High Growth Tech Stocks in Asia for December 2025

As the Asian tech market navigates a landscape shaped by Japan's significant interest rate hike and China's mixed economic indicators, investors are closely watching how these macroeconomic shifts impact high-growth sectors. In such a dynamic environment, identifying promising stocks often involves assessing their ability to adapt to changing economic conditions and leverage technological advancements effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Shengyi TechnologyLtd (SHSE:600183)

Simply Wall St Growth Rating: ★★★★★★

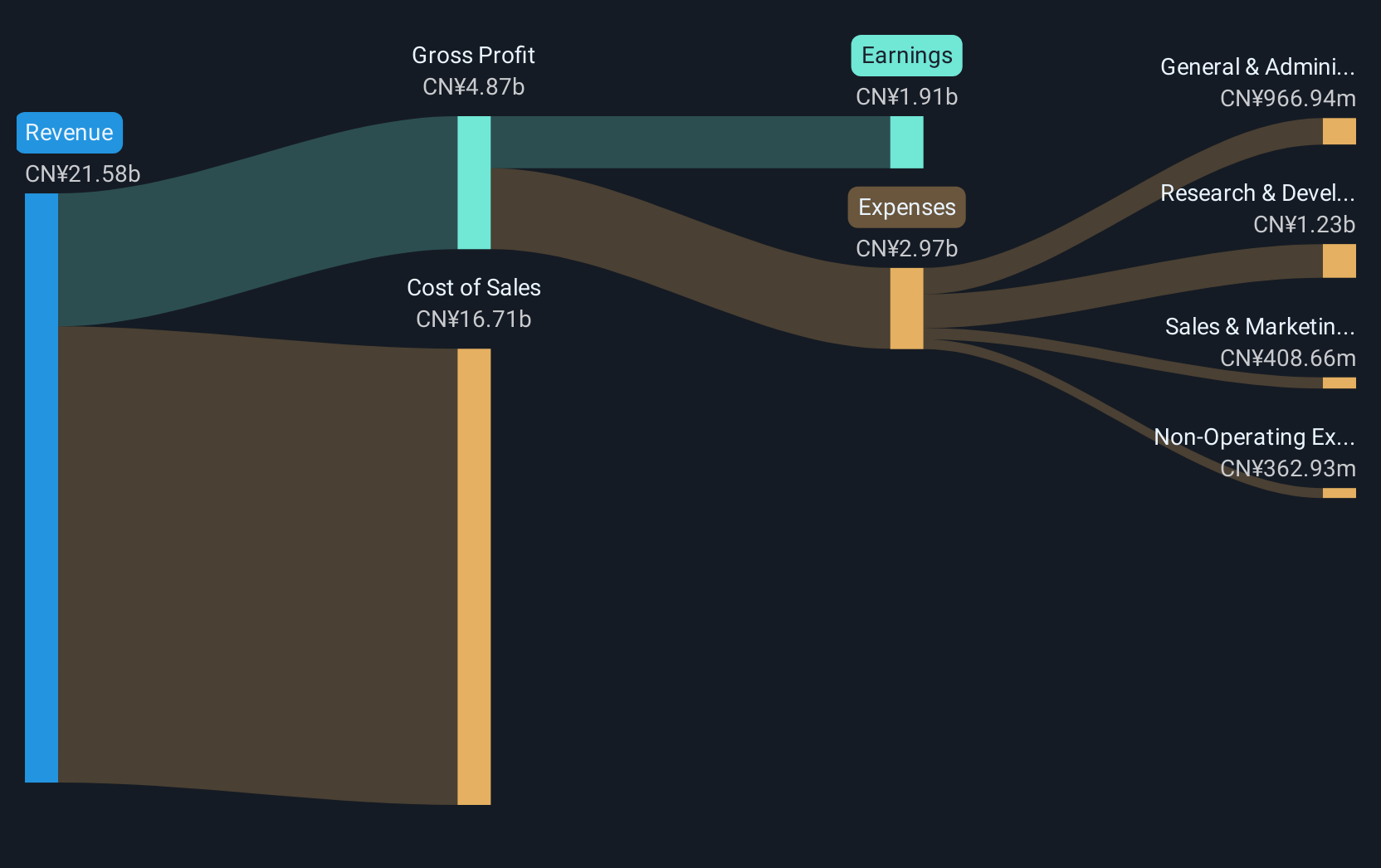

Overview: Shengyi Technology Co., Ltd. specializes in designing, producing, and selling copper clad laminates, adhesive sheets, and printed circuit boards in China with a market cap of CN¥176.35 billion.

