Rapac Communication & Infrastructure Ltd (TLV:RPAC) Stock Rockets 27% But Many Are Still Ignoring The Company

Rapac Communication & Infrastructure Ltd (TLV:RPAC) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 148% following the latest surge, making investors sit up and take notice.

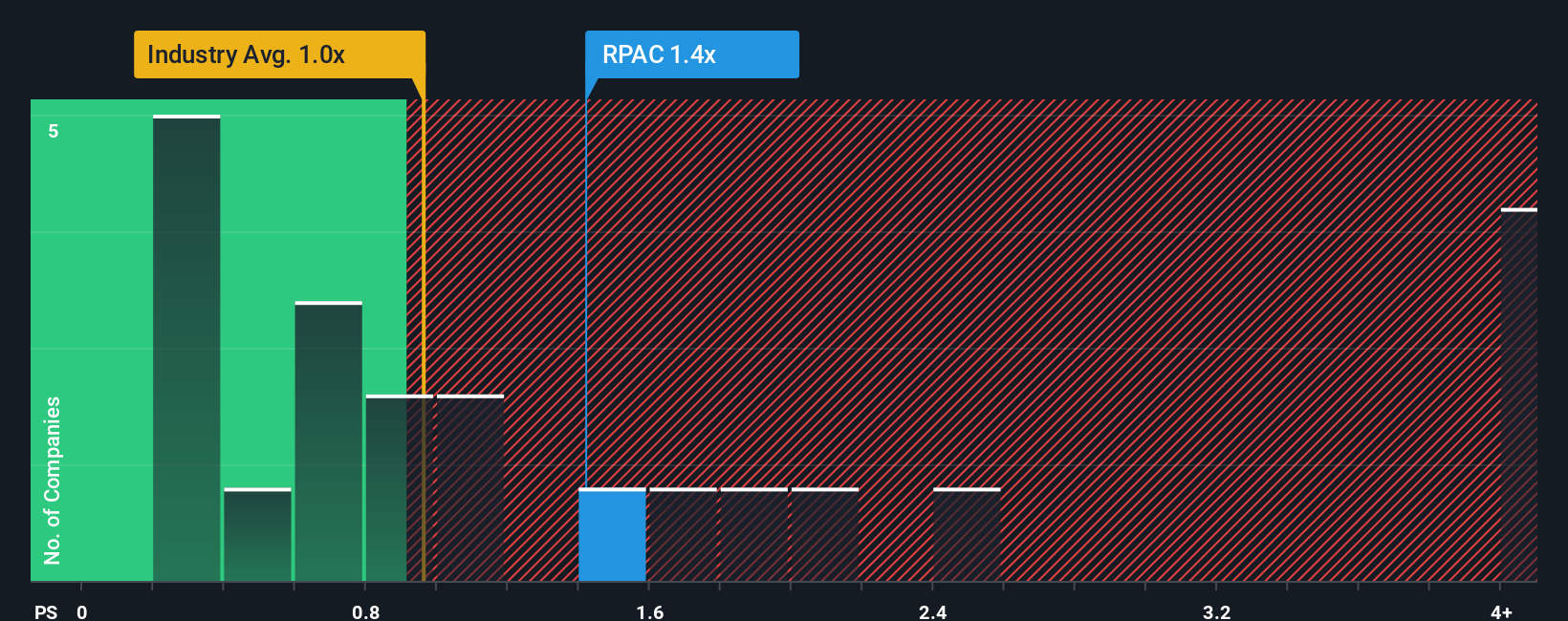

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Rapac Communication & Infrastructure's P/S ratio of 1.4x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Israel is also close to 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Rapac Communication & Infrastructure

What Does Rapac Communication & Infrastructure's Recent Performance Look Like?

The revenue growth achieved at Rapac Communication & Infrastructure over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Rapac Communication & Infrastructure will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Rapac Communication & Infrastructure will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Rapac Communication & Infrastructure?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Rapac Communication & Infrastructure's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Rapac Communication & Infrastructure's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Rapac Communication & Infrastructure's P/S?

Its shares have lifted substantially and now Rapac Communication & Infrastructure's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Rapac Communication & Infrastructure currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 1 warning sign for Rapac Communication & Infrastructure that you need to take into consideration.

If these risks are making you reconsider your opinion on Rapac Communication & Infrastructure, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報