KKR (KKR) Valuation Check After Recent Pullback and Strong Three‑Year Shareholder Returns

KKR (KKR) has been on traders radar after a choppy stretch, with the stock sliding this year even as its three year return still looks strong. That gap is raising fresh valuation questions.

See our latest analysis for KKR.

After a strong run earlier in the year, KKR’s recent pullback has left the shares at $130.78, with a double digit 1 month share price return but a much weaker year to date share price return and a stellar three year total shareholder return that still signals long term confidence in its growth engine.

If KKR’s swings have you thinking about what else could rerate sharply, now is a good time to explore fast growing stocks with high insider ownership.

With the shares lagging this year despite a robust three year run and a sizeable gap to analyst targets, the real question now is whether KKR is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 17.1% Undervalued

With KKR last closing at $130.78 versus a narrative fair value of about $158, the gap rests on some aggressive long term profitability assumptions.

Analysts are assuming KKR's revenue will decrease by 13.9% annually over the next 3 years.

Analysts assume that profit margins will increase from 9.3% today to 39.6% in 3 years time.

Want to know how shrinking top line and surging margins can still support a higher value, plus a rich future earnings multiple? The full narrative spells out the bold profit story behind this call, the implied earnings ramp, and the discount rate that ties it all together, but keeps one core assumption hidden in plain sight.

Result: Fair Value of $158 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that profit story could unravel if fundraising momentum slows or performance fees prove more volatile than expected in a tougher macro backdrop.

Find out about the key risks to this KKR narrative.

Another Lens on Valuation

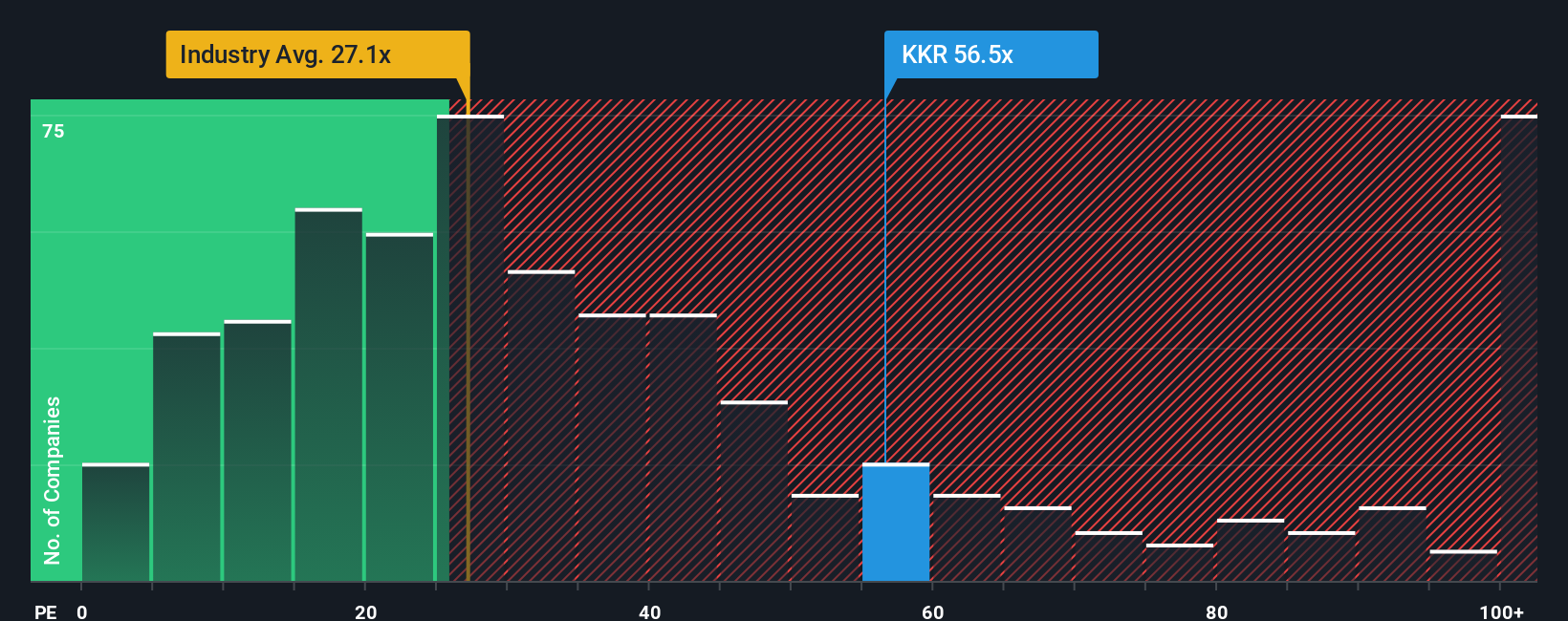

While the narrative fair value points to upside, our price to earnings work paints a tougher picture. KKR trades on 51.3 times earnings versus 37.1 times for peers and a fair ratio of 26.7 times, a steep premium that raises the question: is the risk reward still balanced here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KKR Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KKR.

Looking for more investment ideas?

If you stop at KKR, you could miss other powerful opportunities that fit your strategy, so put the Simply Wall St screener to work for you.

- Capture early stage growth potential by targeting these 3629 penny stocks with strong financials that pair smaller market caps with solid financial underpinnings.

- Tap into structural tech tailwinds with these 24 AI penny stocks positioned at the heart of machine learning and automation trends.

- Lock in value opportunities through these 903 undervalued stocks based on cash flows that trade below what their cash flows suggest they are truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報