Estée Lauder (EL): Valuation Check as ‘Beauty Reimagined’ Turnaround Strategy Takes Shape

Estée Lauder Companies (EL) is back in the spotlight as new CEO Stéphane de La Faverie rolls out the Beauty Reimagined transformation, a shift from damage control to a structured push for growth and profitability.

See our latest analysis for Estée Lauder Companies.

The stock market seems to be warming back up to that story, with a roughly 45 percent year to date share price return and a three year total shareholder return still deeply negative, suggesting momentum is rebuilding from a bruising downturn.

If Beauty Reimagined has you rethinking your portfolio, it could be a good moment to explore other quality names in consumer and healthcare, starting with healthcare stocks.

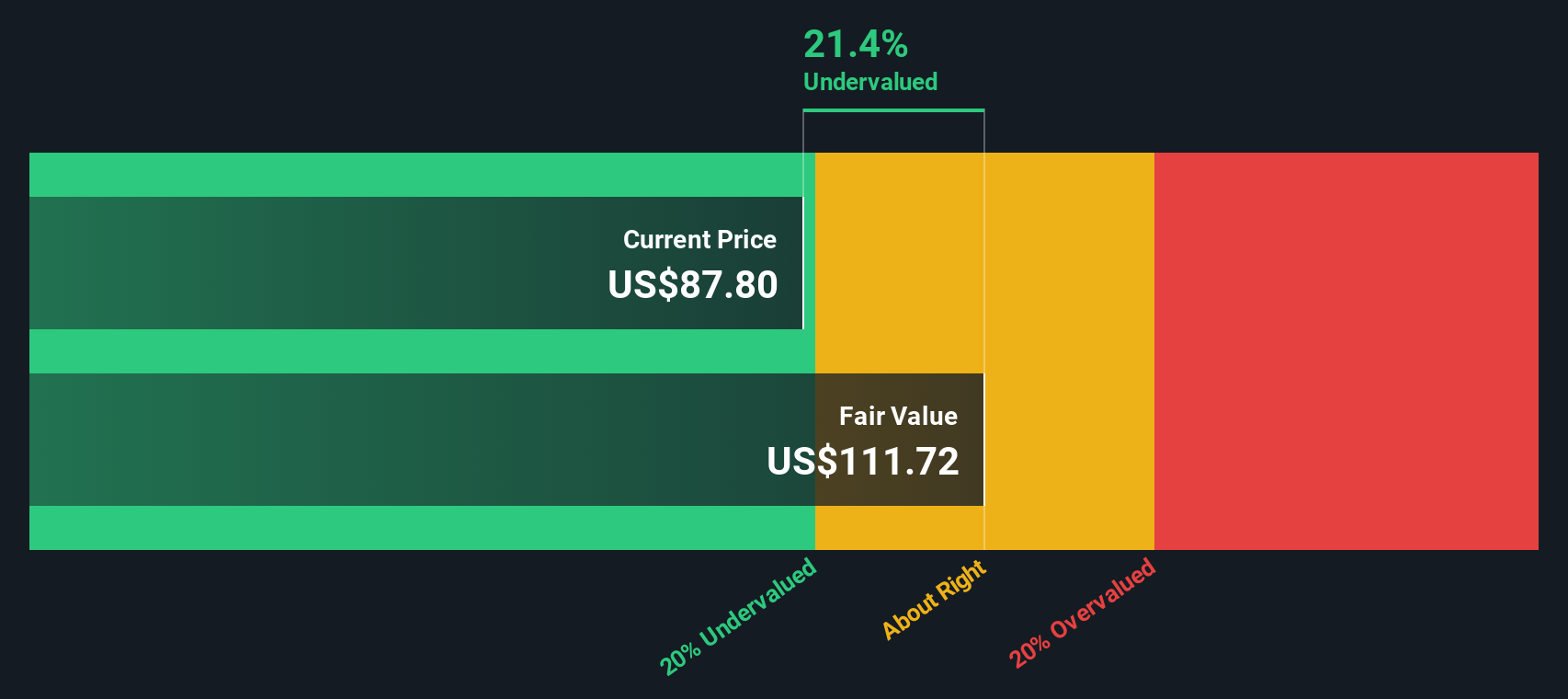

After a sharp rebound and a valuation that sits only fractionally below fair value estimates, investors face a pivotal question: is Estée Lauder still a turnaround bargain, or has the market already priced in Beauty Reimagined’s next leg of growth?

Most Popular Narrative: 3.5% Overvalued

With Estée Lauder closing at 107.48 dollars against a narrative fair value near 104 dollars, the story leans toward a mildly stretched optimism on future earnings power.

Analysts expect earnings to reach $1.4 billion (and earnings per share of $3.75) by about September 2028, up from $-1.1 billion today. The analysts are largely in agreement about this estimate.

Want to see how a loss making beauty giant is penciled in for a dramatic earnings comeback, plus a premium future multiple above its sector? The full narrative explains the growth, margin, and valuation math driving that call.

Result: Fair Value of $104 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that confidence could crack if travel retail remains weak or China centric growth stumbles, undermining both the recovery story and the premium valuation.

Find out about the key risks to this Estée Lauder Companies narrative.

Another Angle on Valuation

Our DCF model presents a slightly different view, indicating that Estée Lauder is trading just below its intrinsic value at around 108.01 dollars, which points to a modest undervaluation. If cash flows remain roughly in line with expectations, could the downside risk already be limited at this level?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Estée Lauder Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Estée Lauder Companies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move? Use the Simply Wall St Screener to uncover targeted opportunities that match your strategy before others spot them.

- Capture potential mispricings by scanning these 904 undervalued stocks based on cash flows that may offer stronger upside than widely followed large caps.

- Capitalize on powerful thematic growth by targeting these 24 AI penny stocks positioned at the intersection of innovation and real revenue traction.

- Lock in recurring income potential with these 10 dividend stocks with yields > 3% that aim to balance yield with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報