Bitmine Immersion Technologies (BMNR): Reassessing Valuation After a 300% Surge and Recent Share Price Pullback

Bitmine Immersion Technologies (BMNR) has quietly become one of the more extreme roller coasters in crypto infrastructure, with shares swinging from deep multi year losses to a huge gain over the past year.

See our latest analysis for Bitmine Immersion Technologies.

At a share price of $29.35, Bitmine’s wild year to date share price return of over 300 percent contrasts sharply with its roughly 40 percent 3 month share price pullback. This suggests powerful but increasingly volatile momentum as investors reassess both upside and risk.

If Bitmine’s swings have caught your attention, this could be a good moment to compare it with other high potential names using our screener for fast growing stocks with high insider ownership.

With Bitmine now trading well below analysts’ targets, yet still up several hundred percent over 12 months, are investors being handed an early entry into its next growth phase, or is the market already pricing that future in?

Price to earnings of 38.1x: Is it justified?

Bitmine Immersion Technologies trades on a price to earnings ratio of 38.1 times, above both peers and the wider US software sector at the latest close of $29.35.

The price to earnings multiple compares the current share price to the company’s earnings per share, giving a snapshot of how much investors are paying for each dollar of profit. For a young, recently profitable blockchain infrastructure business like Bitmine, this ratio indicates how much future earnings growth the market believes the company can deliver.

BMNR has only just moved into sustained profitability, so a higher price to earnings ratio suggests investors are willing to pay up for that turnaround and for potential expansion in digital asset ecosystem services. However, the company’s Return on Equity is currently a modest 4 percent, and there is insufficient analyst data to show whether earnings growth will accelerate enough to fully support such a premium valuation.

Compared to the US Software industry average price to earnings ratio of 31.9 times and a peer average of 30.1 times, BMNR’s 38.1 times earnings stands out as distinctly expensive rather than merely slightly above the pack. The market is assigning it a growth and execution premium, leaving less room for disappointment if profitability or growth falters.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to earnings of 38.1x (OVERVALUED)

However, regulatory shifts or a setback in scaling its BTC ecosystem services could quickly challenge the lofty expectations embedded in Bitmine’s current valuation.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

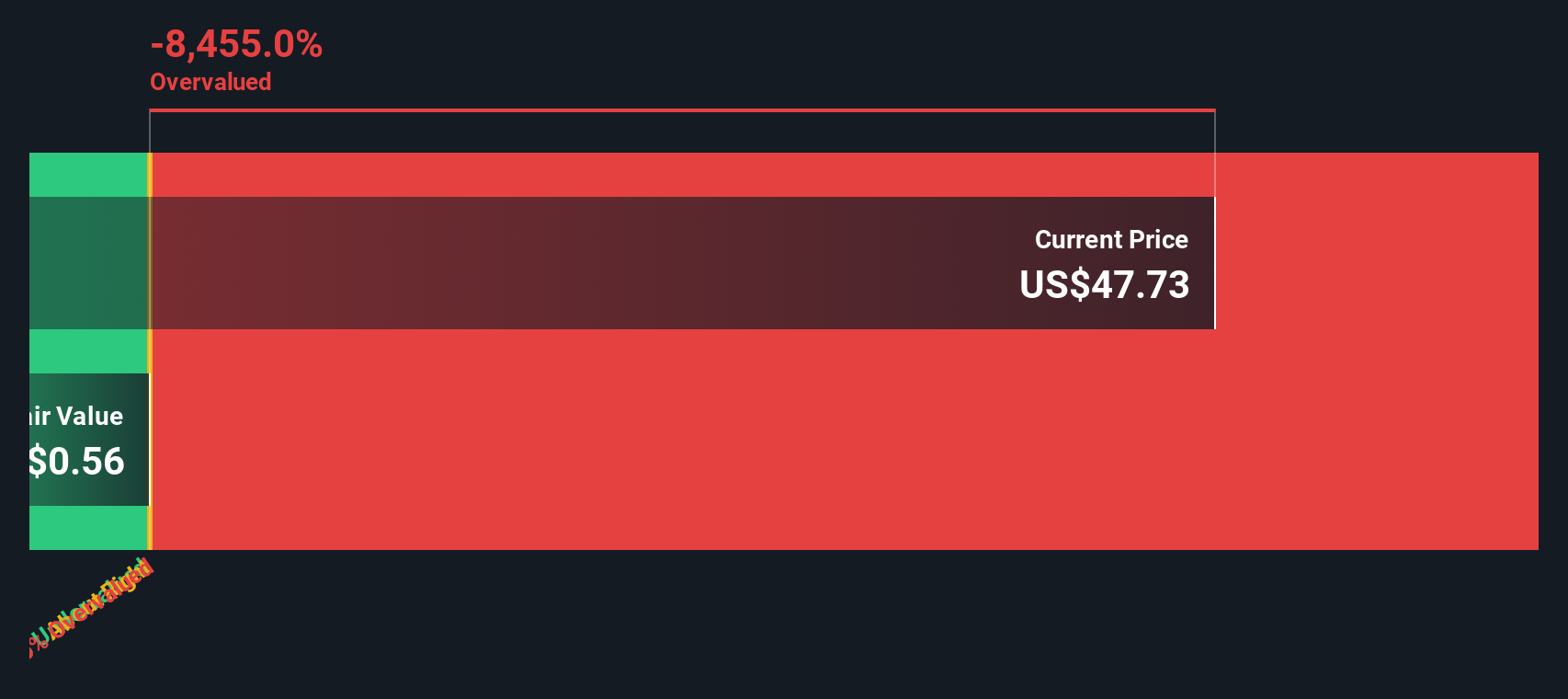

Another View: Our DCF model

While Bitmine looks expensive on earnings at 38.1 times, our DCF model paints an even starker picture, suggesting fair value closer to $0.18 and flagging the stock as significantly overvalued. Is the market betting on a future the cash flow math cannot yet see?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you see the story differently, or would rather test your own assumptions against the numbers, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before Bitmine’s story moves on without you, put structured thinking around your next move by scanning hand picked opportunities tailored to different strategies on Simply Wall St.

- Capitalize on mispriced opportunities by targeting companies trading below their estimated value through these 904 undervalued stocks based on cash flows. This approach may offer a different risk and return profile compared with momentum heavy names.

- Explore the next wave of intelligent automation by focusing on innovators building real world products and platforms with these 24 AI penny stocks. This theme continues to attract institutional attention.

- Identify income focused opportunities by screening for companies with a track record of paying dividends using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報