Asian Stocks Estimated Below Intrinsic Value In December 2025

As 2025 draws to a close, the Asian markets are navigating a complex landscape marked by Japan's significant interest rate hike and mixed signals from China's economic indicators. In this environment, identifying stocks that may be undervalued compared to their intrinsic value can present opportunities for investors looking to capitalize on potential market inefficiencies. A good stock in such conditions is often characterized by strong fundamentals and resilience amid broader economic shifts, making it an attractive candidate for those seeking long-term value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.52 | CN¥162.07 | 48.5% |

| Takara Bio (TSE:4974) | ¥797.00 | ¥1575.68 | 49.4% |

| Shuangdeng Group (SEHK:6960) | HK$14.97 | HK$29.65 | 49.5% |

| NEXON Games (KOSDAQ:A225570) | ₩12270.00 | ₩24535.74 | 50% |

| Kuraray (TSE:3405) | ¥1606.00 | ¥3168.85 | 49.3% |

| JINS HOLDINGS (TSE:3046) | ¥5680.00 | ¥11002.86 | 48.4% |

| H.U. Group Holdings (TSE:4544) | ¥3376.00 | ¥6592.59 | 48.8% |

| Daiichi Sankyo Company (TSE:4568) | ¥3340.00 | ¥6544.37 | 49% |

| CURVES HOLDINGS (TSE:7085) | ¥798.00 | ¥1577.17 | 49.4% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.44 | 49.5% |

Let's review some notable picks from our screened stocks.