Operations: Shengyi Technology Co., Ltd. generates revenue primarily through its production and sale of copper clad laminates, adhesive sheets, and printed circuit boards. The company's operations are centered in China, contributing to a significant market presence with a market cap of CN¥176.35 billion.

Shengyi Technology has demonstrated robust growth, with a notable 71.6% increase in earnings over the past year, outpacing the electronics industry's average of 9.4%. This surge is supported by an aggressive R&D investment strategy, crucial for maintaining technological leadership and fueling future innovations. Despite a highly volatile share price recently, the company's financial health is solid, underscored by a significant revenue jump to CNY 20.61 billion from CNY 14.74 billion year-over-year and an impressive rise in net income to CNY 2.44 billion. Looking forward, Shengyi is poised for continued expansion with forecasted annual revenue and earnings growth rates of 21.9% and 32.84%, respectively—both well above industry averages—indicating strong potential in high-growth tech sectors within Asia.

- Click here to discover the nuances of Shengyi TechnologyLtd with our detailed analytical health report.

Evaluate Shengyi TechnologyLtd's historical performance by accessing our past performance report.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

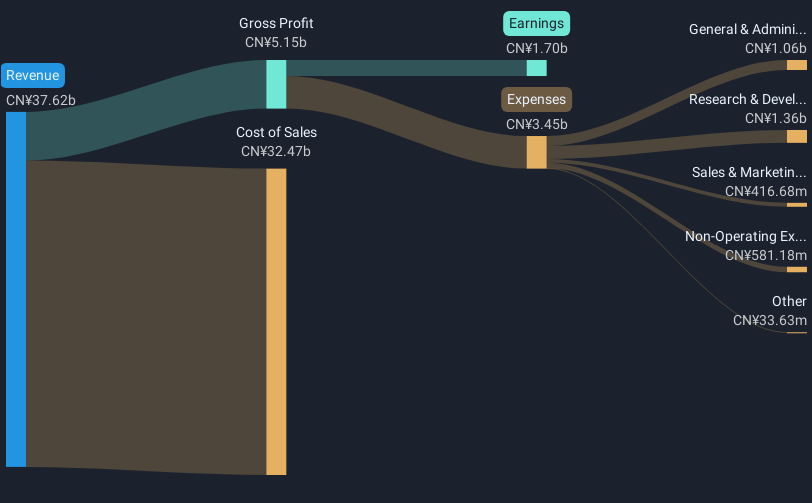

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. is a company engaged in the production of precision manufacturing components, with a market cap of CN¥153.30 billion.

Operations: Suzhou Dongshan Precision Manufacturing focuses on producing precision components, contributing significantly to its revenue. The company operates within a market cap of CN¥153.30 billion.

Suzhou Dongshan Precision Manufacturing has recently shown a strong financial performance with a 2.3% increase in revenue, reaching CNY 27.07 billion and a notable rise in net income to CNY 1.22 billion, up from CNY 1.07 billion year-over-year. This growth is underpinned by strategic amendments to the company's articles of association, aiming to enhance governance and explore opportunities such as H-share listings on the Hong Kong Stock Exchange, which could bolster investor confidence and market presence in Asia’s high-tech industry landscape. These moves reflect an agile adaptation to market demands and regulatory environments, positioning Suzhou Dongshan for potential future growth amidst competitive technological sectors.

- Click here and access our complete health analysis report to understand the dynamics of Suzhou Dongshan Precision Manufacturing.

