Has the BNPL Hype Pushed Affirm’s 2025 Valuation Too Far Ahead of Fundamentals

- Wondering if Affirm Holdings is still a smart buy now that buy now, pay later is back in the spotlight? This article unpacks whether today's price lines up with the business behind the hype.

- The stock has been on a tear lately, climbing 5.5% over the last week, 13.6% over the past month, and 21.6% year to date, while its 3 year return of 741.5% shows how explosive the ride has been.

- Those moves have come as investors refocus on Affirm's partnerships with major retailers and platforms, along with growing adoption of installment payments at checkout. At the same time, shifting sentiment around consumer credit risk and regulation has added extra volatility to how the market prices the story.

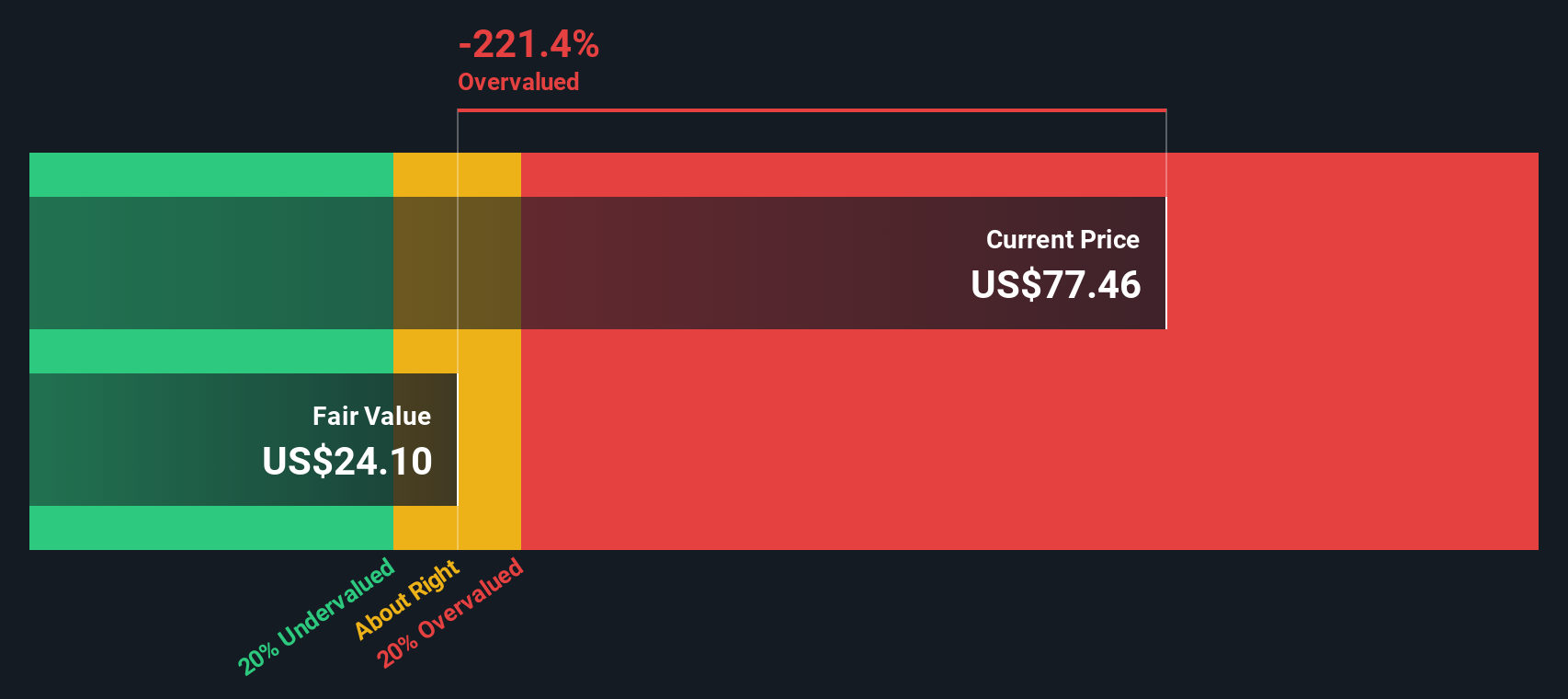

- Despite that excitement, Affirm scores just 0/6 on our valuation checks. This suggests the market may be paying up for growth for now. We will walk through multiple valuation lenses and then finish with a more holistic way to think about what the stock might be worth.

Affirm Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Affirm Holdings Excess Returns Analysis

The Excess Returns model looks at how much profit a company can earn above the return investors demand, then adds the value of those excess profits to its book value. For Affirm, the starting Book Value is about $10.00 per share, with a Stable EPS of $1.95 per share, based on forward Return on Equity estimates from seven analysts.

Investors are assumed to require a Cost of Equity of $1.09 per share, while Affirm is expected to generate an Excess Return of $0.86 per share. That implies an Average Return on Equity of 14.25%, which is comfortably above the required return, and a Stable Book Value rising to around $13.66 per share, based on projections from three analysts.

