Powell Industries (POWL): Valuation Check After Record Profits and a Big Fiscal 2025 Earnings Beat

Powell Industries (POWL) just delivered record profits and a fiscal 2025 earnings report that cleared Wall Street expectations by a wide margin. That upside surprise is reshaping how investors are valuing the stock.

See our latest analysis for Powell Industries.

The latest beat comes on top of a powerful run, with the share price at $336.17 after a year-to-date share price return of nearly 47 percent and a three-year total shareholder return above 900 percent, signalling momentum that investors clearly still believe in.

If Powell’s surge has you rethinking where growth and conviction meet, this could be a good moment to explore fast growing stocks with high insider ownership for other potentially compelling ideas.

With shares now well above most analyst targets and recent gains already reflecting record profitability, the key question is whether Powell is still trading below its true potential or if markets have already priced in the next leg of growth.

Most Popular Narrative: 24.8% Overvalued

With Powell Industries closing at $336.17 against a narrative fair value of $269.26, the valuation debate is shifting from bargain territory to optimism risk.

The stock may be discounting uninterrupted access to favorable market tailwinds (like infrastructure stimulus and data center demand) without adequately accounting for rising supply chain costs, competitive intensity from larger players with broader digital portfolios, or the risk that distributed generation trends could soften long term demand for Powell's core centralized electrical solutions, posing downside risk to revenue growth and margin expansion.

Want to see what kind of growth still justifies a premium at this level? The narrative leans on tempered earnings, measured revenue expansion, and a richer future multiple. Curious how those moving parts add up to that fair value line, and what has to go right for the story to hold?

Result: Fair Value of $269.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained backlog driven growth and lasting margin expansion from higher value projects and automation offerings could justify today’s richer multiple for a longer period.

Find out about the key risks to this Powell Industries narrative.

Another View: Multiples Still Point to Rich Pricing

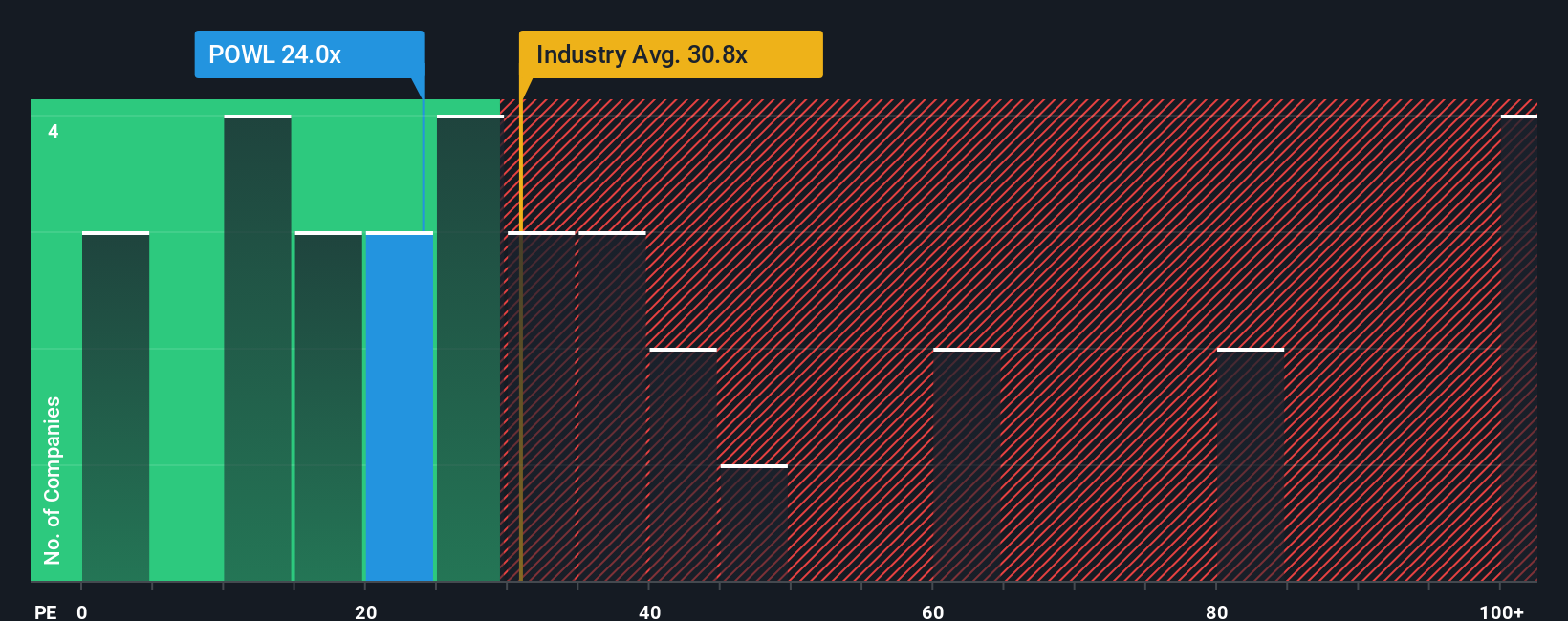

While the narrative fair value pins Powell as 24.8 percent overvalued, its 22.5 times price to earnings ratio also sits above our fair ratio of 21 times, even if it screens cheaper than the US Electrical industry at 30.2 times and peers at 48.1 times. This raises the question of whether this is a reasonable premium or performance pulled too far forward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Powell Industries Narrative

If you see the outlook differently or simply want to test your own assumptions against the numbers, you can build a complete view in just a few minutes, starting with Do it your way.

A great starting point for your Powell Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Serious investors rarely stop at one great story, so use Powell as your benchmark and let the Simply Wall Street Screener surface your next advantage.

- Capitalize on mispriced opportunities by reviewing these 904 undervalued stocks based on cash flows where strong cash flow potential has not yet been fully reflected in share prices.

- Ride powerful structural trends by scanning these 29 healthcare AI stocks that blend medical demand with intelligent technology driven solutions.

- Capture high growth potential at lower price points by assessing these 3630 penny stocks with strong financials that still maintain solid financial underpinnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報