everplay group And 2 Other UK Penny Stocks Worth Watching

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting the global economic interconnections that influence local markets. In such a climate, investors often explore alternative opportunities, including penny stocks—an investment area that remains relevant despite its outdated terminology. These smaller or newer companies can offer significant potential when they are underpinned by solid financials, presenting an opportunity for investors to uncover hidden value in quality businesses.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.255 | £488.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.975 | £159.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.86 | £12.98M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.504 | £182.15M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.47 | £40.51M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

| Billington Holdings (AIM:BILN) | £3.40 | £44.38M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

everplay group (AIM:EVPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Everplay Group PLC, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the United Kingdom, with a market capitalization of £472.59 million.

Operations: The company's revenue is primarily generated from its segment focused on developing and publishing games and apps, which accounts for £158.33 million.

Market Cap: £472.59M

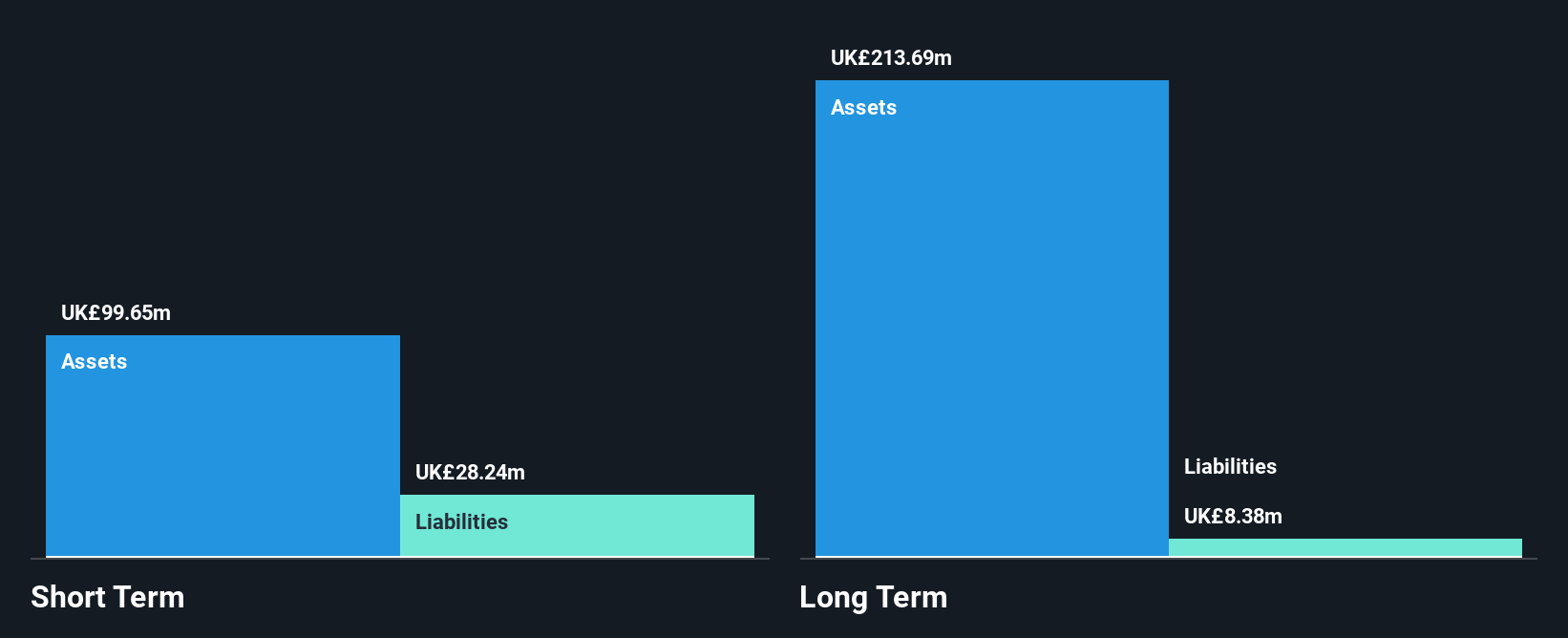

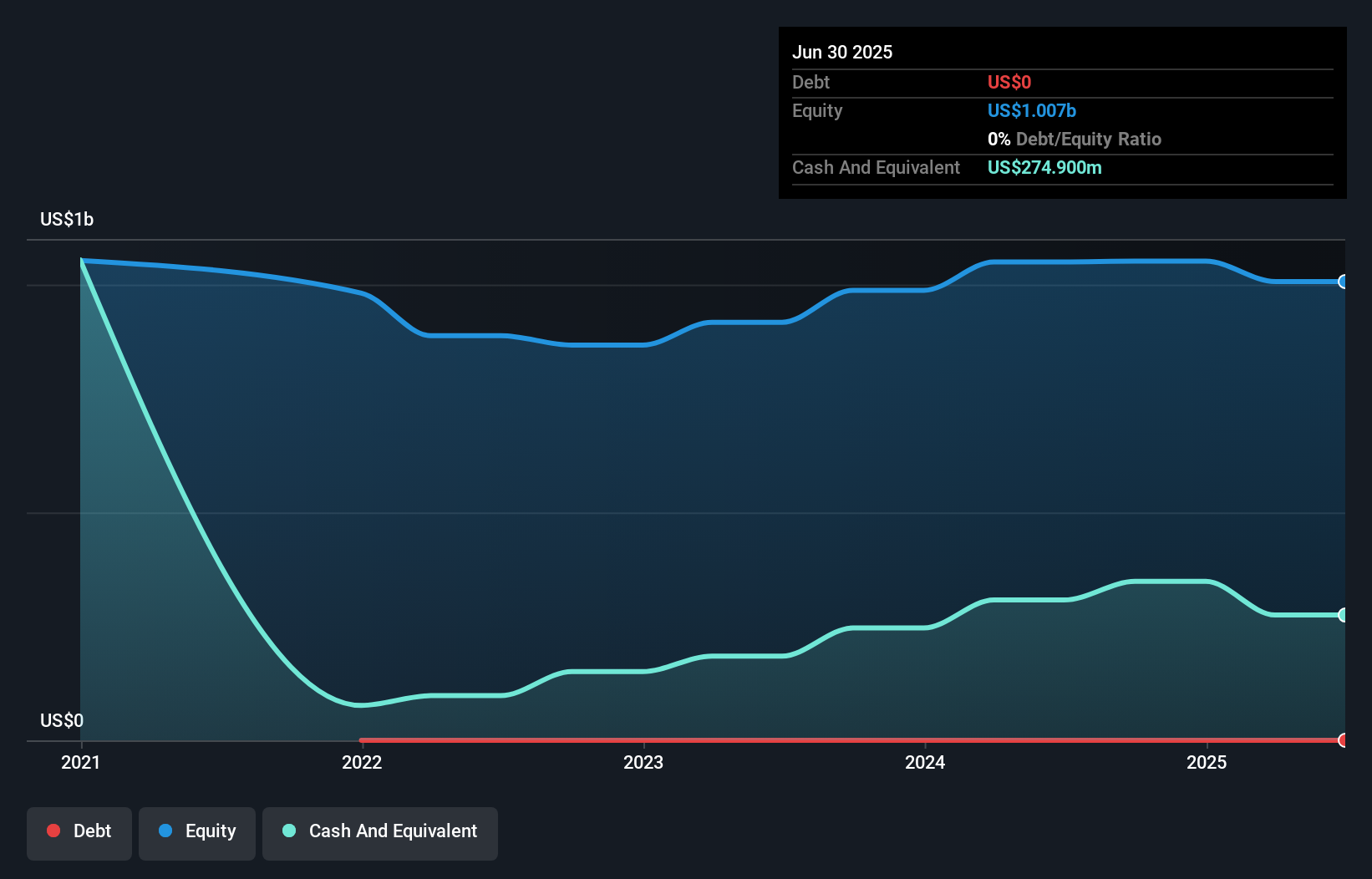

Everplay Group PLC, with a market cap of £472.59 million, has recently turned profitable, which distinguishes it from many penny stocks. Its revenue stream is robust at £158.33 million primarily from game development and publishing. The company trades below its estimated fair value by 22%, suggesting potential undervaluation. Despite a low return on equity at 7.9%, Everplay's financial health is solid with no debt and short-term assets exceeding liabilities significantly. Recent executive changes include appointing Mikkel Weider as CEO, bringing extensive industry experience that could drive future growth and strategic acquisitions in the gaming sector.

- Unlock comprehensive insights into our analysis of everplay group stock in this financial health report.

- Evaluate everplay group's prospects by accessing our earnings growth report.

