Japan's two-year treasury bond auctions are cooling down, and yields are rising, and the market is betting that the central bank will increase interest rate hikes

The Zhitong Finance App learned that demand for Japanese two-year treasury bond auctions is weak, driving up the yield on this term treasury bond. The market speculates that the Bank of Japan may need to increase interest rate hikes to curb inflation and boost the yen exchange rate.

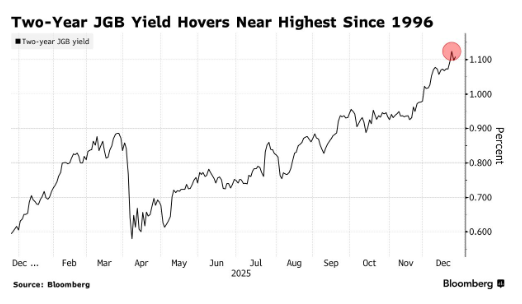

As a core indicator for measuring demand, the bid multiplier for this two-year treasury bond auction recorded 3.26, lower than 3.53 in the previous period, and lower than the 12-month average of 3.65. Affected by this, two-year treasury bond yields rose 1 basis point to 1.11%. Furthermore, ten-year treasury bond futures retreated lower after opening higher.

Less than a week before the auction was held, the Bank of Japan just raised the policy interest rate to the highest level in 30 years. In his speech after the interest rate hike, Governor Kazuo Ueda did not give clear guidance on the future interest rate path. This move dragged down the weakening of the yen exchange rate while driving treasury bond yields to rise sharply.

“The market still has many doubts about the Bank of Japan's policy direction,” said Katsutoshi Inadome, a senior strategist at Sumitomo Mitsui Trust Asset Management. “This uncertainty may cause investors to avoid two-year treasury bonds. After all, this type of maturity is most directly affected by the risk of policy changes.”

Two-year treasury yields, which are more sensitive to monetary policy expectations, climbed to their highest level since 1996 earlier this week. Meanwhile, the 10-year break-even inflation rate, a key indicator reflecting the market's future inflation expectations, also rose to its peak since data was recorded in 2004 on Monday.

However, Japan's Finance Minister Katayama Satsuki warned that the Japanese government “has absolute freedom to take decisive countermeasures” against exchange rate fluctuations that are not in line with economic fundamentals. Following this statement, the depreciation of the yen and the upward trend in yield have abated since the beginning of this week.

Investors are closely watching the treasury bond issuance plan related to the 2026 budget, which is expected to be approved by the cabinet this Friday. Japan's tier 1 traders pointed out this month that for the new fiscal year starting April 1 next year, it is reasonable to increase the issuance volume of two-year, five-year, and ten-year treasury bonds, while also recommending reducing the scale of issuance of ultra-long-term treasury bonds.

According to two unnamed government officials, Japan may reduce the amount of new ultra-long-term treasury bonds issued to about 17 trillion yen (equivalent to 109 billion US dollars) in the next fiscal year. This scale will set a record low in 17 years.

Nasdaq

Nasdaq 華爾街日報

華爾街日報