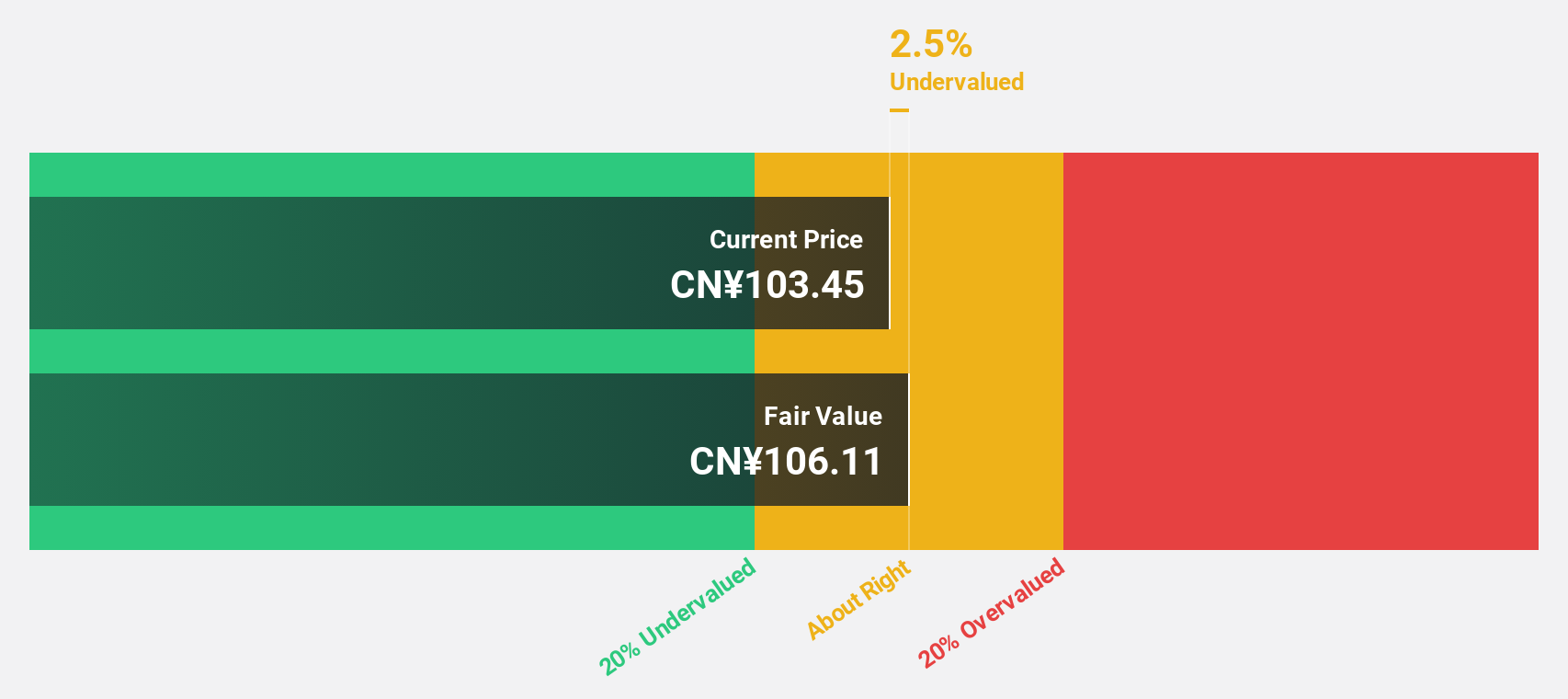

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. specializes in the design, R&D, production, and sales of optical communication transceiver modules and optical devices in China with a market cap of CN¥704.89 billion.

Operations: Zhongji Innolight Co., Ltd.'s revenue is primarily derived from its activities in the optical communication sector, focusing on transceiver modules and optical devices.

Estimated Discount To Fair Value: 35.8%

Zhongji Innolight appears undervalued based on cash flows, trading at CN¥634.4 below its estimated fair value of CN¥987.47. The company reported significant earnings growth with net income reaching CNY 7.13 billion for the first nine months of 2025, up from CNY 3.75 billion a year ago. Despite recent share price volatility, revenue and earnings are forecast to grow faster than the Chinese market over the next three years, suggesting potential long-term value for investors focused on cash flow metrics.

- In light of our recent growth report, it seems possible that Zhongji Innolight's financial performance will exceed current levels.

- Get an in-depth perspective on Zhongji Innolight's balance sheet by reading our health report here.

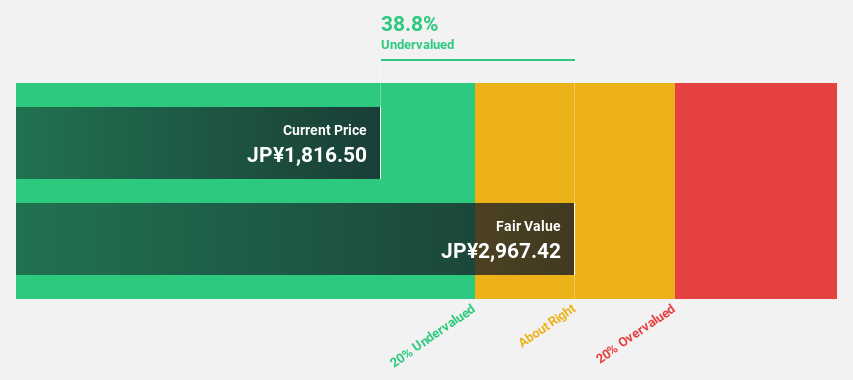

Kuraray (TSE:3405)

Overview: Kuraray Co., Ltd. is involved in the global production and sale of resins, chemicals, fibers, activated carbon, and high-performance membranes and systems with a market cap of ¥494.77 billion.

Operations: Kuraray's revenue segments include Vinyl Acetate at ¥400.80 billion, Functional Materials at ¥204.14 billion, Isoprene at ¥78.79 billion, Trading at ¥68.44 billion, and Fibers and Textiles at ¥60.21 billion.

Estimated Discount To Fair Value: 49.3%

Kuraray is trading at ¥1,606, significantly below its estimated fair value of ¥3,168.85. Despite a forecasted 34.31% annual earnings growth rate outpacing the Japanese market's 8.5%, recent earnings guidance was lowered due to reduced sales volume influenced by economic uncertainties and U.S. tariff policies. A share buyback program aims to enhance capital efficiency, though profit margins have decreased from last year’s levels and the dividend remains inadequately covered by earnings.

- Upon reviewing our latest growth report, Kuraray's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Kuraray's balance sheet health report.

