Will Air Products' (APD) Low Emission Ammonia Push With Yara Redefine Its Clean Hydrogen Narrative?

- Earlier this week, Bernstein SocGen Group reiterated its positive rating on Air Products and Chemicals after an update on the company’s negotiations with Yara to jointly develop large-scale, low-emission ammonia projects in the US and Saudi Arabia.

- The planned collaboration seeks to combine Air Products’ hydrogen production capabilities with Yara’s global ammonia distribution network, aiming to reduce project risk while strengthening both companies’ roles in emerging low-carbon fuel supply chains.

- We’ll now examine how this planned low-emission ammonia partnership with Yara could influence Air Products’ investment narrative around clean hydrogen growth.

Find companies with promising cash flow potential yet trading below their fair value.

Air Products and Chemicals Investment Narrative Recap

To own Air Products today, you need to believe in its pivot toward large-scale, low-emission hydrogen and ammonia projects eventually translating into sustainable profits and healthier cash flows. The Yara negotiations support that long-term thesis but do not materially change the near term picture, where the key catalyst remains converting large capital-in-process projects into productive assets, and the biggest risk is still execution on these multibillion-dollar builds and their impact on already stretched free cash flow.

The December update on the Louisiana Clean Energy Complex, with an estimated US$8,000,000,000 to US$9,000,000,000 cost and a 25-year low carbon hydrogen offtake to Yara, is the most relevant backdrop for this new collaboration. It ties the ammonia partnership directly to Air Products’ largest ongoing project, reinforcing the potential earnings catalyst if the complex ramps as planned, but also underlining how much of the investment case hinges on bringing these mega-projects online without further cost or schedule setbacks.

Yet beneath the promise of cleaner fuels, investors should be aware of how prolonged construction timelines and heavy capital spending could...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' narrative projects $14.9 billion revenue and $3.8 billion earnings by 2028. This requires 7.4% yearly revenue growth and a $2.2 billion earnings increase from $1.6 billion today.

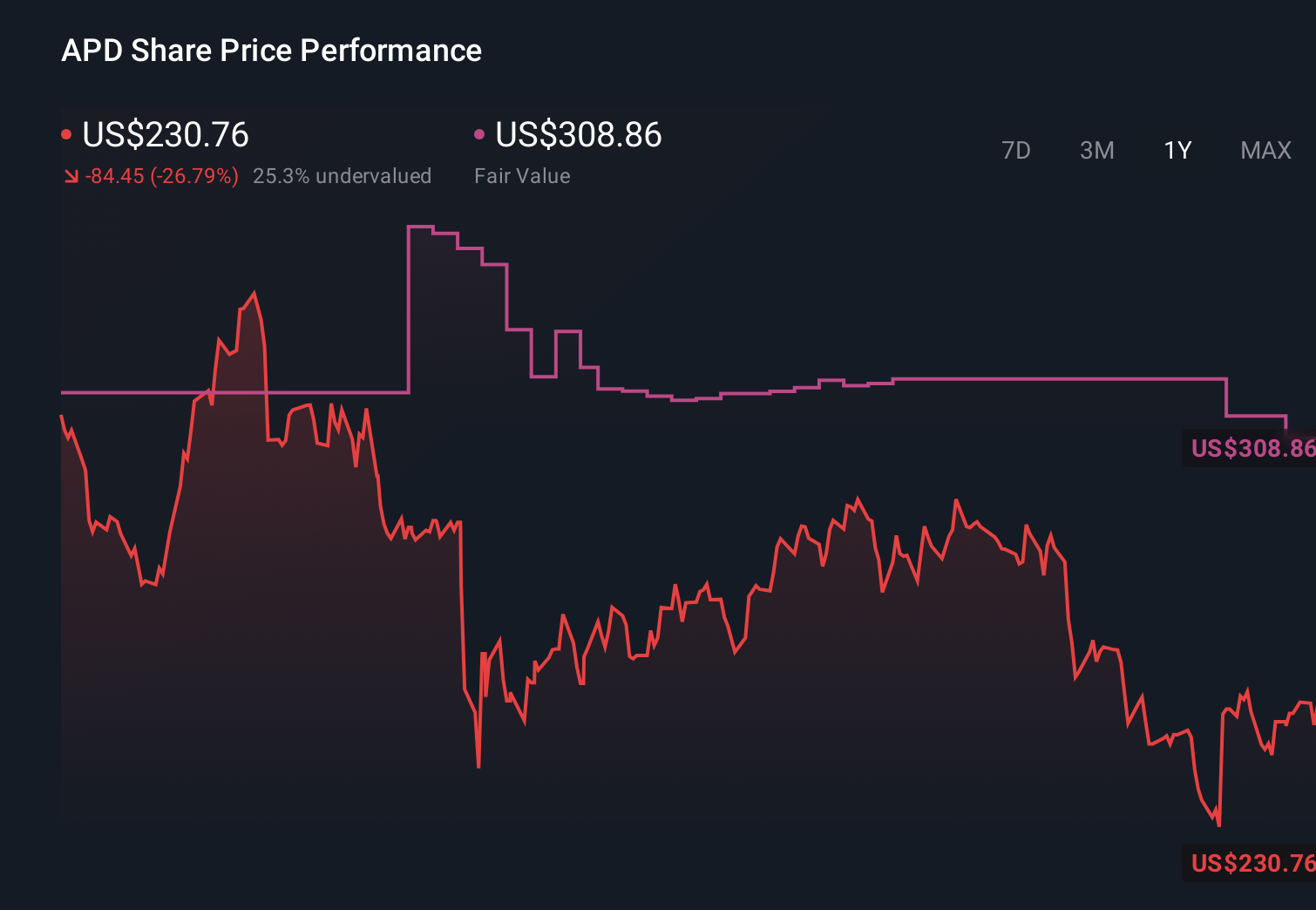

Uncover how Air Products and Chemicals' forecasts yield a $292.86 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently see fair value for Air Products between US$263.17 and US$292.86 per share, highlighting a fairly tight cluster of views. You can weigh these against the execution risk around Air Products’ large hydrogen and ammonia projects, which may influence how quickly today’s heavy capital spending translates into stronger returns.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth as much as 19% more than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報