Asian Opportunities: 3 Penny Stocks With Market Caps Under US$2B

As the Bank of Japan raises its benchmark interest rate to a 30-year high, Asian markets are navigating a period of economic recalibration. Amid these shifts, penny stocks—traditionally associated with speculative ventures—continue to attract attention when they demonstrate robust financial health. In this article, we explore three Asian penny stocks that may offer compelling opportunities for investors seeking companies with solid balance sheets and potential for long-term growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.90 | THB870M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.78 | HK$2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.71 | HK$20.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$53.4B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 972 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

C-MER Medical Holdings (SEHK:3309)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C-MER Medical Holdings Limited operates as an investment holding company offering ophthalmic services under the C-MER Dennis Lam brand in Hong Kong and Mainland China, with a market cap of HK$2.04 billion.

Operations: C-MER Medical Holdings generates revenue from its HK$941.61 million Hong Kong medical business, HK$456.95 million Mainland China dental business, and HK$531.05 million Mainland China ophthalmic business.

Market Cap: HK$2.04B

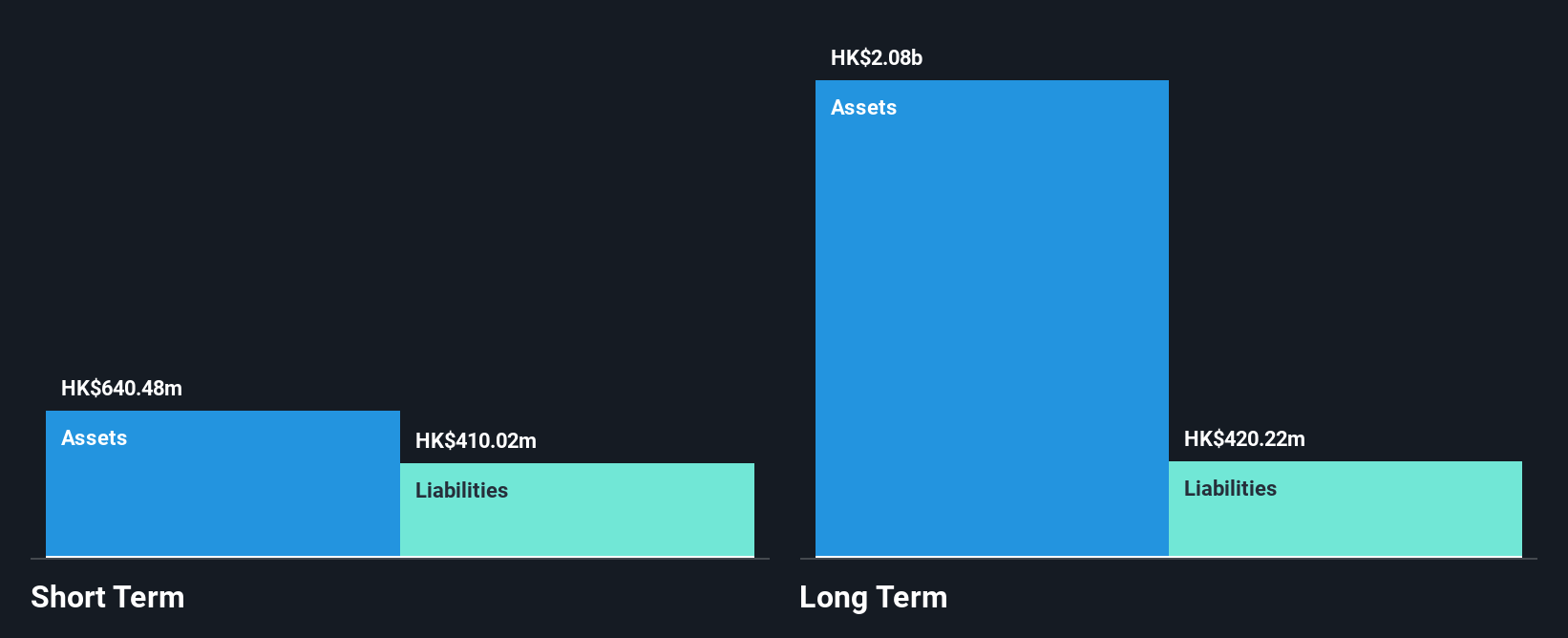

C-MER Medical Holdings, with a market cap of HK$2.04 billion, generates substantial revenue from its Hong Kong medical and Mainland China dental and ophthalmic businesses. Despite being unprofitable, the company maintains a strong financial position with more cash than total debt and short-term assets exceeding both short-term and long-term liabilities. The board is experienced with an average tenure of 5.1 years, though management experience data is insufficient. Trading at 26% below estimated fair value suggests potential undervaluation; however, earnings have declined significantly over the past five years, presenting challenges for future profitability improvements.

