Is Restaurant Brands International (QSR) Still Undervalued After Its Recent Share Price Gains?

Restaurant Brands International (QSR) has quietly outperformed many consumer peers over the past year, and that steady climb has investors asking whether the stock’s current price still reflects its fundamentals.

See our latest analysis for Restaurant Brands International.

The share price has eased slightly in recent weeks, but Restaurant Brands International still trades around 69.57 dollars after a solid 90 day share price return of 7.76 percent and a 1 year total shareholder return of 9.99 percent. This suggests momentum is gently building rather than fading as investors warm to its earnings trajectory.

If this steady consumer story has your attention, it could be a good moment to broaden your watchlist and discover fast growing stocks with high insider ownership.

With earnings growing faster than revenue, a double digit discount to analyst targets, and shares already up strongly, the real question now is whether QSR is still mispriced or if the market has fully baked in its next leg of growth.

Most Popular Narrative Narrative: 11% Undervalued

With Restaurant Brands International closing at 69.57 dollars against a narrative fair value near 78 dollars, the spotlight shifts to the earnings engine behind that gap.

Analysts expect earnings to reach 2.0 billion dollars and earnings per share of 4.51 dollars by about September 2028, up from 862.0 million dollars today. The analysts are largely in agreement about this estimate.

Curious how relatively modest revenue growth, sharply higher margins, and a richer future earnings multiple all fit together. Want to see the full playbook behind this valuation call.

Result: Fair Value of $78.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity inflation and setbacks in key international markets could quickly pressure margins and stall the upbeat earnings trajectory that investors are betting on.

Find out about the key risks to this Restaurant Brands International narrative.

Another View: Multiples Paint a Hotter Picture

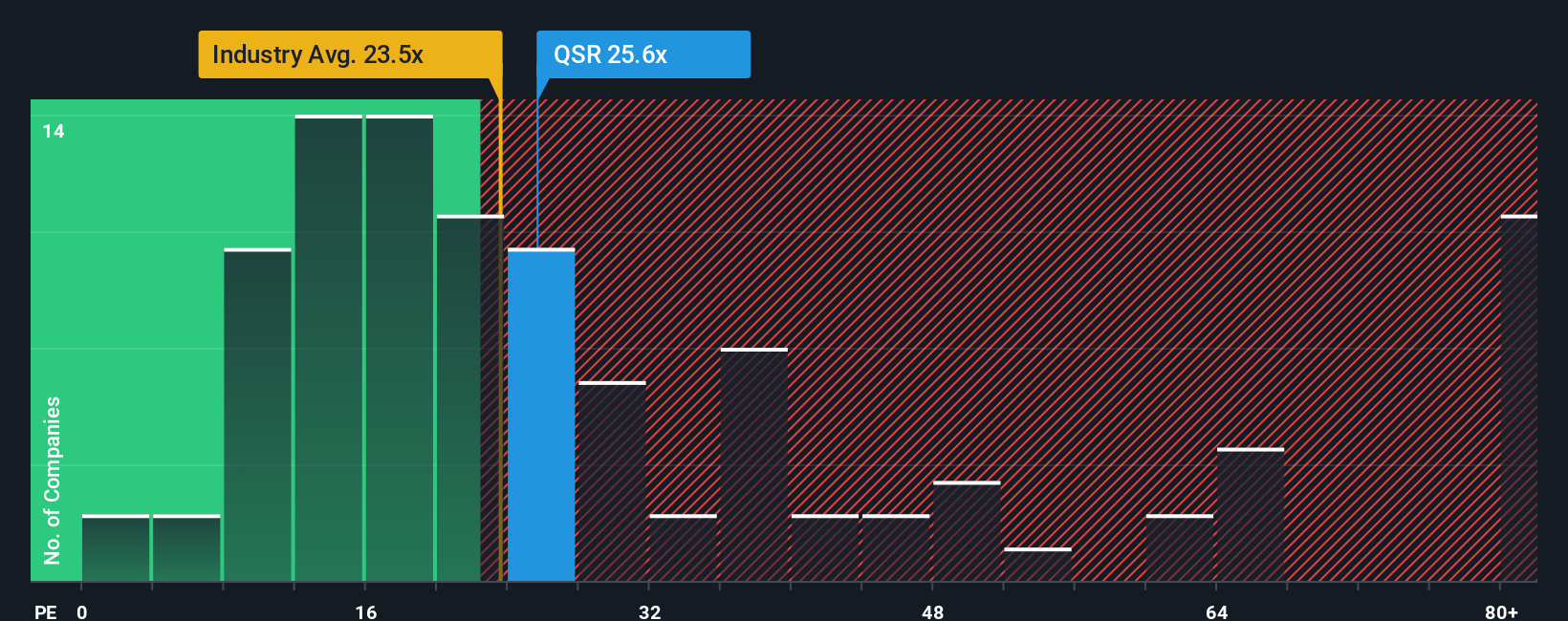

On simple earnings multiples, Restaurant Brands International looks less like a bargain. The stock trades around 24.5 times earnings, richer than the US hospitality average of 22 times and only slightly below peers at 25.3 times, even though growth is hardly explosive.

At the same time, our fair ratio sits higher at 29.6 times earnings. This implies the market could still move up if execution stays on track, but also leaves less room for error if margins wobble or expansion slows. Which story do you believe the market will price in next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Restaurant Brands International Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Restaurant Brands International research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge and use the Simply Wall Street Screener to uncover focused, data backed ideas that most investors overlook.

- Capture potential early stage growth by targeting these 3630 penny stocks with strong financials that already show stronger balance sheets than the typical speculative name.

- Explore the potential for a productivity shift with these 29 healthcare AI stocks in areas such as diagnostics, drug discovery, and hospital efficiency.

- Find dependable income streams using these 10 dividend stocks with yields > 3% offering yields above 3 percent while maintaining a focus on financial quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報