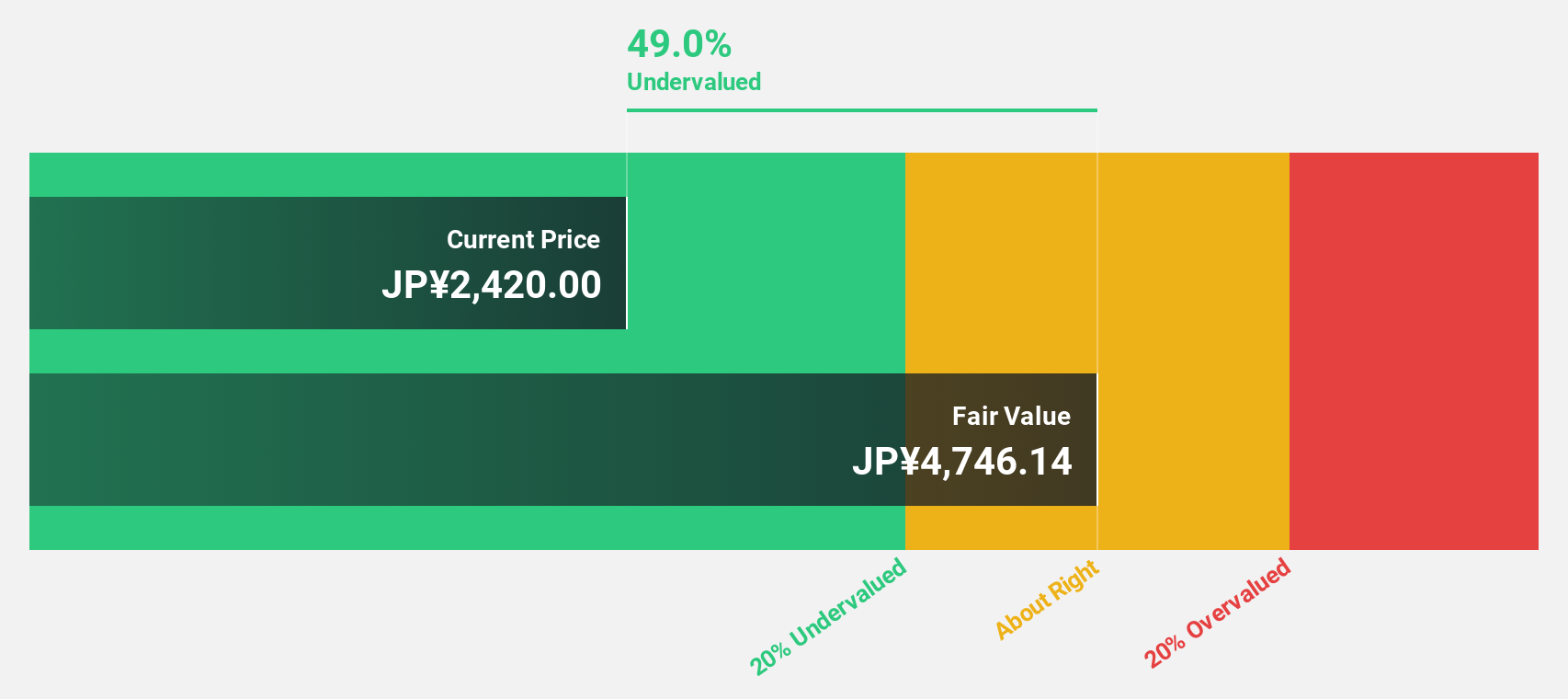

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components globally with a market capitalization of approximately ¥444.55 billion.

Operations: Revenue Segments (in millions of ¥): Capacitors: ¥171,234; Ferrite and Applied Products: ¥72,456; Integrated Modules & Devices: ¥89,567. Taiyo Yuden's revenue primarily comes from its Capacitors segment at ¥171.23 billion, followed by Integrated Modules & Devices at ¥89.57 billion and Ferrite and Applied Products at ¥72.46 billion.

Estimated Discount To Fair Value: 22.1%

Taiyo Yuden is trading at ¥3,555, which is 22.1% below its estimated fair value of ¥4,565.39. Despite a lower profit margin this year compared to last year and high share price volatility recently, earnings are projected to grow significantly at 37.96% annually over the next three years—outpacing the Japanese market's growth rate. Recent product innovations in hybrid capacitors and multilayer ceramic capacitors could bolster future revenue streams amidst forecasted moderate revenue growth of 5.2% annually.

- Our growth report here indicates Taiyo Yuden may be poised for an improving outlook.

- Click here to discover the nuances of Taiyo Yuden with our detailed financial health report.

Seize The Opportunity

- Investigate our full lineup of 272 Undervalued Asian Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報