Assessing W.W. Grainger (GWW) Valuation After Parnassus Builds a New Long‑Term Position

W.W. Grainger (GWW) just caught the attention of Parnassus, with both its flagship funds opening new positions after highlighting the distributor's scale advantages, e commerce engine, and leverage to long term industrial digitization trends.

See our latest analysis for W.W. Grainger.

The Parnassus move lands as W.W. Grainger’s share price hovers around $1,030.73, with a robust 30 day share price return of 10.84 percent but a softer year to date trend, while a 5 year total shareholder return of 167.69 percent indicates that long term momentum remains firmly intact.

If Grainger’s blend of scale, digital execution, and steady compounding appeals to you, this may be a useful time to broaden your search and explore fast growing stocks with high insider ownership.

Yet with shares near record highs, trading at a slight premium to analyst targets and showing only modest intrinsic upside, investors now face the key question: Is W.W. Grainger undervalued, or has the market already priced in its next leg of growth?

Most Popular Narrative: 2.2% Undervalued

Against W.W. Grainger’s last close of $1,030.73, the most widely followed narrative pegs fair value slightly higher, implying a modest valuation gap that hinges on specific growth and margin assumptions.

The analysts have a consensus price target of $1041.769 for W.W. Grainger based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1213.0, and the most bearish reporting a price target of just $930.0.

Want to understand why steady revenue gains, only slightly slimmer margins, and a premium future earnings multiple still add up to upside from here? The most popular narrative quietly leans on ambitious long term earnings power and a rich valuation framework usually reserved for faster growing sectors. Curious which profit and multiple assumptions need to come true to justify that fair value? Read on to see how the entire case is built.

Result: Fair Value of $1,053.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on managing LIFO and pricing headwinds, as well as avoiding a prolonged MRO slowdown that could pressure margins and free cash flow.

Find out about the key risks to this W.W. Grainger narrative.

Another Lens On Value

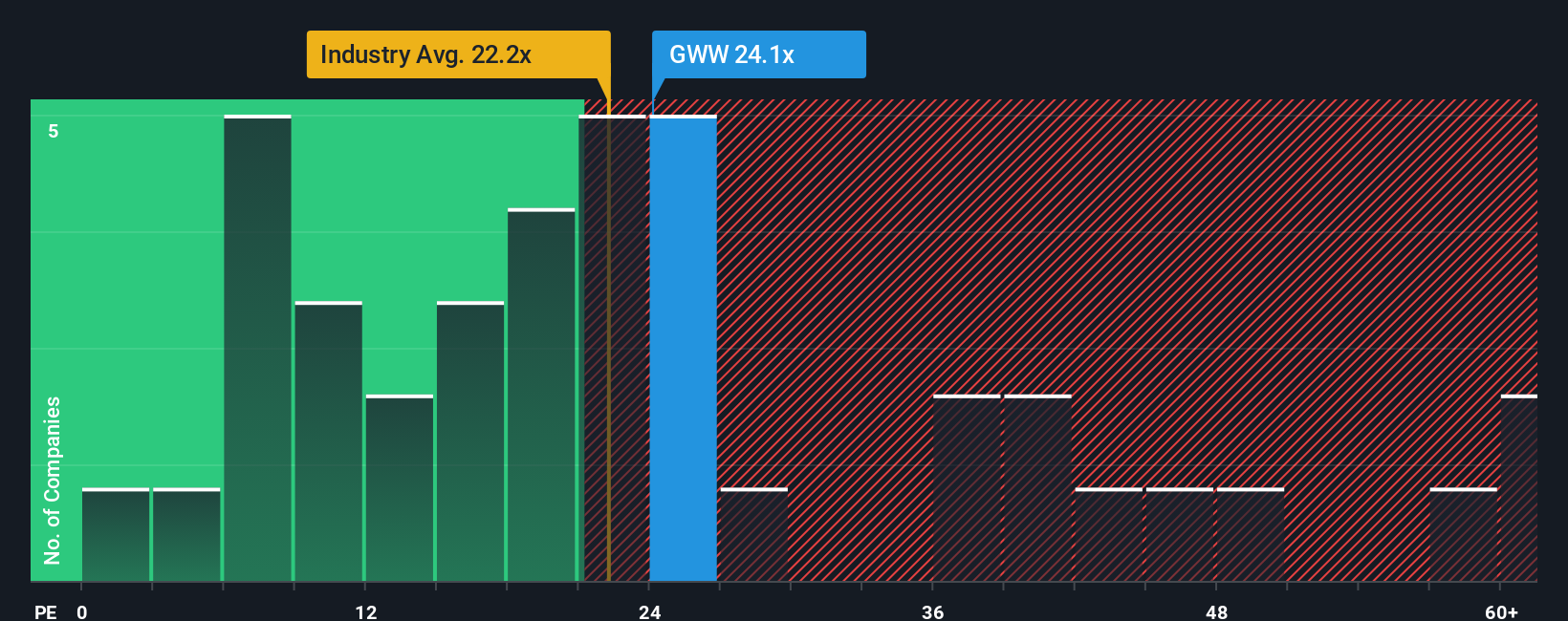

Looked at through its earnings multiple, W.W. Grainger screens as expensive, trading on a P E of 28.3 times versus 20.7 times for the US Trade Distributors industry and 22.6 times for peers, and only slightly above a 28.1 times fair ratio, which leaves little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W.W. Grainger Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your W.W. Grainger research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning targeted stock ideas on Simply Wall Street’s Screener so your watchlist never stands still.

- Capture potential mispricings by hunting for companies trading below their intrinsic value through these 904 undervalued stocks based on cash flows, which focuses on discounted cash flows.

- Capitalize on powerful secular themes by targeting businesses at the heart of machine learning breakthroughs with these 24 AI penny stocks, which spotlights this fast changing space.

- Strengthen your income stream by zeroing in on reliable payers using these 10 dividend stocks with yields > 3%, which can be filtered to meet your yield and stability expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報