- Unlock comprehensive insights into our analysis of C-MER Medical Holdings stock in this financial health report.

- Explore historical data to track C-MER Medical Holdings' performance over time in our past results report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers cloud services and on-premises software in China, with a market cap of HK$5.81 billion.

Operations: The company's revenue primarily comes from Cloud Services, generating CN¥1.11 billion, and On-premise Software and Services, contributing CN¥212.91 million.

Market Cap: HK$5.81B

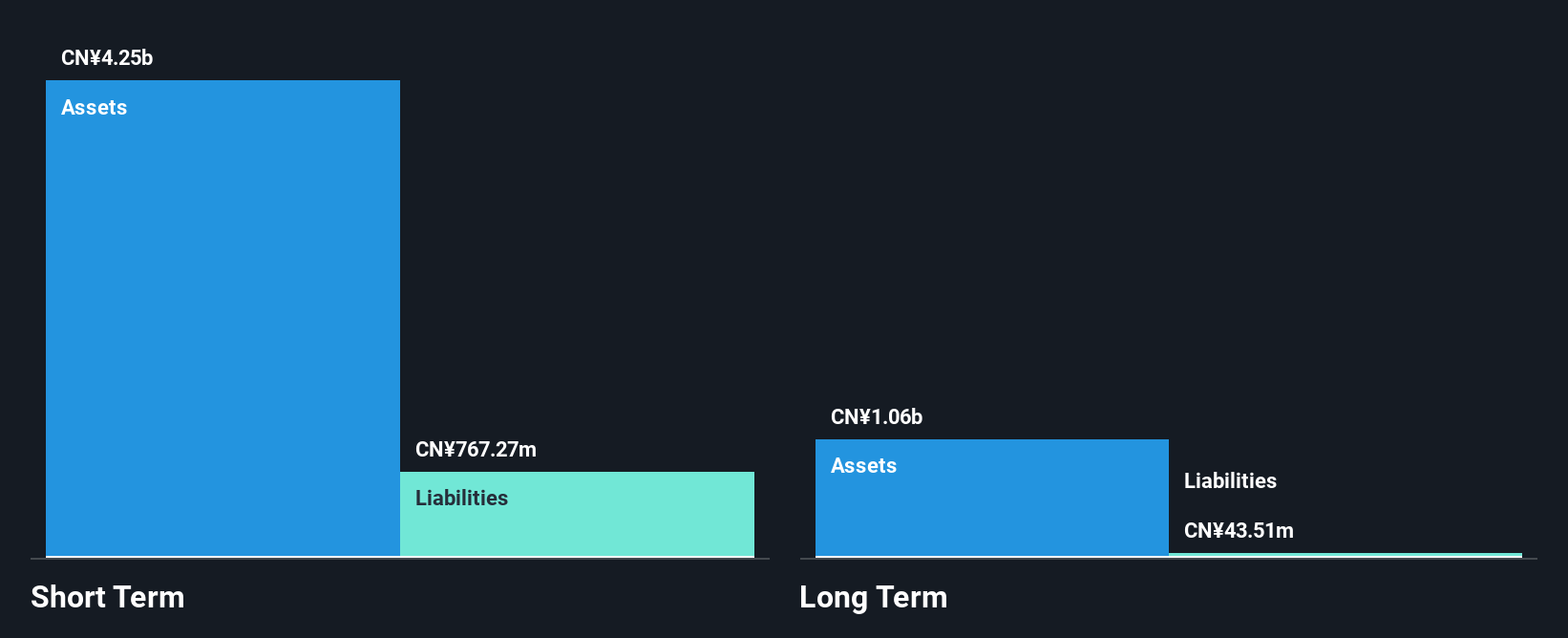

Ming Yuan Cloud Group Holdings, with a market cap of HK$5.81 billion, focuses on cloud services and software in China. Despite being unprofitable, the company has reduced losses by 4.8% annually over five years and maintains a solid financial position with CN¥4.3 billion in short-term assets surpassing its liabilities. The management team and board are experienced, averaging tenures of 4.3 and 5.8 years respectively. While debt-free now compared to a high debt-to-equity ratio five years ago, the company holds sufficient cash runway for over three years even as free cash flow diminishes annually by 32.7%.

- Dive into the specifics of Ming Yuan Cloud Group Holdings here with our thorough balance sheet health report.

- Gain insights into Ming Yuan Cloud Group Holdings' outlook and expected performance with our report on the company's earnings estimates.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China with a market cap of CN¥9.46 billion.

Operations: The company generates revenue of CN¥2.30 billion from its operations within China.

