UK Stocks That May Be Trading Below Their True Value In December 2025

As the United Kingdom's FTSE 100 index faces challenges from weak trade data in China and global economic uncertainties, investors are keenly observing market dynamics for potential opportunities. In such a climate, identifying stocks that may be trading below their intrinsic value can offer strategic advantages, as these assets might hold the potential for growth despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.266 | £12.30 | 49.1% |

| Tortilla Mexican Grill (AIM:MEX) | £0.425 | £0.78 | 45.5% |

| PageGroup (LSE:PAGE) | £2.266 | £4.50 | 49.6% |

| Motorpoint Group (LSE:MOTR) | £1.34 | £2.67 | 49.9% |

| Ibstock (LSE:IBST) | £1.396 | £2.67 | 47.7% |

| Gym Group (LSE:GYM) | £1.47 | £2.94 | 49.9% |

| Fintel (AIM:FNTL) | £2.09 | £3.80 | 45% |

| Fevertree Drinks (AIM:FEVR) | £8.16 | £15.87 | 48.6% |

| Anglo Asian Mining (AIM:AAZ) | £2.65 | £5.15 | 48.6% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.175 | £4.18 | 48% |

Let's explore several standout options from the results in the screener.

NIOX Group (AIM:NIOX)

Overview: NIOX Group Plc focuses on designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally, with a market cap of £284.16 million.

Operations: The company's revenue primarily comes from its NIOX® segment, which generated £46 million.

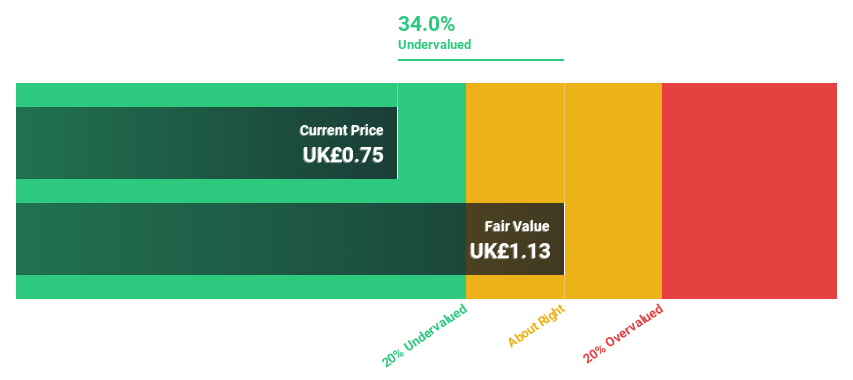

Estimated Discount To Fair Value: 34.6%

NIOX Group is trading at £0.68, significantly below its estimated fair value of £1.04, indicating it may be undervalued based on cash flows. Recent earnings show improved sales and net income compared to last year. Although profit margins have decreased, the company's earnings are forecast to grow at 34.2% annually, outpacing the UK market's growth rate. Analysts agree that the stock price could rise by 24.6%, reflecting potential for capital appreciation despite low future return on equity expectations.

- Upon reviewing our latest growth report, NIOX Group's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of NIOX Group.

Ibstock (LSE:IBST)

Overview: Ibstock plc is a UK-based company that manufactures and sells clay and concrete building products for the residential construction sector, with a market cap of approximately £551 million.

Operations: The company generates revenue through its clay segment, which accounts for £262.88 million, and its concrete segment, contributing £118.59 million.