Learn about Suzhou Dongshan Precision Manufacturing's historical performance.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★★

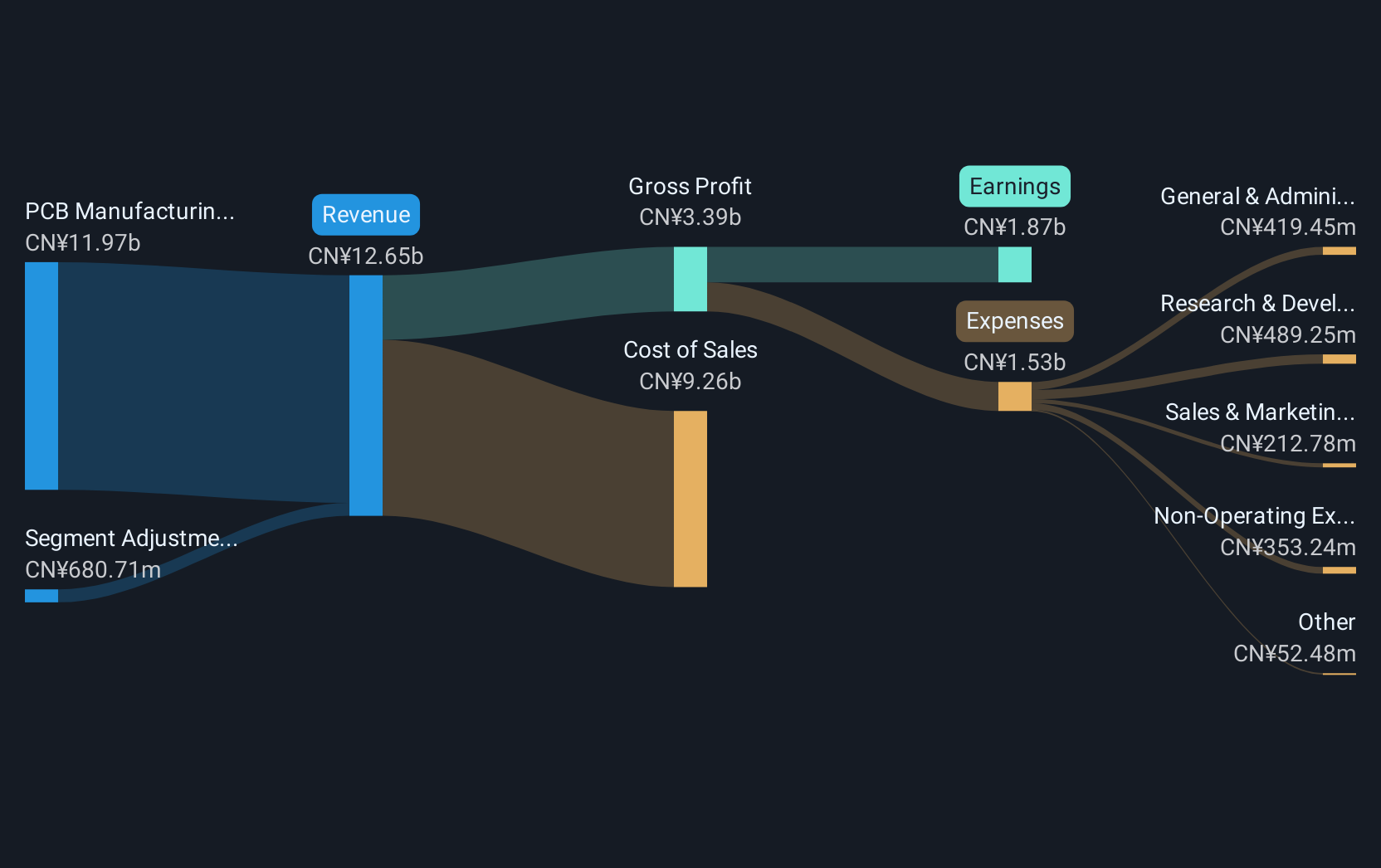

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. operates in the technology sector with a focus on PCB manufacturing and has a market capitalization of approximately CN¥266.36 billion.

Operations: The company's primary revenue stream is PCB manufacturing, generating approximately CN¥16.47 billion. The gross profit margin for this segment shows a notable trend at 24%.

Victory Giant Technology (HuiZhou)Co.Ltd has demonstrated remarkable growth, with a reported revenue surge to CNY 14.12 billion from CNY 7.70 billion year-over-year, and net income skyrocketing to CNY 3.24 billion from CNY 764.61 million. This financial uptick is backed by a strategic partnership with ECARX, focusing on high-density interconnect PCBs for AI-driven automotive platforms—highlighting VGT's pivotal role in evolving AI technologies and manufacturing precision within the tech sector. The company's commitment to R&D and innovation in high-performance computing platforms is evident as they cater to over 350 technology clients globally, securing their position in competitive markets like automotive intelligence and data centers.

Summing It All Up

- Reveal the 187 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報