When these excess returns are projected forward and discounted, the model arrives at an intrinsic value of about $31.88 per share. Compared with the current market price, this implies the stock is roughly 138.3% overvalued in this framework.

Result: OVERVALUED

Our Excess Returns analysis suggests Affirm Holdings may be overvalued by 138.3%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

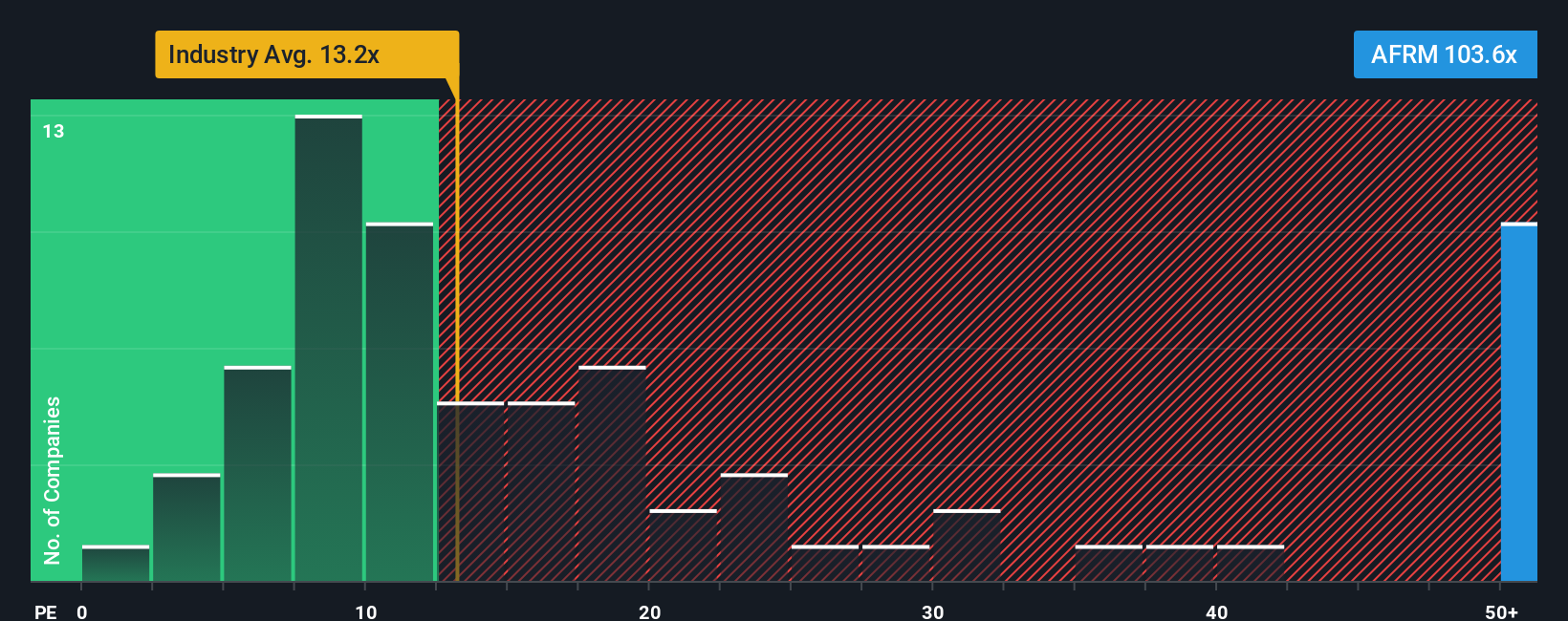

Approach 2: Affirm Holdings Price vs Earnings

For a business that is expected to generate ongoing profits, the price to earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of earnings. A higher PE can be justified when a company is growing quickly and its earnings are seen as relatively dependable, while slower growth or higher risk usually calls for a lower, more conservative multiple.

Affirm currently trades on a PE of about 107.6x, which is far richer than the broader Diversified Financial industry average of roughly 13.9x and also well above the peer group average of about 31.0x. To add more nuance than a simple comparison, Simply Wall St uses a Fair Ratio, which estimates what PE you might expect for Affirm given its earnings growth outlook, margins, risk profile, industry and size.

On this basis, Affirm’s Fair Ratio is around 30.9x, meaning the stock is trading at more than three times the level that would be considered reasonable once growth and risk are factored in. That gap suggests the current share price reflects very optimistic expectations and screens as significantly overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Affirm Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce Narratives, a simple framework on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of a company’s future revenue, earnings and margins to a concrete forecast and Fair Value. You can then compare that Fair Value to today’s price to decide whether Affirm is a buy, hold or sell. The Narrative automatically updates as new news, earnings and analyst estimates come in. For example, a bullish investor might build a Narrative around Affirm’s expanding platform partnerships, high expected revenue growth, improving margins and a Fair Value near the current analyst consensus in the high 80s to low 90s. A more cautious investor could instead create a Narrative that leans into competitive, regulatory and credit risks, assumes slower growth, lower margins and a Fair Value closer to the most bearish analyst target in the mid 60s. This shows how different yet structured stories can coexist and evolve in real time.

Do you think there's more to the story for Affirm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報