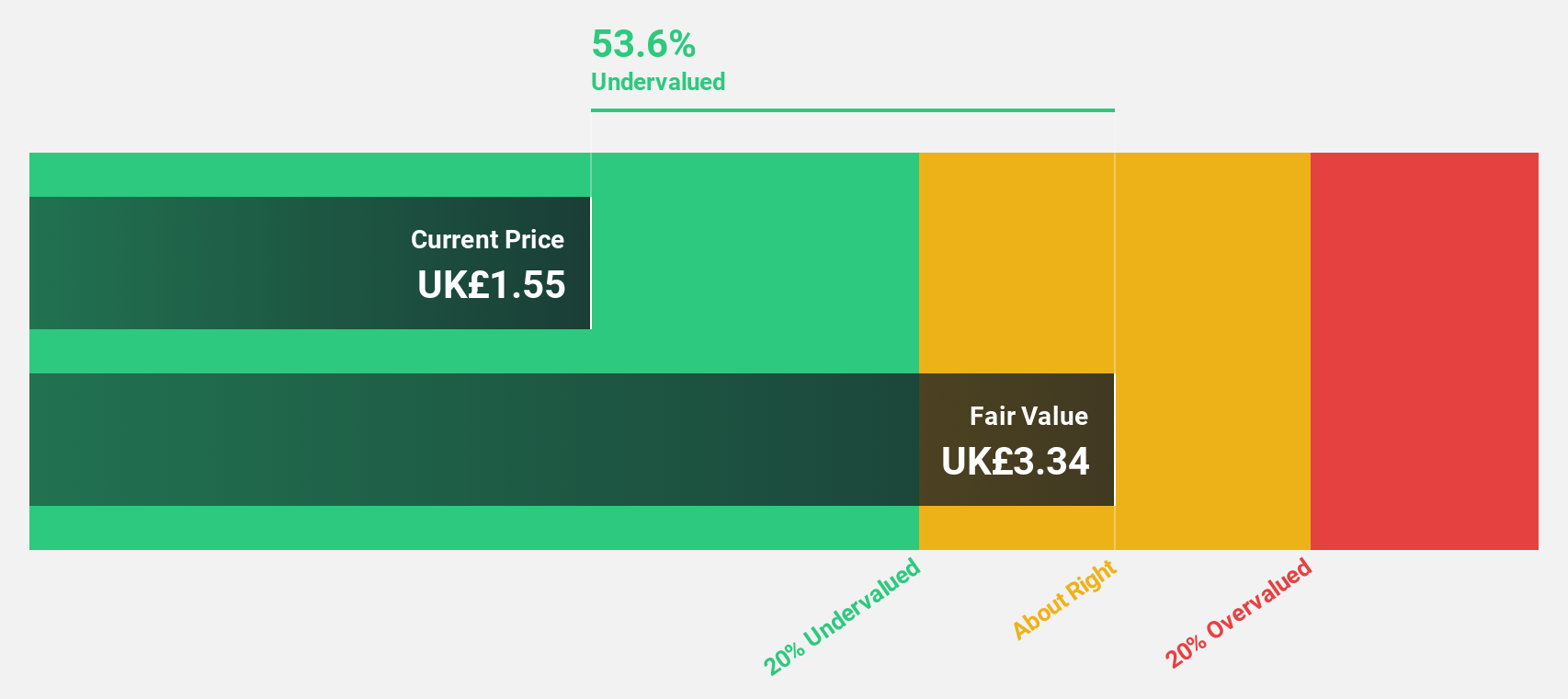

Estimated Discount To Fair Value: 47.7%

Ibstock is trading at £1.4, well below its estimated fair value of £2.67, suggesting it is undervalued based on cash flows. Despite revenue growth forecasts of 6.1% annually being modest, earnings are expected to grow significantly at 31.4% per year, outpacing the UK market's average growth rate. The recent renewal of a £125 million revolving credit facility with improved terms supports financial stability, though dividend sustainability remains a concern due to inadequate coverage by earnings or cash flows.

- Our earnings growth report unveils the potential for significant increases in Ibstock's future results.

- Dive into the specifics of Ibstock here with our thorough financial health report.

S&U (LSE:SUS)

Overview: S&U plc is a UK-based company offering motor, property bridging, and specialist finance services with a market cap of £239.37 million.

Operations: The company's revenue is derived from motor finance (£70.07 million) and property bridging finance (£15.82 million) services in the United Kingdom.