Market Cap: CN¥9.46B

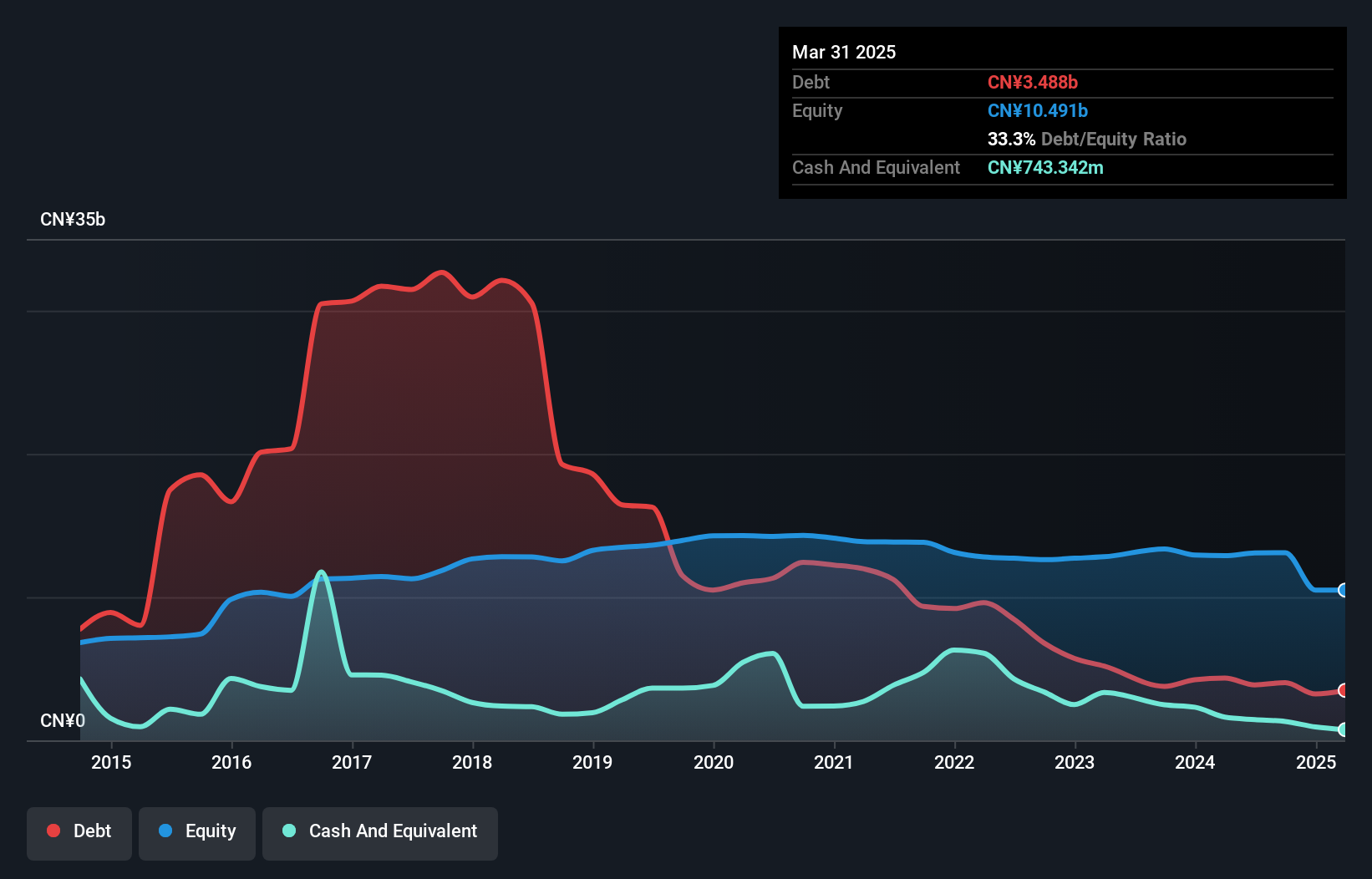

Greattown Holdings Ltd., with a market cap of CN¥9.46 billion, operates in China's real estate sector and reported a revenue decline to CN¥1.94 billion for the first nine months of 2025. Despite this, net income rose slightly to CN¥257.54 million. The company is unprofitable but has reduced its debt-to-equity ratio from 86.8% to 15.7% over five years, indicating improved financial health with short-term assets exceeding liabilities significantly. However, its share price remains highly volatile and earnings are not covering dividends adequately, highlighting potential risks for investors considering penny stocks in Asia's dynamic markets.

- Take a closer look at Greattown Holdings' potential here in our financial health report.

- Gain insights into Greattown Holdings' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Investigate our full lineup of 972 Asian Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報