Innoviva (INVA): Valuation Check After FDA Approval of First-in-Class NUZOLVENCE Antibiotic

Innoviva (INVA) just cleared a major hurdle with FDA approval for NUZOLVENCE, a first in class single dose oral antibiotic for uncomplicated gonorrhea, potentially reshaping both its pipeline value and long term growth story.

See our latest analysis for Innoviva.

The NUZOLVENCE approval lands at a time when Innoviva’s share price has climbed 13.62 percent year to date and 6.46 percent over 90 days, while its 3 year total shareholder return of 51.73 percent signals momentum that investors clearly have been willing to back.

If this breakthrough has you rethinking where future healthcare winners might come from, it could be worth exploring healthcare stocks for other potential standouts in the sector.

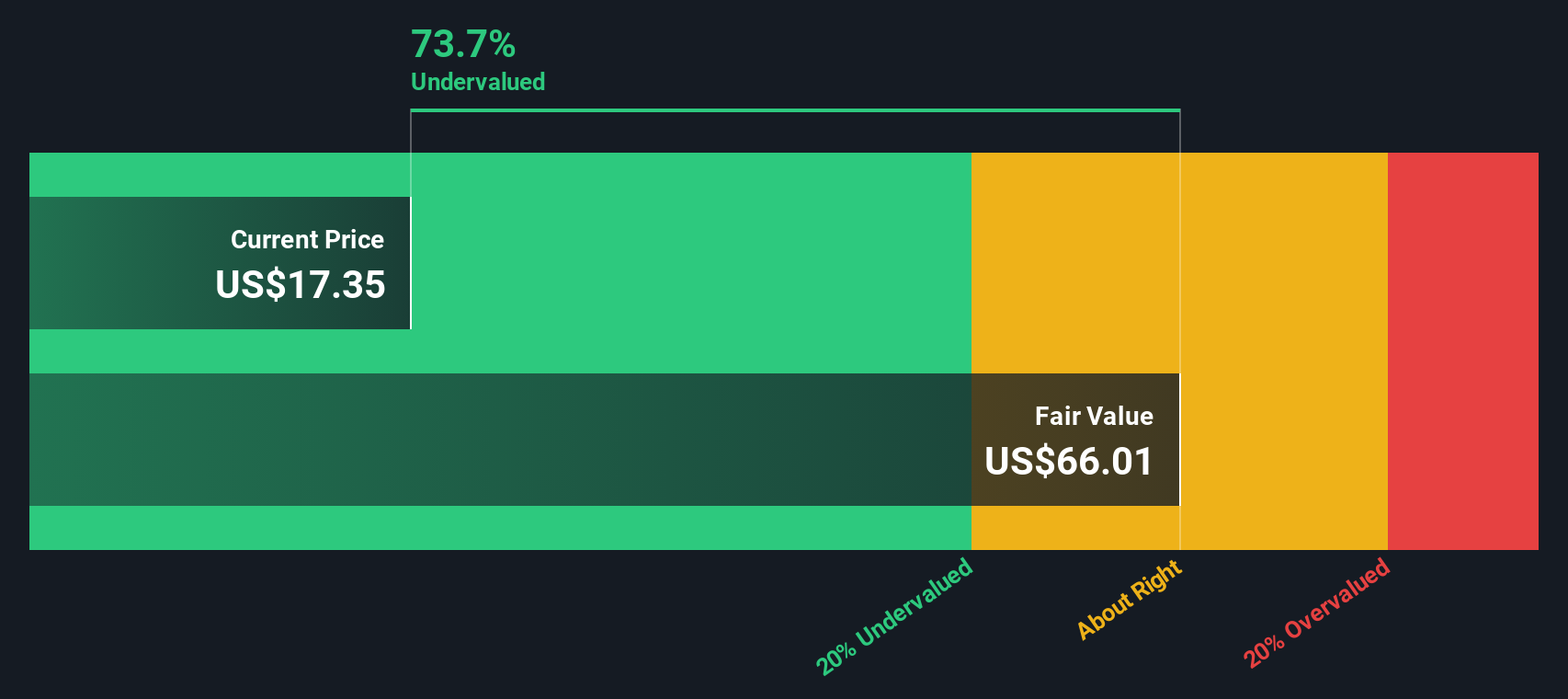

With shares still trading at roughly a 36 percent discount to intrinsic value and over 35 percent below consensus targets, is Innoviva flying under the radar? Or is the market already pricing in NUZOLVENCE driven growth?

Price to Earnings of 11.6x, is it justified?

Innoviva last closed at $19.77 and, on a price to earnings ratio of 11.6x, it screens as clearly undervalued relative to peers and the wider pharmaceuticals space.

The price to earnings multiple compares the company’s share price to its per share earnings and is a common yardstick for profitable drug developers and commercial stage biopharma companies. For Innoviva, this lens is particularly relevant given its high quality earnings and near triple digit profit growth over the last year.

With earnings forecast to keep growing, albeit at a more moderate pace than the broader US market, a low double digit earnings multiple suggests investors may be discounting the durability of that profitability. The contrast is stark when set against both the pharmaceuticals industry average multiple of 19.7x and the estimated fair price to earnings ratio of 16.9x. These are levels the market could ultimately gravitate toward if Innoviva continues to execute.

Explore the SWS fair ratio for Innoviva

Result: Price to earnings of 11.6x (UNDERVALUED)

However, lingering regulatory, competitive and execution risks around NUZOLVENCE uptake and broader pipeline commercialization could still derail the closing of the current valuation gap.

Find out about the key risks to this Innoviva narrative.

Another Lens on Value

Our SWS DCF model paints an even more aggressive upside story, putting fair value near $54.61, around 64 percent above today’s $19.77 price. If cash flows track that path, are investors simply too cautious, or are they rightly skeptical of long term execution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innoviva for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innoviva Narrative

If our view does not fully align with yours or you would rather dive into the numbers yourself, you can build a tailored thesis in minutes: Do it your way.

A great starting point for your Innoviva research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work now and use the Simply Wall St Screener to uncover focused opportunities before other investors move first.

- Capture early stage growth potential by scanning these 3630 penny stocks with strong financials positioned to turn small market caps into meaningful upside.

- Ride the next wave of innovation through these 24 AI penny stocks targeting companies that could benefit most from accelerating AI adoption.

- Lock in quality at attractive prices with these 904 undervalued stocks based on cash flows that flag businesses trading below what their cash flows may truly warrant.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報