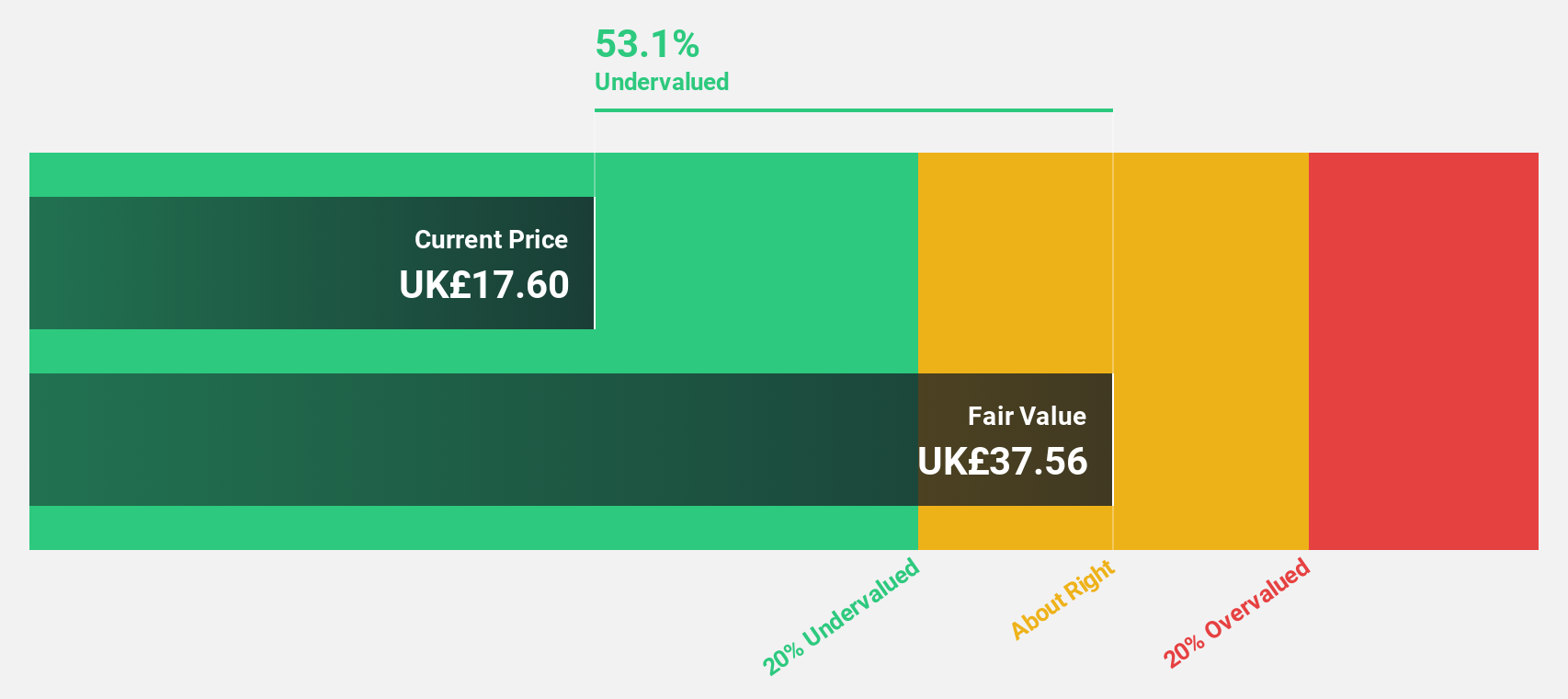

Estimated Discount To Fair Value: 25.4%

S&U is trading at £19.7, significantly below its estimated fair value of £26.4, highlighting its undervaluation based on cash flows. The company's revenue growth is expected to exceed 22% annually, outpacing the UK market's 4.4%. However, a high debt level and an unstable dividend track record pose concerns despite recent earnings improvements and a declared interim dividend increase to 35p per share for November 2025 distribution.

- Our expertly prepared growth report on S&U implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of S&U stock in this financial health report.

Key Takeaways

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 57 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報