Citizens Financial Group (CFG): Revisiting Valuation After a 13% Monthly and 41% Annual Share Price Rally

Citizens Financial Group (CFG) has quietly delivered a strong run, with the stock up about 13% over the past month and more than 41% in the past year, catching the attention of value oriented investors.

See our latest analysis for Citizens Financial Group.

That performance is not a one off. The recent 13 percent 1 month share price return sits on top of a robust 1 year total shareholder return of just over 41 percent. This suggests momentum is still building as investors reassess Citizens Financial Group’s earnings power and risk profile.

If this bank’s move has you thinking more broadly about financials and growth potential, it could be worth exploring fast growing stocks with high insider ownership for other ideas showing strong conviction from insiders.

With earnings growing solidly and the share price still trading at a material discount to some intrinsic value estimates, the key question now is whether Citizens Financial Group remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 3.8% Undervalued

Citizens Financial Group is trading just below its most widely followed fair value estimate of about $62.23, a gap that hinges on some ambitious profitability assumptions.

The analysts have a consensus price target of $56.45 for Citizens Financial Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $51.0.

Want to see what justifies a higher fair value than consensus targets, despite that tight range of opinions and required returns? The narrative leans on faster profit growth, expanding margins, and a future earnings multiple that quietly assumes Citizens can lift itself into a more profitable tier of regional banks. Curious how those moving parts stack up over the next few years and what that implies for shareholder returns today? Read on to unpack the full valuation storyline.

Result: Fair Value of $62.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, meaningful credit stress in commercial real estate or a slower than expected digital transformation could quickly pressure margins and challenge today’s optimistic assumptions.

Find out about the key risks to this Citizens Financial Group narrative.

Another Lens On Value

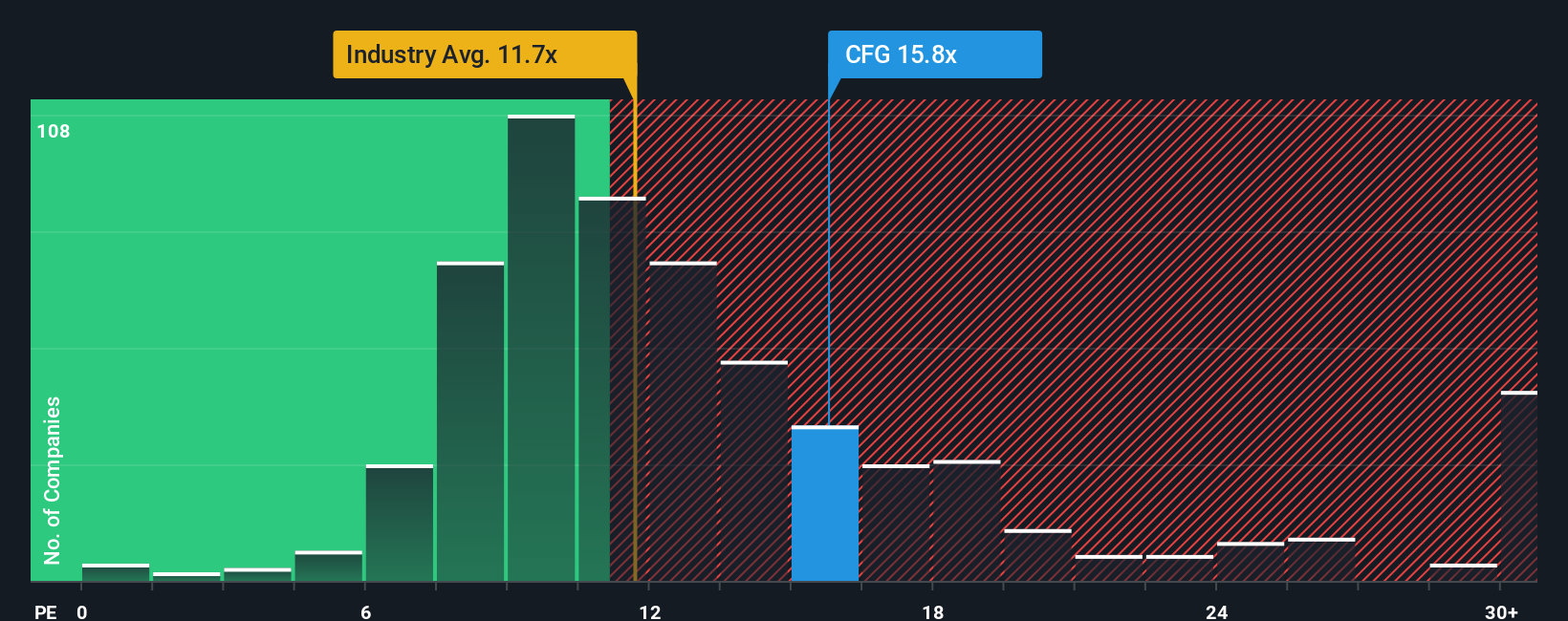

On simple earnings terms, Citizens does not look cheap. The stock trades on a price to earnings ratio of about 16.4 times, richer than both US bank peers at 12.4 times and the wider industry at 11.9 times, even if that sits slightly below our fair ratio of 17.3 times. Is the premium really earned, or just momentum driven?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citizens Financial Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citizens Financial Group.

Ready for more investment ideas?

Before the market moves on without you, use the Simply Wall Street Screener to pinpoint fresh opportunities tailored to your strategy and sharpen your next decision.

- Capture potential income streams by zeroing in on reliable payers through these 10 dividend stocks with yields > 3% and strengthen the foundation of your portfolio.

- Ride the next wave of innovation by targeting growth-focused names using these 24 AI penny stocks and position yourself ahead of structural shifts in technology.

- Lock in value opportunities early by filtering for attractively priced companies via these 904 undervalued stocks based on cash flows before the wider market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報