Seascape Energy Asia (AIM:SEA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Seascape Energy Asia plc is a full-cycle exploration and production company focused on acquiring oil and gas assets in Malaysia, with a market cap of £46.08 million.

Operations: The company's revenue from Blank Checks amounts to £0.43 million.

Market Cap: £46.08M

Seascape Energy Asia plc, with a market cap of £46.08 million, focuses on oil and gas exploration in Malaysia but remains pre-revenue with only £0.43 million from Blank Checks. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges due to its unprofitability and inexperienced management team. Recent developments include entry into the second exploration phase of Block 2A offshore Malaysia, where Seascape is fully carried by INPEX CORPORATION for its 10% interest at no cost. This provides exposure to significant prospective resources without immediate financial burden but does not guarantee profitability soon.

- Click to explore a detailed breakdown of our findings in Seascape Energy Asia's financial health report.

- Gain insights into Seascape Energy Asia's outlook and expected performance with our report on the company's earnings estimates.

Conduit Holdings (LSE:CRE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Conduit Holdings Limited, with a market cap of £598.05 million, operates globally through its subsidiary by offering reinsurance products and services.

Operations: The company's revenue is derived from three main segments: Property ($343.4 million), Casualty ($184.7 million), and Specialty ($166.6 million).

Market Cap: £598.05M

Conduit Holdings Limited, with a market cap of £598.05 million, operates globally in the reinsurance sector and is currently trading at 67.9% below its estimated fair value. Despite being debt-free and having high-quality earnings, the company faces challenges with short-term assets ($376.5M) not covering its liabilities ($1.1B). Recent leadership changes include appointing Nicholas Shott as a Non-Executive Director and Stephen Postlewhite as Chief Underwriting Officer to strengthen strategic oversight and underwriting capabilities. However, Conduit's profit margins have declined to 1.7% from last year's 30.2%, indicating potential profitability concerns amid industry volatility.

- Take a closer look at Conduit Holdings' potential here in our financial health report.

- Gain insights into Conduit Holdings' future direction by reviewing our growth report.

Next Steps

- Reveal the 305 hidden gems among our UK Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報