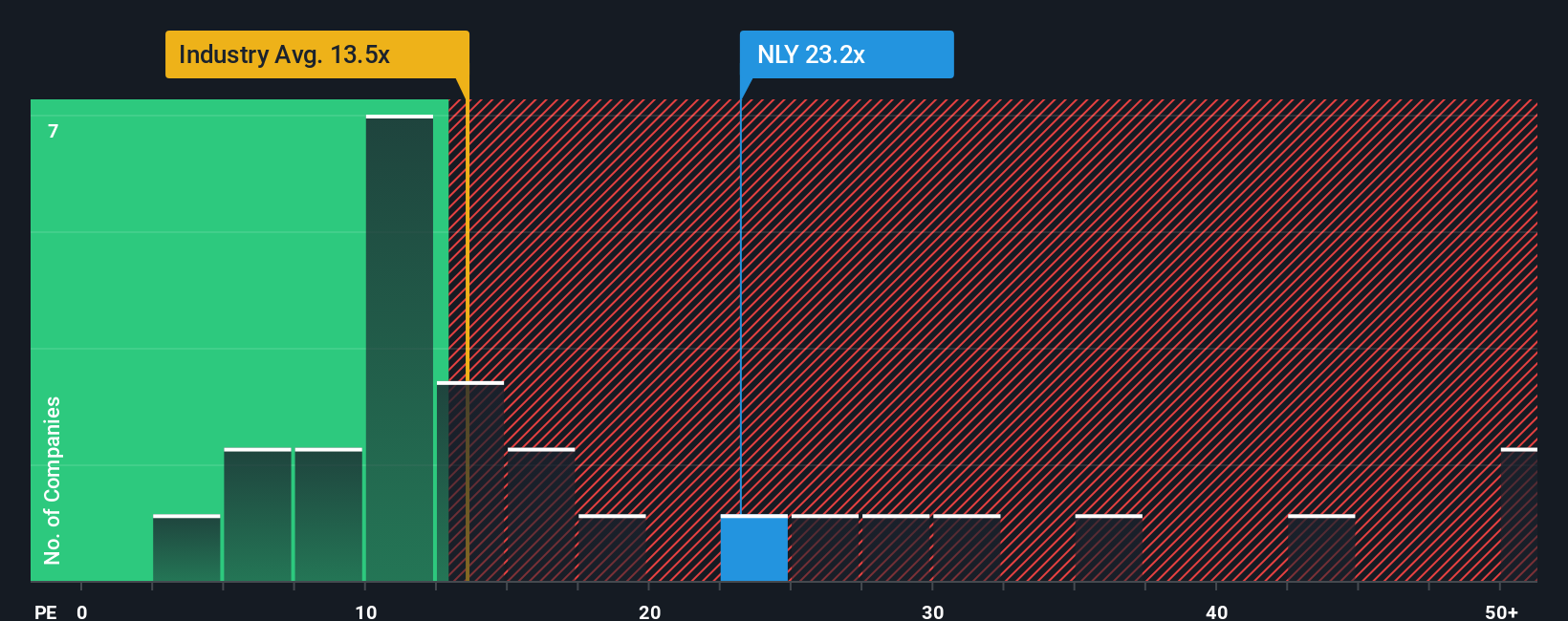

Market based metrics paint a very different picture. At roughly 11.8 times earnings, Annaly trades materially below both the Mortgage REITs industry at 13 times and peers at 13.9 times, and well under a 17.9 times fair ratio, suggesting the market may be underestimating its earnings power.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Annaly Capital Management Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock lists built from fundamentals, growth, and income potential across different corners of the market.

- Capture early stage growth potential with these 3629 penny stocks with strong financials that already show financial strength instead of just hype.

- Position your portfolio at the heart of intelligent automation by screening these 24 AI penny stocks shaping how data, software, and hardware work together.

- Reinforce your income strategy with these 10 dividend stocks with yields > 3% that balance reliable payouts with solid business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報