Assessing Eutelsat Communications (ENXTPA:ETL) Valuation After Bharti Space’s Strategic 88.7 Million Share Purchase

Bharti Space Limited’s purchase of 88.7 million Eutelsat Communications (ENXTPA:ETL) shares on 16 December is a big governance moment, tightening its grip on the satellite operator’s future direction.

See our latest analysis for Eutelsat Communications.

That move comes after a bruising stretch for investors, with a 30 day share price return of minus 47.1 percent and a five year total shareholder return of minus 72.1 percent. As a result, any sign of strategic conviction now looks like an attempt to arrest fading momentum.

If this kind of strategic repositioning has you rethinking your watchlist, it could be a good moment to explore aerospace and defense stocks for other space and satellite names that might be better aligned with your risk appetite.

With the share price crushed, analysts still seeing upside, and annual revenue inching higher despite heavy losses, investors now face a crucial question: Is Eutelsat a contrarian bargain, or is the market already discounting any future growth?

Most Popular Narrative: 42.5% Undervalued

With Eutelsat Communications last closing at €1.71 versus a narrative fair value of €2.97, the most followed storyline implies a sizable disconnect in expectations.

The signing of the SpaceRISE consortium agreement and the IRIS² multi orbit constellation project is a catalyst for growth, as it represents significant investment in future satellite infrastructure and is expected to generate around €6.5 billion in revenues over a 12 year concession period, which will positively impact future revenue streams.

Curious how modest top line expansion, a sharp swing in margins, and a richer future earnings multiple can still justify a near doubled valuation? The narrative lays out that roadmap in detail.

Result: Fair Value of €2.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the GEO business is shrinking, and heavy impairments plus rising leverage could constrain cash generation, undermining the bullish long term LEO growth story.

Find out about the key risks to this Eutelsat Communications narrative.

Another View: Market Ratios Send a Mixed Signal

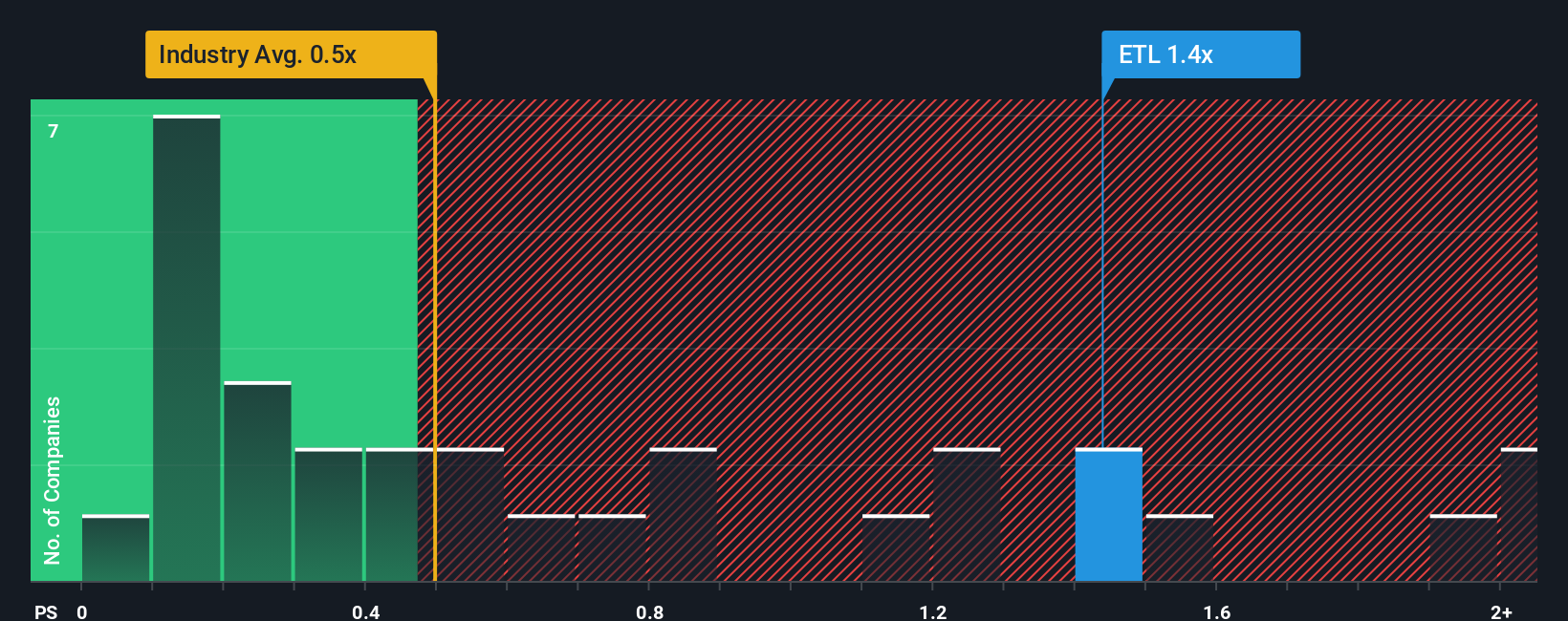

While the narrative fair value points to upside, the market’s own yardsticks are less clear. Eutelsat trades on a price to sales ratio of 0.7 times, richer than the French media average of 0.5 times, yet cheaper than peers at 0.9 times and below a 1.5 times fair ratio. Is this a real discount, or just a value trap forming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eutelsat Communications Narrative

If you see the numbers differently or want to stress test these assumptions with your own lens, you can build a personalised view in minutes: Do it your way.

A great starting point for your Eutelsat Communications research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Put your research momentum to work now by hunting for fresh opportunities on the Simply Wall Street Screener before the next wave of market winners gets priced in.

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is still overlooking.

- Ride powerful tech trends by targeting these 24 AI penny stocks positioned to benefit from real world adoption of AI, automation, and data driven decision making.

- Boost your income focus by reviewing these 10 dividend stocks with yields > 3% that may enhance portfolio yield while still maintaining solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報