Investors Appear Satisfied With Cementir Holding N.V.'s (BIT:CEM) Prospects As Shares Rocket 848%

Despite an already strong run, Cementir Holding N.V. (BIT:CEM) shares have been powering on, with a gain of 848% in the last thirty days. The last 30 days were the cherry on top of the stock's 1,343% gain in the last year, which is nothing short of spectacular.

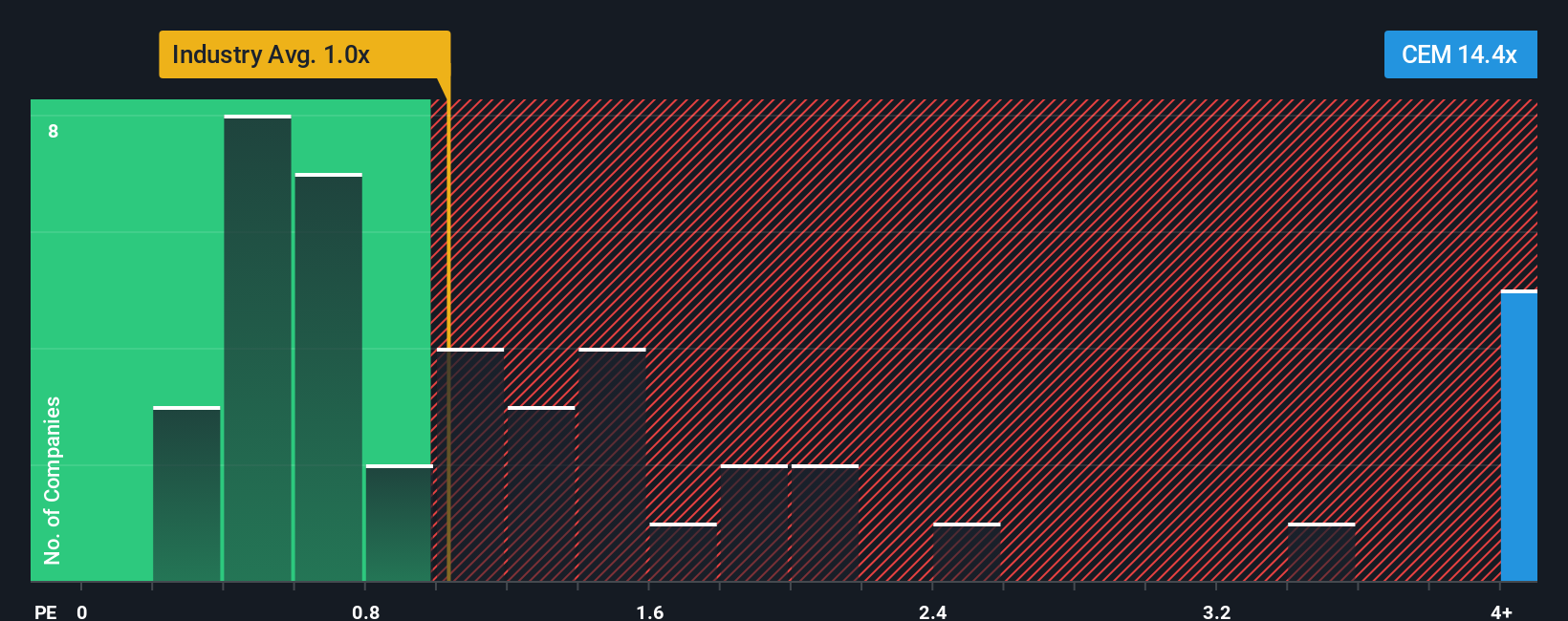

After such a large jump in price, given around half the companies in Italy's Basic Materials industry have price-to-sales ratios (or "P/S") below 1x, you may consider Cementir Holding as a stock to avoid entirely with its 14.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Cementir Holding

What Does Cementir Holding's P/S Mean For Shareholders?

Cementir Holding could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Cementir Holding will help you uncover what's on the horizon.How Is Cementir Holding's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Cementir Holding's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.3% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.7% per annum during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 0.5% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Cementir Holding's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Cementir Holding's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Cementir Holding shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Cementir Holding that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報