Reassessing CoStar Group (CSGP): Valuation Check as Earnings and Returns Lag Revenue Growth

CoStar Group (CSGP) is back in focus after fresh analysis underscored an uncomfortable trend: revenue has climbed over the past five years, but earnings per share and returns on capital have moved in the wrong direction.

See our latest analysis for CoStar Group.

At around $66.89, the stock has seen a 3.18% 7 day share price return but a 19.50% 90 day share price decline, in line with a weaker 1 year total shareholder return of 8.31%. This suggests momentum has clearly faded as investors reassess execution risk against long term growth potential.

If CoStar’s wobble has you rethinking your exposure, now could be a smart time to explore fast growing stocks with high insider ownership for other compelling growth stories with management firmly invested alongside shareholders.

With revenue still rising but profits and returns lagging, and the shares trading below consensus targets, investors face a key question: is CoStar quietly undervalued here, or is the market correctly pricing in its future growth?

Most Popular Narrative Narrative: 27.2% Undervalued

With CoStar Group last closing at $66.89 against a narrative fair value of about $91.94, the story centers on whether rapid scaling can unlock that gap.

Integration of AI driven features, Matterport's 3D technology, and advanced analytics across platforms is increasing user engagement, enabling higher value product offerings and upsells, and improving client retention, which is positioning the company for elevated margins and increased net income over time.

Curious how double digit growth, margin expansion, and a rich future earnings multiple can still add up to upside from here? The full narrative unpacks the bold revenue ramp, profit inflection, and valuation bridge that underpin this higher fair value, step by step.

Result: Fair Value of $91.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps at Homes.com, or slower than expected margin gains from heavy tech and AI investment, could quickly undermine this upbeat valuation story.

Find out about the key risks to this CoStar Group narrative.

Another Lens On Valuation

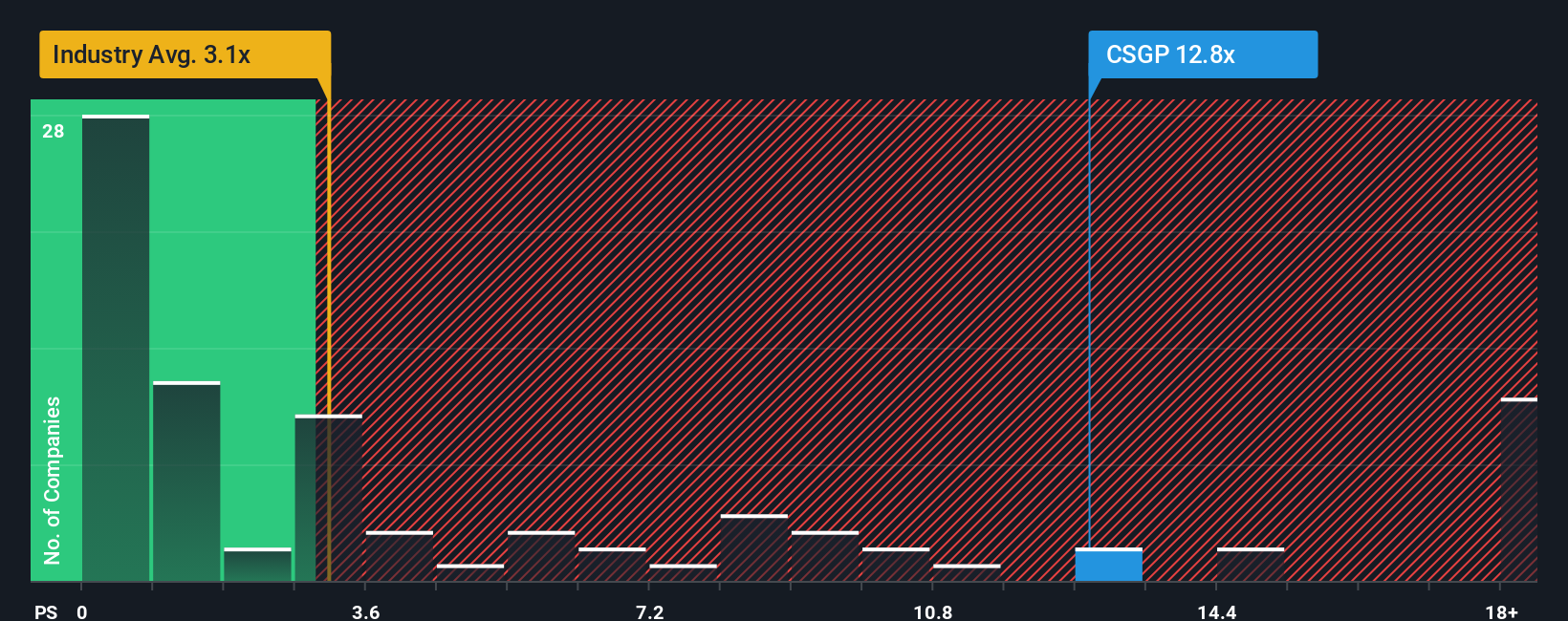

While the AI narrative leans on fast growth and higher future margins to argue CoStar is undervalued, today’s price to sales ratio of 9.3 times paints a harsher picture versus the US real estate sector at 2 times and a fair ratio nearer 6.1 times. This raises the risk that expectations are simply too far ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If you are not fully convinced by this view, or would rather dig into the numbers yourself, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your CoStar Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore your next opportunity by using our screeners that help surface quality stocks you may be less likely to find elsewhere.

- Look for potential multi baggers early by scanning these 3629 penny stocks with strong financials that pair lower share prices with real, measurable business strength.

- Align your portfolio with the AI transformation by targeting these 24 AI penny stocks driving change with scalable, data driven business models.

- Focus on these 904 undervalued stocks based on cash flows that appear inexpensive relative to their projected cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報